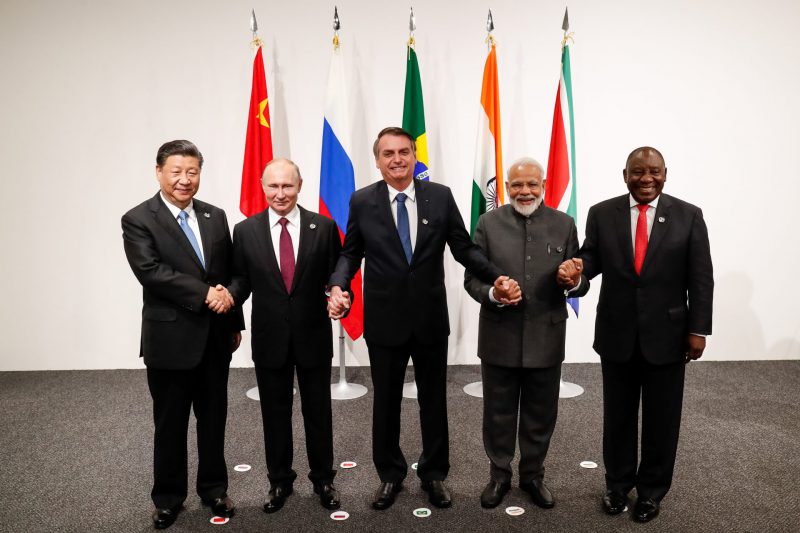

Russia’s President Vladimir Putin discussed the prospects of an upcoming BRICS currency ahead of the 16th summit. The upcoming summit is scheduled to be held from October 22 to 24 in the Kazan region of Russia. The nine-member alliance will sit at the table for discussions for the first time since the expansion in 2023.

Also Read: 11 Countries Might Join BRICS in 2024 as ‘Associated Partners’

Putin emphasized the need for an alternative BRICS currency that will take on the US dollar and SWIFT payment system. He addressed the idea of the currency but confirmed that it is not fully developed. However, Putin hinted that the launch was not too far and could come as a surprise, similar to the new BRICS Pay card.

Also Read: BRICS Settle 78% Oil Trade in Local Currencies, Ditch the US Dollar

Russia Talks About BRICS Currency Ahead of 2024 Summit

In a press conference, Putin made it clear that the currency will not be launched at the 2024 summit. “As regards the common BRICS currency, we do not consider this issue at the moment. It is not mature,” he said. The President revealed that the launch will happen gradually and the alliance is not in a hurry. “We should be very careful; we need to act gradually, without haste in this regard,” he said.

Also Read: BRICS Control 20% of the World’s Gold Reserves

At the moment, BRICS is exploring settling trade in local currencies and not the US dollar. The common currency could take more time as the exploration of the functionality needs more work. Trade in local currencies could dominate the 16th summit as a way to end reliance on the US dollar.

Read here to know how many sectors in the US will be affected if BRICS ditches the dollar for trade. However, when a BRICS common currency is launched, it could bring in a paradigm shift in the global financial order. Emerging economies could begin using it and push the US dollar on the path of a decline.