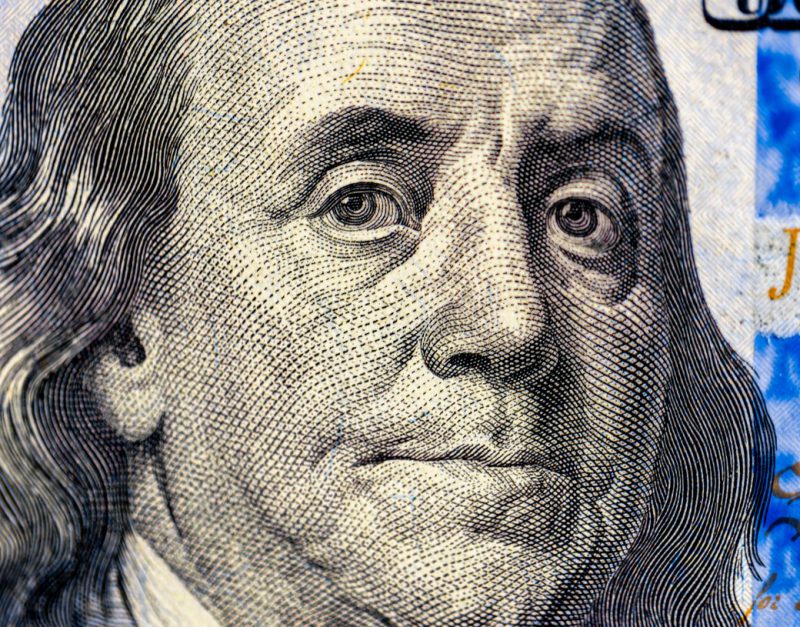

A handful of members in the BRICS alliance have openly embraced the US dollar, and Russia is disappointed with the stance. India has repeatedly distanced itself from the new payment system, expressing interest in the US dollar. Other countries, such as Brazil and South Africa, are also stepping aside from the Chinese yuan to trade in the USD.

The newfound respect for the US dollar from BRICS members comes after Trump threatened to impose further tariffs. Russia’s Finance Minister Anton Siluanov explained that the open support for the US dollar is what’s stopping BRICS from forming a new payment system. There is a lack of progress on the new settlement as member nations are skirting the issue.

Also Read: Sanctions on BRICS Will Lead to Turbulence in the US Economy

BRICS Members Satisfied With US Dollar Settlements, Avoiding New Payment System: Anton Siluanov

Siluanov confirmed that many BRICS members are not willing to participate in the payment settlement as they want to trade in the US dollar. Only Russia, China, and Iran are eager to ditch the USD for cross-border transactions as they are reeling under sanctions. China, on the other hand, wants to diminish the USD to internationalize the Chinese yuan.

“We settle accounts directly, so as not to be vulnerable to any external influences. This is most important. Therefore, one of the topics is establishing a cross-border settlement system within BRICS. This is a rather tenuous issue, as not everyone is ready to participate. Many are satisfied with settlements in US dollar as long as there are no restrictions,” he said.

Also Read: Jim O’Neill Marks 25 Years of BRICS Amid Rising De-Dollarization

This is the complete antithesis of BRICS, where the alliance was hell bent on toppling the US dollar. Members have taken a U-turn on the issue as the USD is the most important currency that drives their GDP and economy. Their respective local currencies, especially India’s rupee, are already at a lifetime low. Therefore, taking on the US dollar will be the worst decision that could derail their economic growth.