With Bitcoin’s price knocking on $39,000’s door, most of the market’s coins have started showing signs of recovery. All the gaming tokens, in particular, have been flashing pretty impressive numbers of late.

At press time, all the top-30 tokens from the aforesaid category had registered upticks in the 1%-51% bracket. Unlike others, Sandbox, the second-largest gaming token by market cap–has been pretty consistent with its rally. After appreciating by close to 40% on the weekly timeframe, SAND was seen trading at $4.02.

Capitalizing on the price movements, top ETH whales have not only been monitoring this token but have also started adding them to their bags. Less than a day back, for instance, the 13th largest whale–Jiraiya–bought more than a million Sandbox tokens worth $4.357 million.

Zooming out and looking at the bigger picture

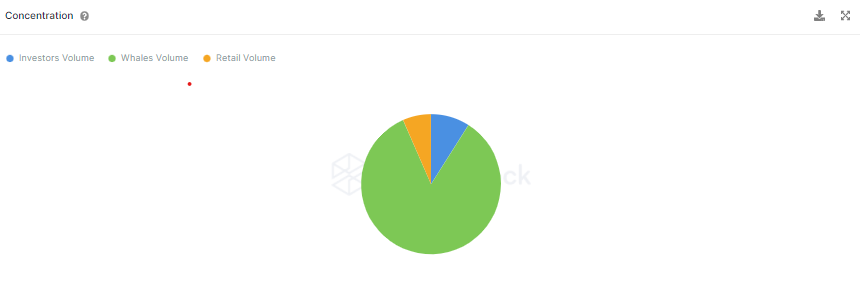

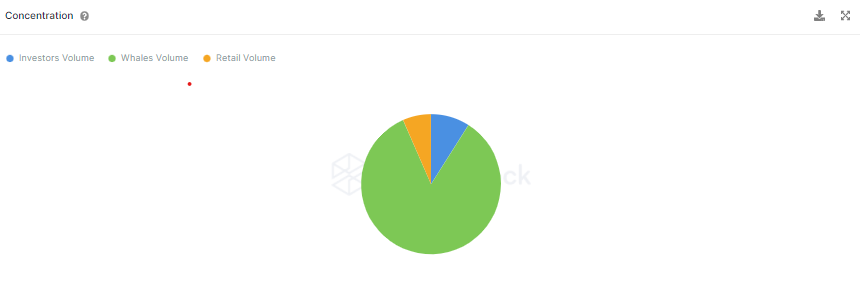

Alongside the said whale purchase, the average HODLer balance has also witnessed an uptick. This means that other market participants have also been engaging in buying tokens, amidst the price rise. Such behavior is typically exhibited during the initial legs of rallies.

It is a known fact that more than 85% of SAND HODLers are whales. So, a rise in the overall average balance directly corresponds to a rise in the number of their tokens. So, whales doing some heavy-lifting at this time paint quite an optimistic picture about the prospects of Sandbox.

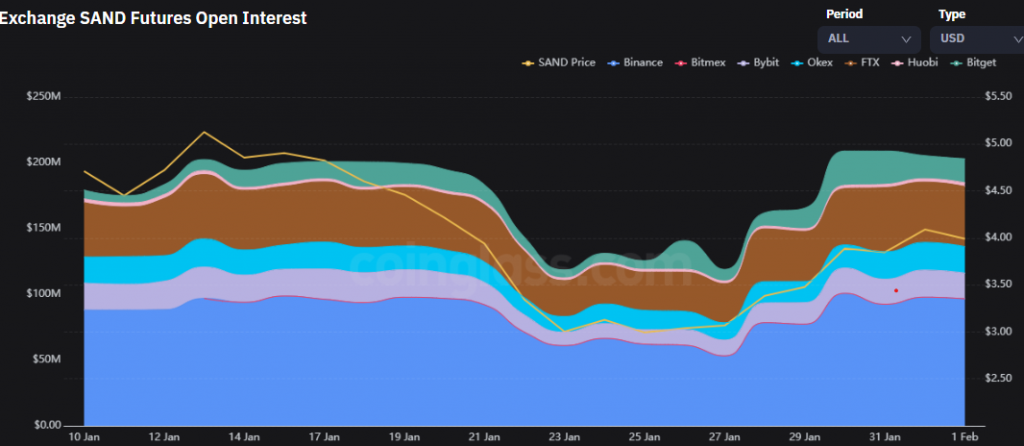

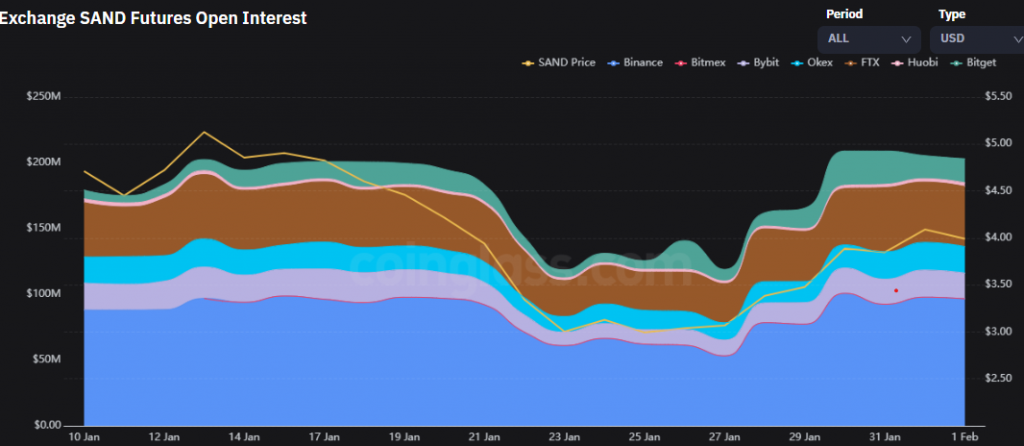

Additionally, interest in the futures market has also been picking up pace. The Open Interest that was around the $100 million mark during the last fortnight of January, has climbed to $200 million already.

So, with additional money flowing into the SAND market, it can be said that the confidence of market participants, especially traders, is gradually intensifying.

Thus, it wouldn’t be wrong to expect more market participants and whales to enter into the SAND market going forward. In effect, the current trend would end up becoming more concrete.