In a notable development within the cryptocurrency market, Bitcoin spot exchange-traded funds (ETFs) in the United States are now on the brink of potential simultaneous approvals in January. Analysts posit that the recent decision by the Securities and Exchange Commission (SEC) to postpone the considerations for Franklin Templeton and Hashdex ETFs has effectively paved the way for a smooth approval process.

Strategic Maneuvers by the SEC

Bloomberg ETF analyst James Seyffart decided to shed light on the SEC’s strategic moves. He emphasized that the SEC’s delay in deciding on the ETF applications occurred 34 days prior to the decision deadline of Jan. 1, 2024. The SEC has called for comments on forms submitted by Templeton and Hashdex, forms crucial for the ETFs to secure listing and commence trading. The designated comment and rebuttal period is set to last 35 days.

Seyffart and colleague Eric Balchunas had previously assigned a 90% likelihood of spot Bitcoin ETF approvals by January 10 of the following year. Seyffart contends that the recent delays strongly indicate that the SEC is orchestrating the alignment of all applicants for potential approval by the January 10, 2024, deadline.

Balchunas echoed this sentiment, proposing that the SEC is likely seeking to “clear the runway” by swiftly addressing these delays. However, commercial litigator Joe Carlasare provided a slightly divergent perspective, suggesting that the delays might elevate the probability of approval in March 2024. He highlighted the extension of the comment period for Franklin’s ETF bid until January 3, 2024, and noted the SEC’s typical three-week maximum duration for reviewing comments. Nevertheless, Carlasare maintained that January remains the favored timeline, speculating approval on either January 5 or January 8.

Distinctive Position of Franklin

On November 28, Franklin Templeton submitted an updated Form S-1 for its ETF, a crucial document for registering securities with the SEC. Seyffart had previously underscored that Franklin stood out as the only bidder yet to submit an updated prospectus. Balchunas, while supportive of the idea of simultaneous ETF launches, expressed reservations about Franklin potentially being granted approval to launch its ETF on the same day as other providers, despite submitting the form months later.

Also Read: Bitcoin: GBTC May Lose $2.7B If ETF Approved: JPMorgan

Evolution of Market Dynamics

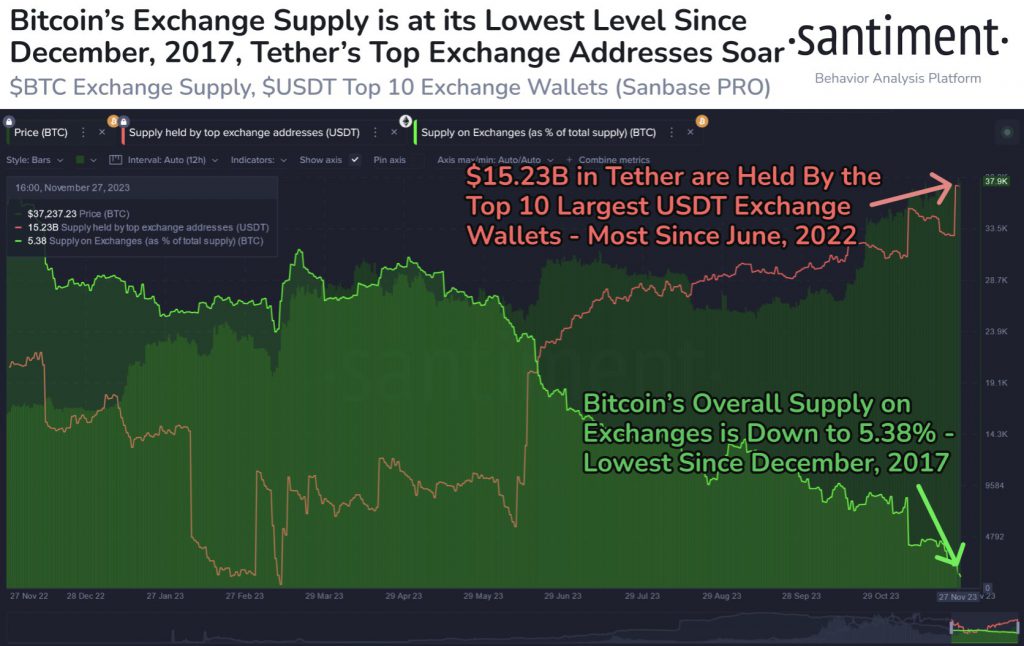

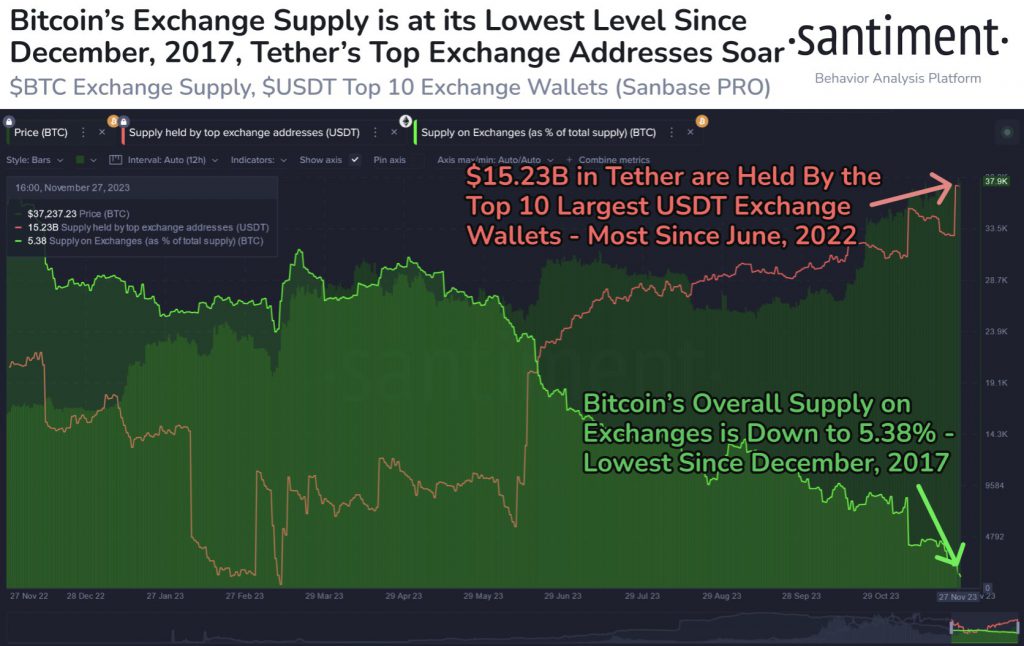

Amidst these regulatory developments, the cryptocurrency market’s dynamics are undergoing continuous transformation. Reports suggest that Bitcoin’s supply on exchanges is shifting towards self-custody, signifying a trend where users opt to securely hold their assets rather than keep them on exchanges. Concurrently, the ten largest Tether exchange wallets currently hold $15.23 billion, indicating a notable increase in exchange buying power to its highest level in 17 months.

Additionally, at press time, BTC was trading at $37,959.20 with a 2.47% daily rise.

Also Read: Bitcoin: Microstrategy Stock Reaches 2-year High After BTC Surge

The recent delays in the approval process for Bitcoin spot ETFs in the United States have triggered anticipation and speculation among analysts. As the cryptocurrency market eagerly anticipates regulatory clarity, the prospect of simultaneous approvals in January 2024 emerges as a potential game-changer. The nuances of Bitcoin’s supply dynamics and the surge in Tether exchange wallet holdings contribute additional layers of complexity to the evolving narrative of cryptocurrency adoption and market dynamics.