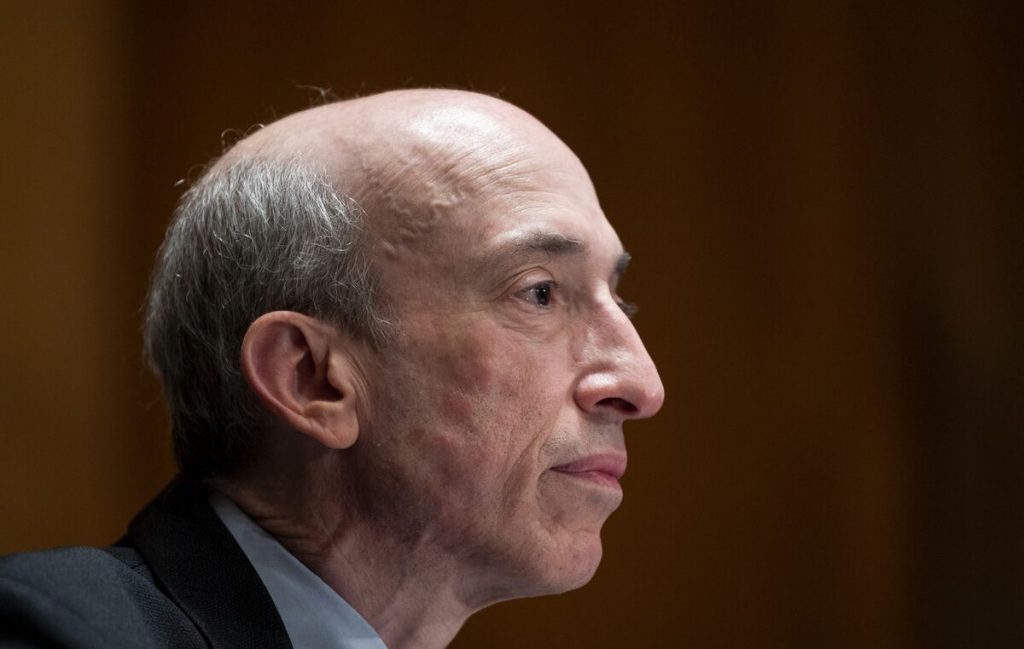

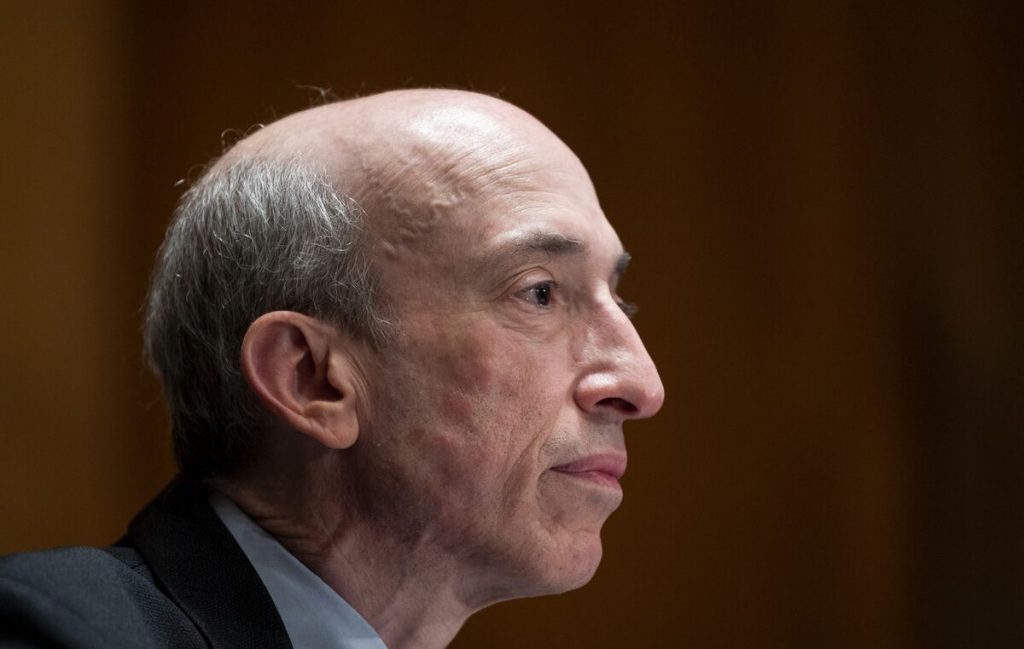

Amid the ongoing regulatory question regarding the second largest cryptocurrency, new court filings reveal that the US Securities and Exchange Commission (SEC) has been investigating Ethereum since 2023. Indeed, the filings show that chairman Gary Gensler and the agency have been seeking to challenge the asset’s security status for a year.

Ethereum software firm Consensys filed a lawsuit against the SEC last week. However, they paint an interesting picture of how the agency has viewed the cryptocurrency. Specifically, they note that it has been building a case against the asset since early 2023. Conversely, development is vital as the agency is facing a plethora of Spot Ethereum ETF applications.

Also Read: Ethereum May Price Prediction: Can ETH Hit $4,000?

SEC Has Been Seeking to Challenge ETH Security Status Since 2023

The digital asset market has faced an ever-changing regulatory landscape. Indeed, United States investors have struggled with a lack of clarity in this area regarding the industry. This is in large part due to the SEC and its ongoing enforcement-first approach to regulation.

Now, revealed court filings show that the SEC has been investigating Ethereum since March 2023. Specifically, the agency has reportedly been building a case to challenge ETH’s security status for more than a year.

According to reports, the SEC director of the Division of Enforcement, Gurbir Grewal, approved an investigation order in March of last year. That allows the agency to investigate both the buying and selling of Ethereum. The presence of a formal order of investigation allowed the SEC to issue subpoenas and gather witness testimony under oath.

Also Read: SEC Sued Over Ethereum, Prosecutors Say ETH Isn’t A Security

The revelation explains why Gensler had previously refused to answer if Ethereum was a commodity or security at a recent Congressional testimony. According to Consensys, Gensler “did not want to admit that his SEC had already secretly cemented its power-grab” through the investigation order.

The SEC has been known to target specific digital assets by referring to them as securities in filed lawsuits against cryptocurrency exchanges. In 2023’s lawsuits against Coinbase and Binance, more than ten assets were named security. However, ETH was not included among them.