Russia’s push for de-dollarization wasn’t its choice, according to President Vladimir Putin. At the Valdai Discussion Club, Putin said Russia was pushed out of the dollar system. This shift impacts the global financial system as BRICS nations build new ways to trade without US dollars. These changes signal a significant transformation in how countries handle international trade and monetary exchanges.

Also Read: Solana: AI Sets SOL Price For November 15

Putin’s Stance on De-dollarization: Impacts and Global Financial Reactions

Russia’s Dollar Dilemma

Let’s break this down – Putin came out with a pretty direct message: “We—Russia in any case—do not reject the dollar and do not intend to do this. We were merely denied of using the dollar as the payment instrument.” The interesting part? He’s basically telling US leaders they’re shooting themselves in the foot when he says “the entire power of the US to date rests on that, on the dollar.”

BRICS Bridge: Reshaping Global Finance

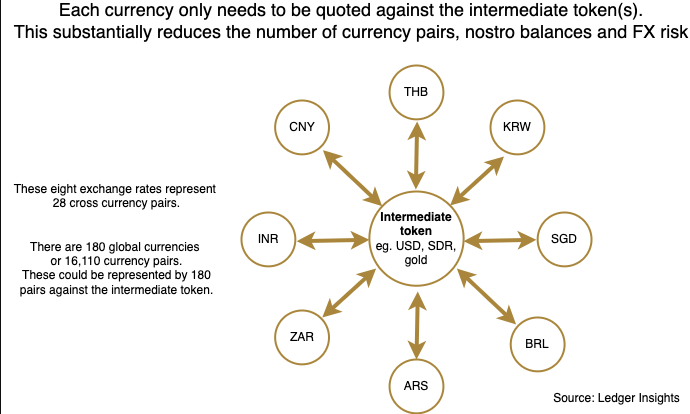

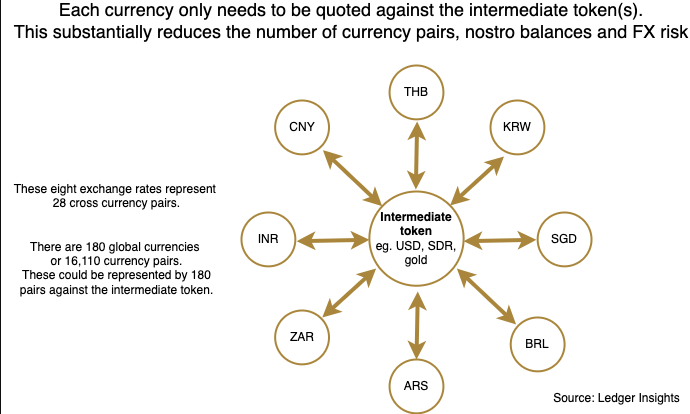

Here’s where things get interesting at the BRICS Summit in Kazan. You know what Russia’s cooking up? Something called “BRICS Bridge.” And check this out – Lavrov didn’t mince words: “Everyone understands that anyone may face US or other Western sanctions.” Pretty wild how they’re building this whole system just to work “without being dependent on those that decided to weaponize the dollar and the euro.” This is a key aspect of de-dollarization globally.

Also Read: FTX Sues Binance & Founder CZ, Seeks $1.8 Billion

Western Sanctions and Financial Impact

Talk about a financial earthquake – $282 billion in frozen assets and Russian banks kicked out of SWIFT. Looking at how Russia’s trying to make the yuan work, it’s kind of like trying to fill an ocean with a garden hose. You can see why other countries are starting to wonder if the US dollar might not be the safest bet anymore.

Global Response and Future Implications

BRICS isn’t just getting bigger; it’s also getting bolder. China and India are jumping in with both feet. They are cooking up new ways to move money around without issues and with real efficiency. Russia’s not just sitting there waiting either—they’re building their own financial toolbox. It seems like those US sanctions are making everyone rethink their game plan, and some think that it’s long overdue.

Also Read: Ripple vs. SEC: Shockwave as CEO Demands SEC Chair’s Immediate Resignation

Trump-Putin Dynamic Shapes Policy

Here’s a very interesting twist to the story- while Putin’s busy building dollar-free highways for money, he’s having chats with Trump. Looking at their Ukraine discussions and Trump questioning old alliances, it’s obvious why the world’s money map might look pretty different soon. Meanwhile, Biden’s still backing Ukraine with that $6 billion support package. Wild times in the global finance world, right?