The bloodbath in the Indian stock markets continues to extend today as well, with major indices flashing bold red signals. Sensex and Nifty crashed 450 points on February 28, erasing major gains that they had accumulated since June 2024. The plummet is set to have been caused by the changing geopolitical changes, including uncertainty about Trump’s tariff stance towards India. At the same time, the US dollar is expected to strengthen further against major currencies, including the INR, which is again causing major market fluctuations to unravel with time. That being said, these major stocks have fallen and hit new lows amid the new market pressure.

The Indian markets are also feeling additional pressure due to new FIR filings submitted against SEBI chief Madhavi Puri Buch and five other executives. The Sensex and Nifty responded to the news negatively, declining significantly in the process.

Also Read: BRICS: Brazil Reiterates Need to End US Dollar, Will 150% Tariffs

Three Major Stocks That Have Reached New Lows Amid the Latest Sensex and Nifty Crash

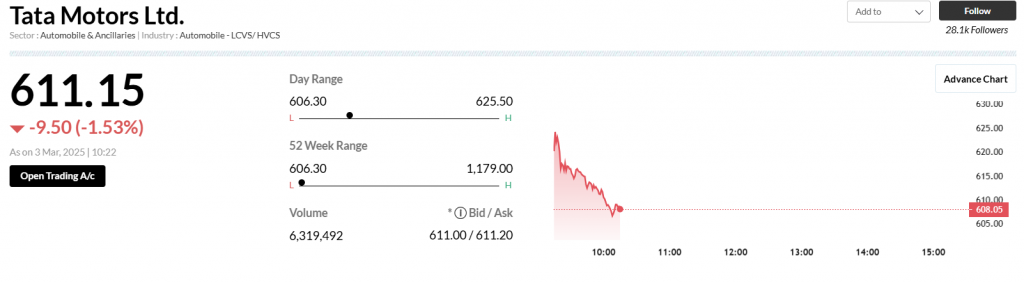

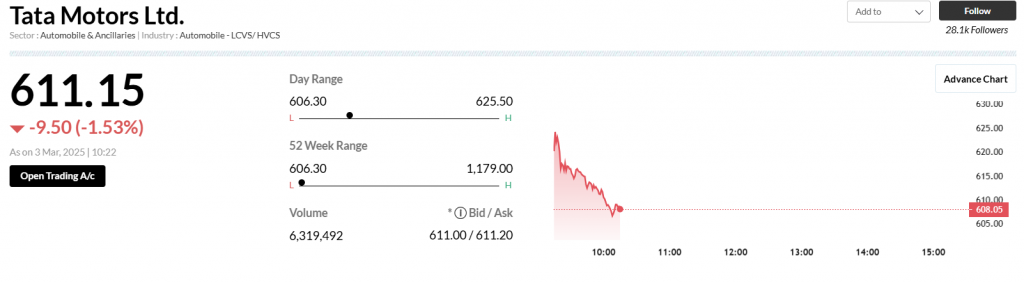

1. Tata Motors Ltd. (TAMO)

The shares of Tata Motors (TAMO) have fallen dramatically in the last week, erasing 47% gains from its peak price since June 2024. However, the good news is that despite the significant fall noted in its price today, TAMO is expected to rise high, with analysts predicting an INR 1000 and beyond price value for the stock. Per CNBC, 34 analysts have flashed a buy signal for the stock, with projections indicative of a 34% upside soon.

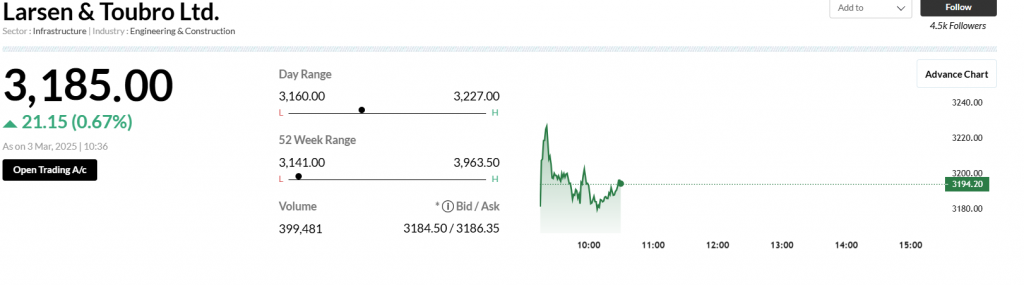

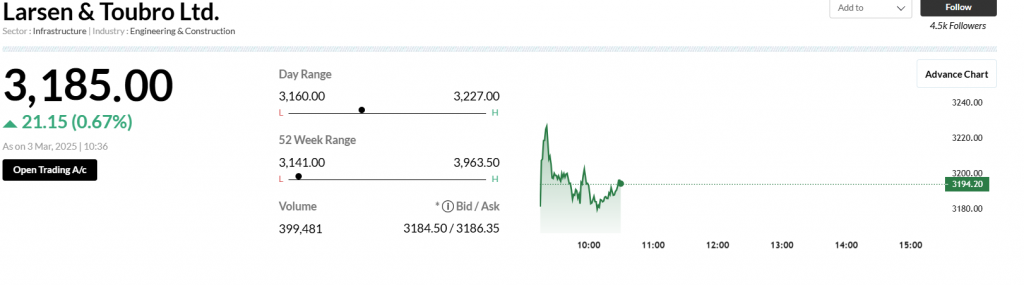

2. Larsen And Toubro (LT)

Per the portal, Larsen and Toubro, a mega giant, is also trading in a very narrow range, hitting a 52-week low at present. The stock has plummeted nearly 20% from its peak and is now predicted to gradually pick up its pace provided the market pressure eases soon. Analysts have predicted LT to score a new high soon, possibly peaking by 20% soon. The experts are bullish on LT, claiming that the stock has the potential to turn the tables around soon.

Also Read: Shiba Inu to Get Boost From ETH Upgrade: Can SHIB Reverse 12% Fall?

3. Asian Paints (ASIANPAINT)

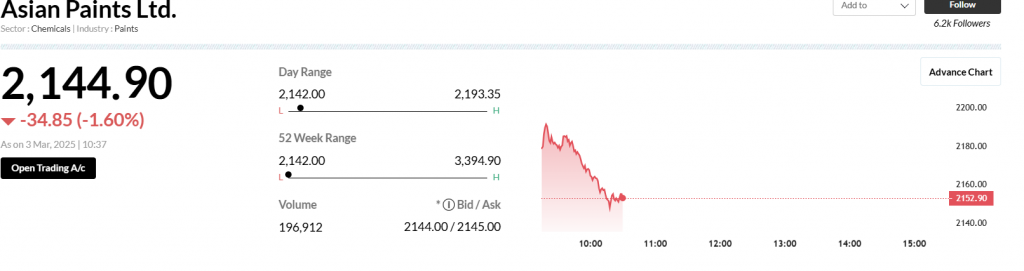

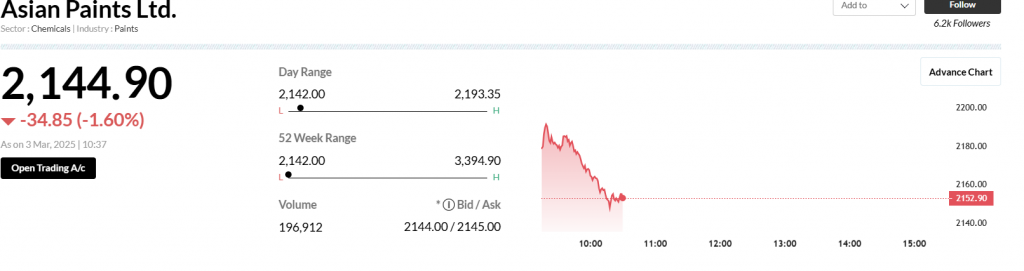

A leading Indian market player, Asian Paints has also noted a dramatic stock plunge, as geopolitical narratives continue to dictate the Indian stock scene. Per CNBC, Asian Paints have declined 35% as of late, down to a new 52-week low. The stock is flashing a “sell” signal per experts, with analysts projecting a 10% upside for the stock in the near future.

Also Read: Ripple XRP Falls 18% In 7 Days: How Low Will It Go?