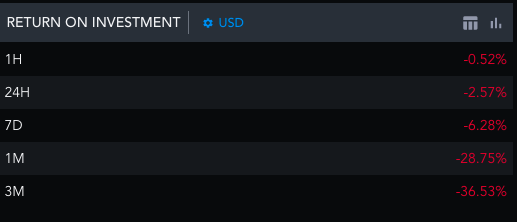

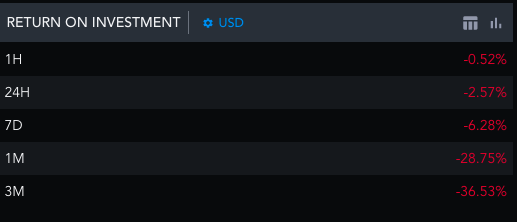

Shiba Inu investors have not been fetched with fancy returns of late. In fact, their investment size has only shrunk with time. Leaving aside the short-term windows, SHIB’s RoI on the monthly and tri-monthly windows too have been soaked in blood. As per data from Messari, SHIB had shed 29% and 37% of its value in the aforesaid periods.

Well, it is not fair to point the whip solely towards SHIB because the entire market has been in a wobbly state since the end of last year. Four fingers ought to be directed towards the macro-sluggishness as well.

A place in the top 10 – A thing of the past?

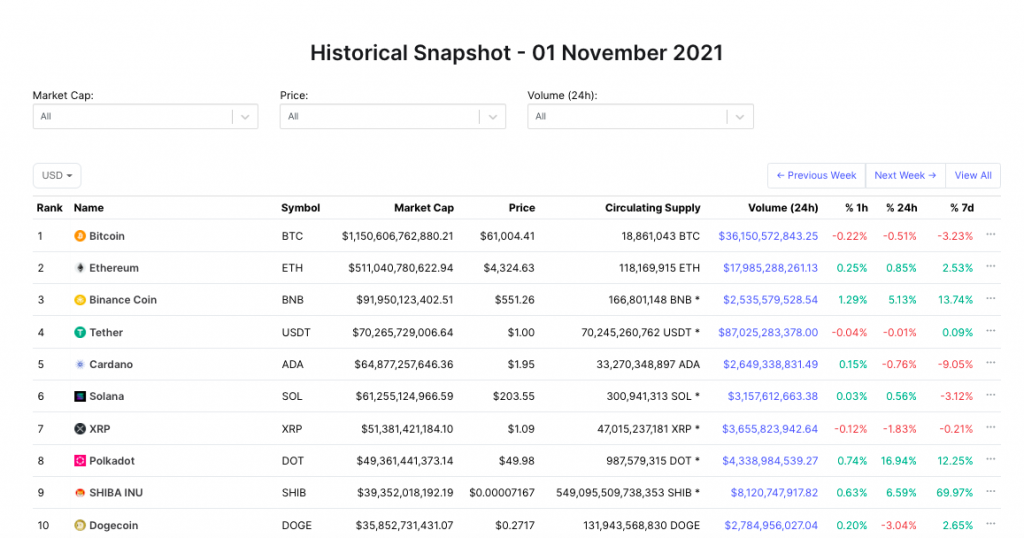

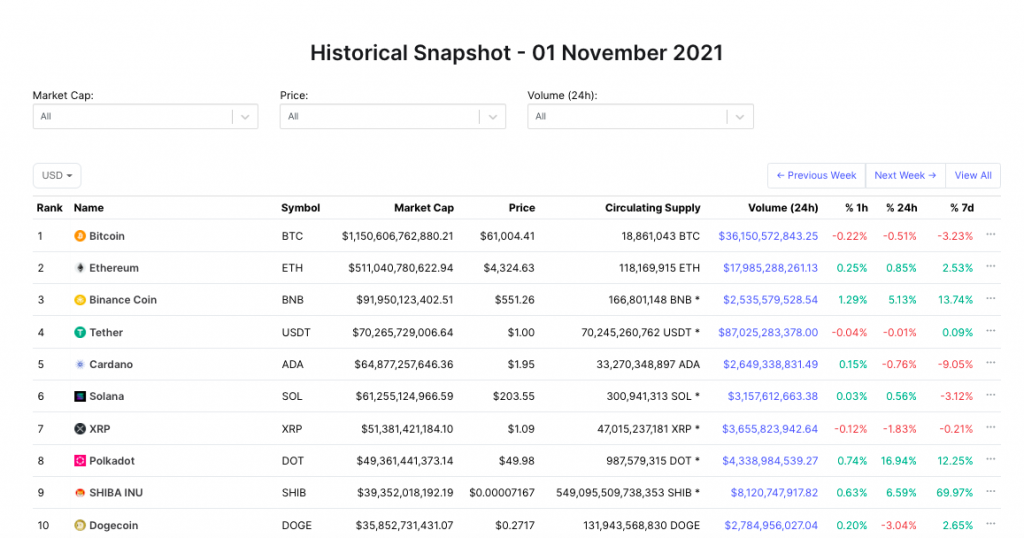

Back in November last year, Shiba Inu had comfortably carved out a spot for itself in the top-10 list. In fact, there was a point in time when SHIB had even flipped DOGE to become the largest meme-coin in terms of capitalization.

Ever since it slipped out of the list, this token has hardly been able to get back into the arena and reassert its dominance. When compared to its $39.3 billion market cap and #9th standing on 1 November ’21, Shiba Inu’s current state is definitely not up to par. Per CMC’s latest figures, the token was ranked #15th at the time of press and depicted a deflated $11.8 billion market cap.

Currently, the 10th ranked BUSD has a market cap worth $17.9 billion. So, to hop back into the list, SHIB would have to bridge a gap as wide as $6 billion.

Reality Check – Is it possible?

At this stage, it is crucial to weave a couple of factors together and analyze Shiba Inu’s macro landscape.

1. Despite whales randomly mass purchasing tokens, the cumulative number of large transactions and their volume hasn’t registered any notable uptick of late. This means that the Shiba Inu market doesn’t necessarily boast of buy-side momentum at the moment. The same was elaborated in an article yesterday.

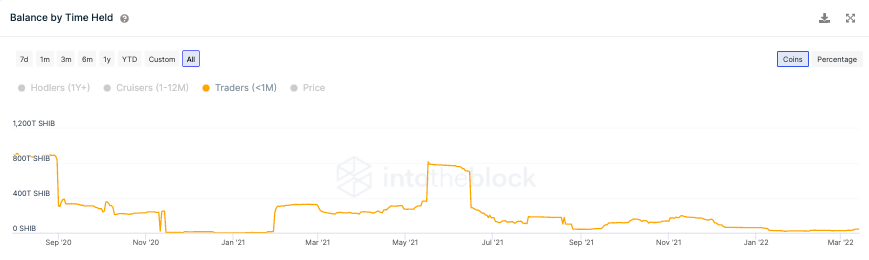

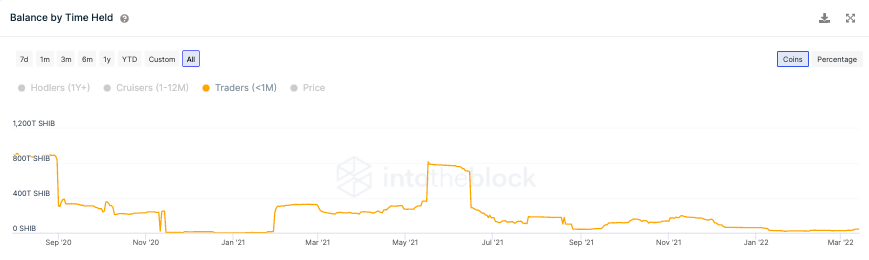

2. The influx of traders into any token’s ecosystem aids its price to swing dramatically in short spans of time. But as far as SHIB is concerned, the number of traders has not seen any substantial bump of late. In fact, this number continues to hover around the lows at the moment, wiping off the odds of SHIB pumping.

3. Also, it is critical to note that the volatility in the SHIB market continues to remain suppressed. As per Messari’s data, the same has been hovering below 1 of late, when compared to the 4 noted during its rally phase in November last year. A highly volatile environment usually instigates price swings in either direction and its scantiness in the SHIB market, alongside the buying momentum and trader count deficiency, reduces the odds of the token’s market cap swelling up immediately.

In all, the odds of Shiba Inu reclaiming a spot in the top-10 seems to be next to no in the short run, unless and until some major catalyst incites it to do so.