SHIB enters its most dangerous quarter as historical data shows June delivering brutal -15.1% average returns, and this makes the summer of 2025 potentially devastating for investors right now. The meme coin faces its worst seasonal period, with Q2 historically producing consistent losses.

The numbers reveal a stark pattern. June stands as SHIB’s worst month, posting -15.1% average returns with -11.8% median losses. This Shiba Inu price prediction becomes concerning when crypto market volatility typically peaks during these exact months.

Also Read: XRP or Shiba Inu: Which Cryptocurrency Delivered Profits This Year?

Whale Activity, Volatility & Regulation Weigh On SHIB’s Outlook

Historical Data Confirms Pattern

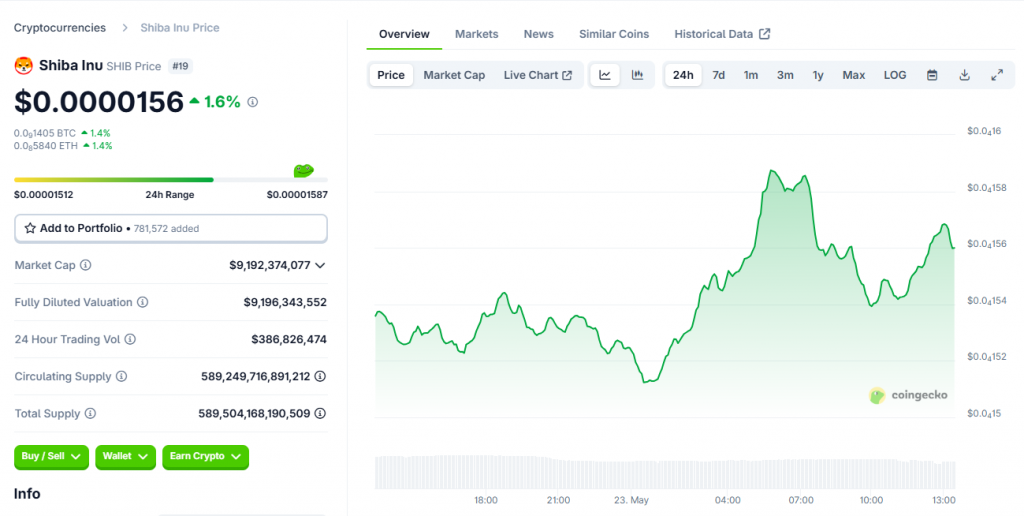

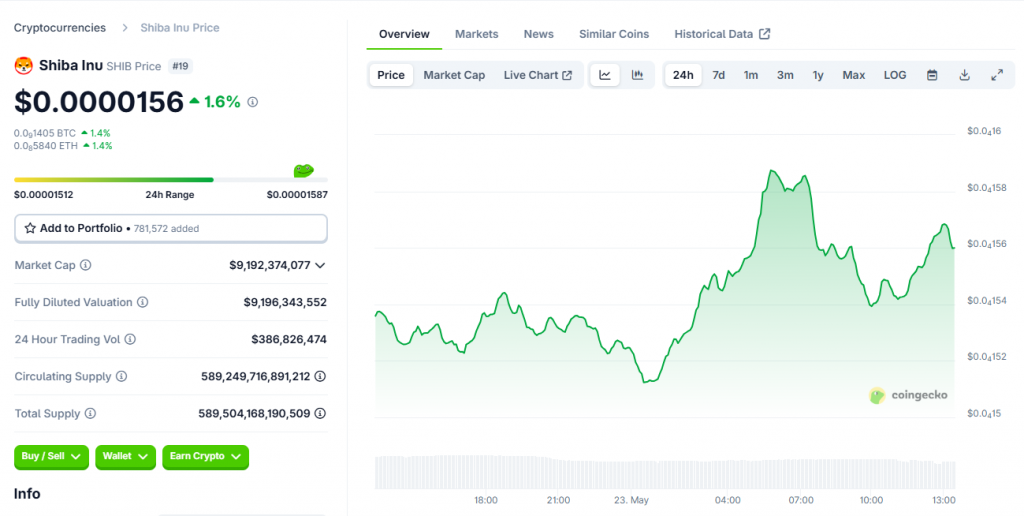

The price of SHIB at this moment is $0.0000156 and it is not doing well, being below its February mark and meeting resistance at $0.00001698. In Q2, the token maintained an extremely negative trend, losing -30.2% in 2023 and -44.3% in 2024.

Investing in May may deceive with an average gain of +65.4%. However, it seems this pattern happens the same way – magic in May and reality during June. SHIB whale moves during these changes indicate that big holders are more aware of seasonal trends than retail investors. At this point, the setup resembles what happened before as SHIB enters a risky quarter for its price.

Also Read: This Is How Much Shiba Inu You Need to Retire Before 2040

Technical Setup Shows Weakness

From a technical standpoint, Shiba Inu price prediction looks grim heading into summer. Support at $0.00001107 represents a potential 28% decline from current levels. Volume patterns show weakening buying interest.

The charts reveal a wounded token heading into its most challenging period. Being trapped below previous support levels indicates underlying weakness that summer selling pressure could exploit. Crypto market volatility during these months has historically been brutal for meme coins.

Why SHIB Enters Most Dangerous Quarter Every Year

Summer is usually a time when crypto activity slows down. A lot of traders are gone on holiday and college students stopped hyping meme coins for summer leisure, leading to a big decrease in market activity. The drop in hype during holidays harms applications that depend on excitement for their success. Technical considerations are enriched by psychology in education.

After the spring earning season, investors often want to reach their desired profit level before going on vacation which leads to natural waves of selling. If big crypto declines are in the summer, loss rates for SHIB are usually much higher.

All of these results suggest that Shiba Inu prices may fall in the summer. SHIB whale activity suggests smart money recognizes these patterns.

Also Read: Shiba Inu: Shibarium Officially Burns 1 Billion SHIB Tokens

Limited Escape Routes

A major catalyst is needed for SHIB to overcome its summer challenge. Important additions to exchange listings or token burning activities could help move the market forward. Nevertheless, such past ecosystem innovations as Shibarium did not stop the default crypto from dropping in the spring.

There has been no improvement in SHIB’s summer performance. It’s likely another painful summer lies ahead unless some unforeseen factor intervenes. Having both deficiencies with technology and the season’s trends working against it, the token could end up at important support levels as the dangerous quarter approaches.