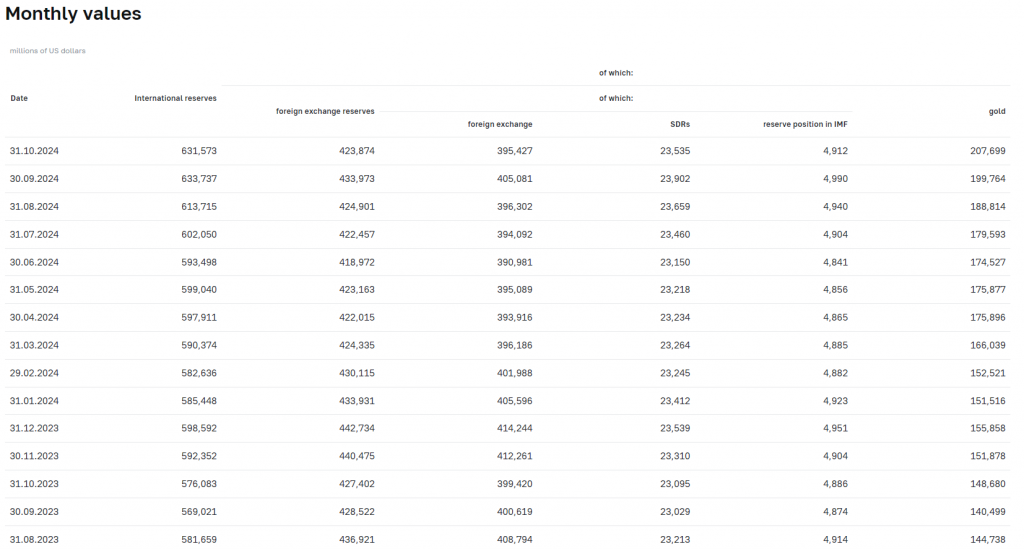

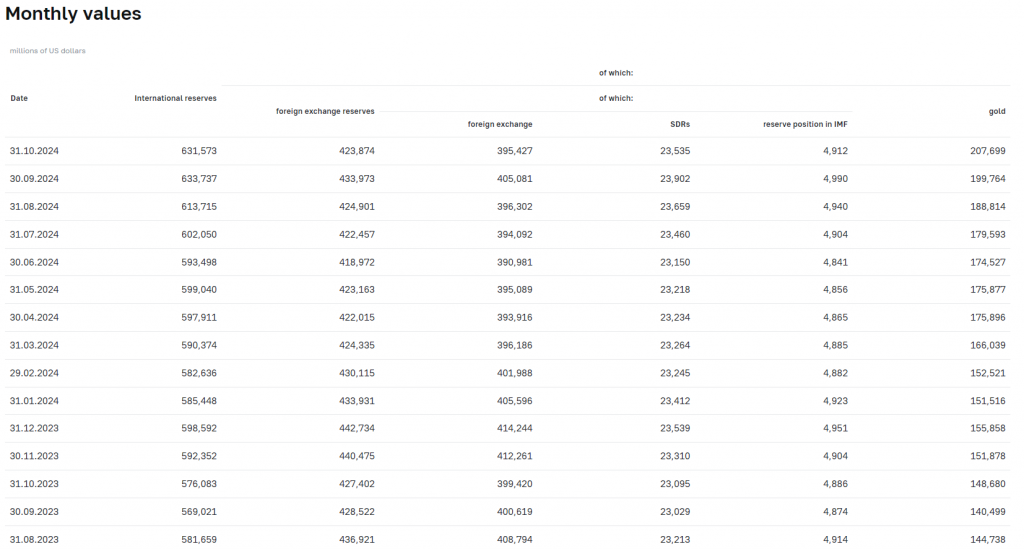

Russia’s gold reserves hit $207.7 billion in October. This marks a key step in de-dollarization and shows a major shift in global finance. The central bank reports that gold makes up 32.9% of total reserves – the highest since 1999. This change comes as Russia pushes for currency diversification while facing economic sanctions.

Also Read: Ethereum: Justin Sun Cashes Out 19,000 ETH Amid Rally: Profits Soar

Russia’s De-Dollarization Strategy: Gold Reserves and Global Financial Shifts

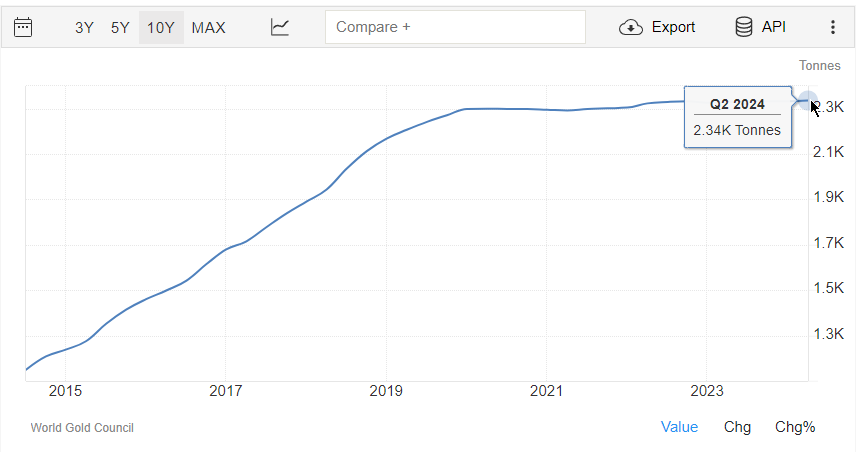

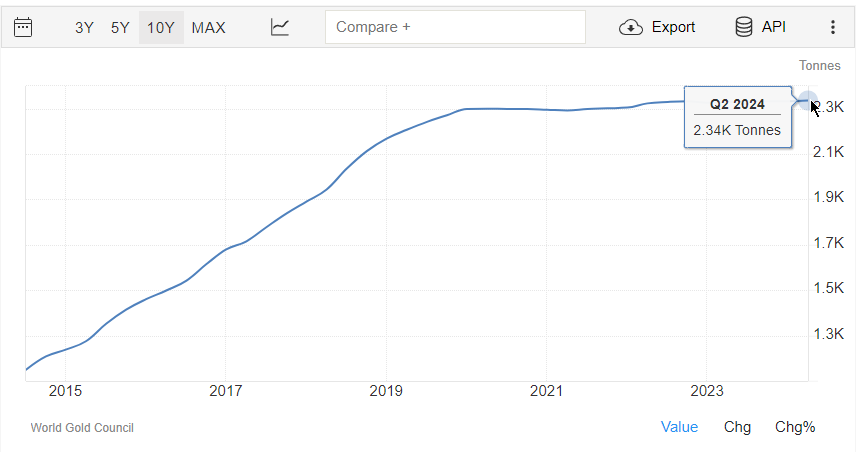

Record-Breaking Gold Holdings For De-dollarization

The Russian central bank keeps adding to its gold stack. Total reserves dropped slightly from $633.7 billion to $631.6 billion between September and October. Yet gold’s share grew from 31.5% to 32.9%. Russia’s growing gold reserves show its push for currency diversification and financial independence.

Historical Context and Strategic Timing

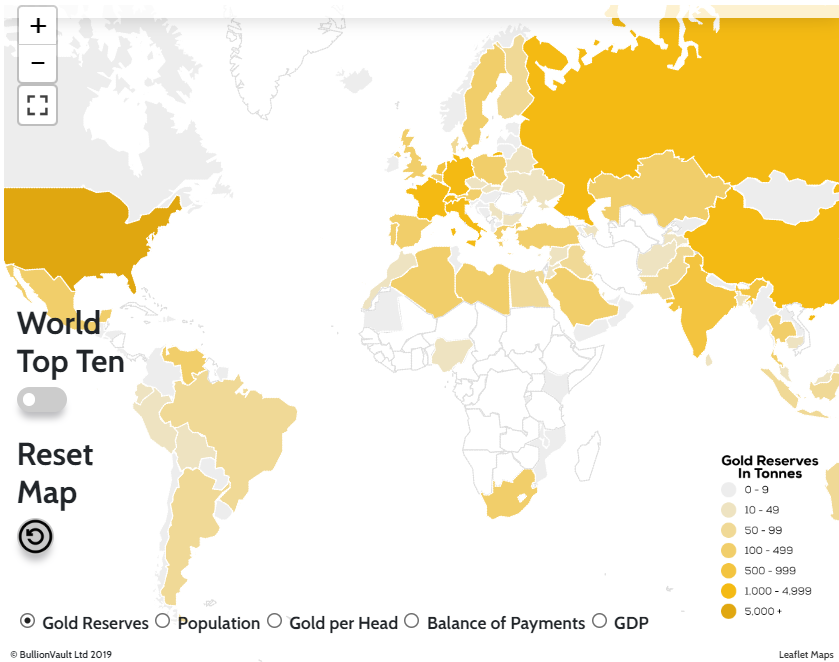

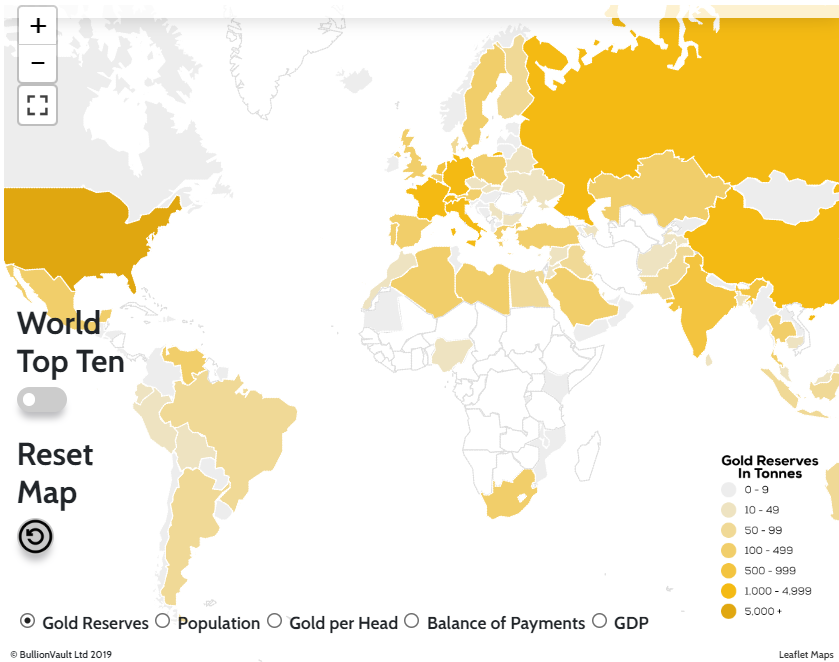

Gold levels in Russia’s reserves have changed a lot over time. They peaked at 56.9% in January 1993, then fell to 2.1% in June 2007. The recent increase comes from shifts in global financial strategy and pressure from economic sanctions. These sanctions made Russia look for new ways to store value.

Also Read: Dogecoin (Doge) & Shiba Inu (SHIB) Price Prediction For Mid November 2024

International Response and Market Impact

Central banks worldwide want more gold, as shown at the London Bullion Market Association meeting. Gold prices are up, but demand stays strong. Most central banks keep their gold in London. Russia’s gold buying has changed how global financial markets work.

Future Implications

More countries may copy the move Russia made to hold more gold than dollars. This shift could reshape how nations trade with each other as they move away from using one main currency. The shift from old reserve currencies marks a new chapter in global financial strategy, and de-dollarization seems to be ongoing. We’ll keep you updated!

Also Read: Massive XRP Bull Run: Target $1 Before Trump’s Inauguration?