While speaking on financial surveillance and privacy at the SEC Crypto Task Force Roundtable, SEC Chair Paul Atkins warned that crypto could become the most powerful financial surveillance architecture ever invented if pushed in the wrong direction. However, Atkins advocated for privacy tools like zero-knowledge proofs to protect user freedoms while ensuring compliance.

SEC’s Pro Crypto Approach

The US SEC taken a 180-degree turn after President Trump assumed office. Previous SEC Chair Gary Gensler was seen as a villain in the crypto space. The appointment of Paul Atkins came as a blessing to the American crypto industry. In fact, President Donald Trump’s pro-crypto stance has a lot to do with the SEC’s change in its crypto outlook.

The SEC’s pro-cryptocurrency stance is likely to continue over the coming years, at least till the Trump administration is in power. The Trump family has garnered immense wealth through their cryptocurrency dealings. The President will likely continue to favor their business as long as he is in power.

Market Continues To Dip

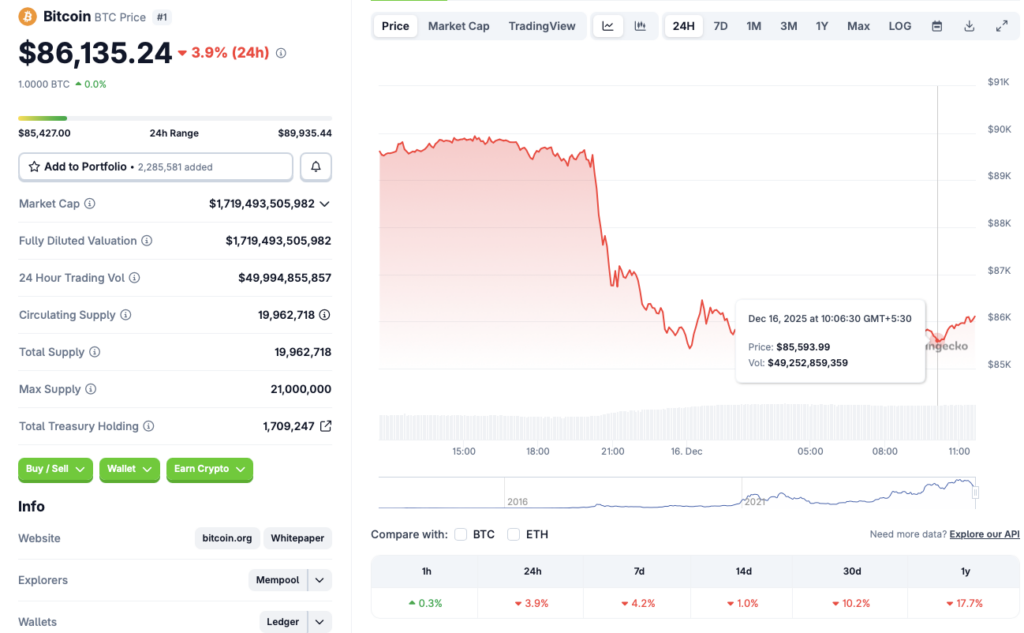

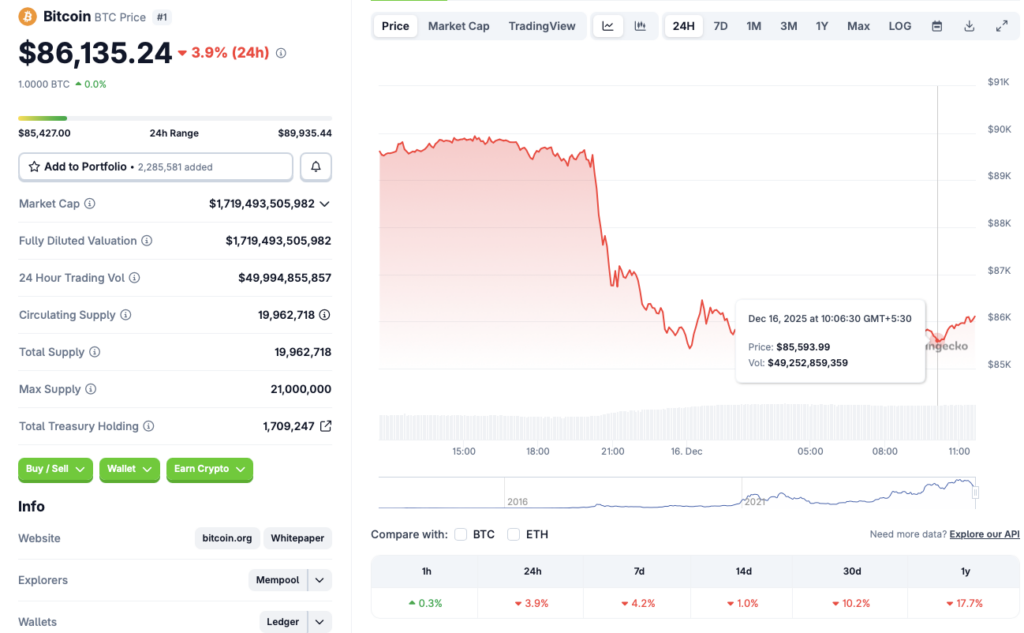

Atkins’ speech coincides with the cryptocurrency market taking another massive blow. Bitcoin (BTC) fell to the $85,000 price level earlier today, pulling most other assets down with it. According to CoinGecko’s BTC data, the original crypto is down 3.9% in the last 24 hours, 4.2% in the last week, 1% in the 14-day charts, and 10.2% over the previous month. BTC’s price has also dipped by 17.7% since December 2024.

Also Read: Silver Price Now Equals Oil in a Major Market Shift Not Seen in Years

The latest market downturn is likely due to continued macroeconomic uncertainty. High-risk assets, such as cryptocurrencies, have taken the brunt of the ongoing storm. Investors are likely redirecting their funds to safe havens such as gold and silver. Silver recently climbed to a new all-time high last Friday. Silver’s rise could be seen as a signal that market participants are taking a risk-averse trajectory.