Saitama Inu was experiencing a massive surge in trading inflows ahead of a fully functional SaitmaMask launch of Sunday. Its price copped up a 31% surge over the last 24 hours. However, an in-house technical analysis revealed that SAITAMA was due for a near-term correction after trading close to some rigid price barriers.

Login issues surrounding SaitaMask’s added some more complications and it is still early to tell whether this would be a classic example of buying the rumor and selling the news.

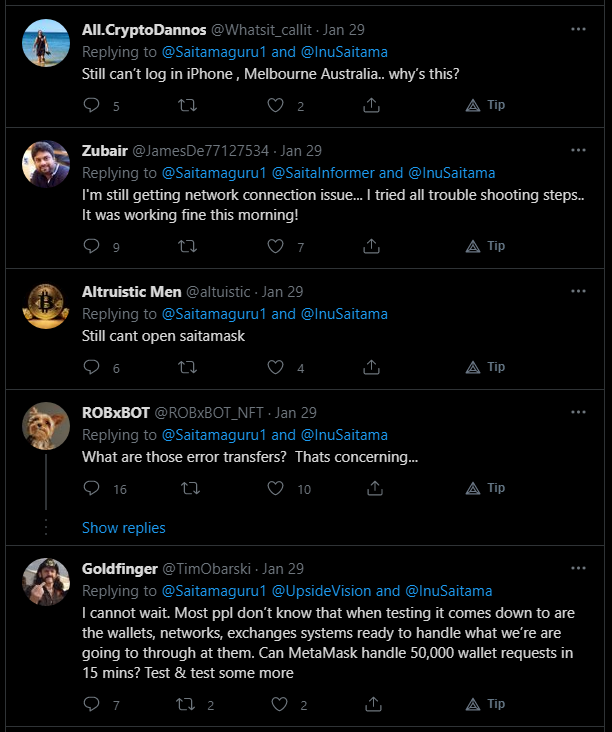

Saitama Inu 4-hour Chart

On the 4-hour chart, Saitama Inu’s rally kicked off after a double bottom setup emerged after a bearish week of trade. However, the rally was about to test a critical region between a $0.0000000338 resistance and the 200 period EMA (pink) at $0.000000044. The region was made more significant after it collided with the 200-period Moving Average.

Since the area functioned as an attractive take-profit for short-term investors, SAITAMA was likely to experience some selling pressure in the coming sessions. The outlook was backed by overbought RSI and a volume oscillator which highlighted receding buy volumes.

The resulting sell-off could drag SAITAMA back to near-term supports at $0.000000034 and $0.000000031, slightly above the 20 (orange) and 50 (blue) period MA’s. It would be interesting to see this second buy opportunity bears similar results. A higher-high above $0.000000044 would expel a ton of sell pressure and prompt an extended recovery.

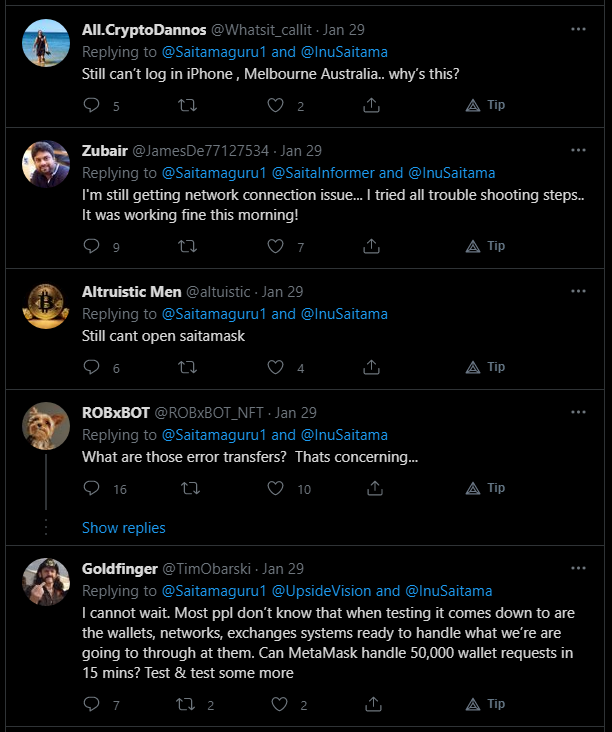

SaitaMask Issues Persist

Meanwhile, users complained of multiple login issues ahead of SaitaMask’s swap function. This prompted COO Russel Armand to reassure users that the app would continue to be optimized. However, the issues were not fully resolved at the time of writing.

Conclusion

Those who have missed out on SAITAMA’s rally should now wait as the price was trading close to a lucrative take-profit at $0.000000044 and the 200-period Moving Average. A correction, followed by a retest of $0.000000025 support would present a second buy opportunity. However, it’s uncertain whether the resulting rally would mimic the current one if SaitaMask issues persist.