Volatility has truly been acting like a double-edged sword, and prices of crypto assets like Shiba Inu have been fluctuating dramatically over the last couple of days. In fact, there has been no decisive uptrend or downtrend confirmation, and trends on the lower timeframe and higher timeframe charts have been contradicting each other.

During such indecisive periods, traders usually flock into the market en-masse to take advantage of price actions. However, as far as SHIB is concerned, that has not necessarily been the case.

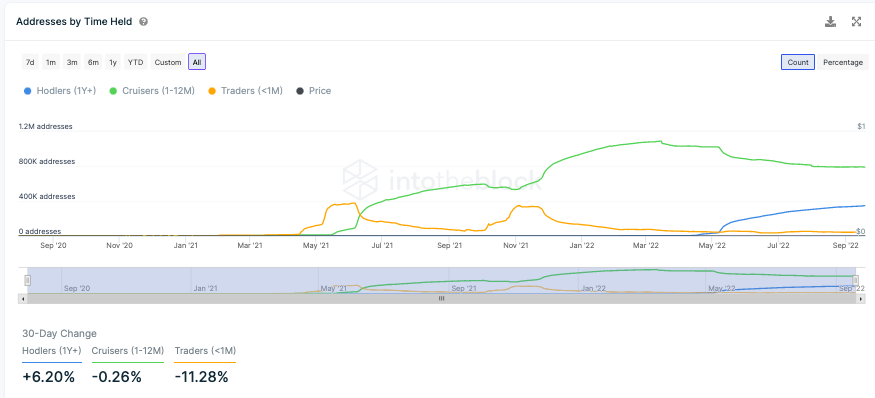

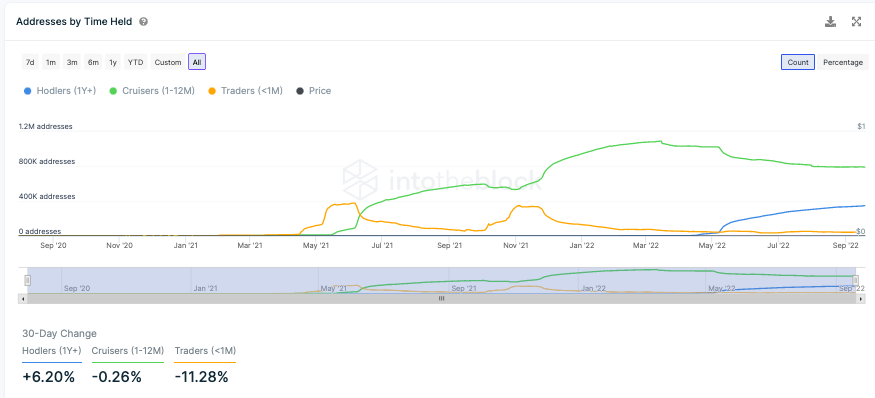

As illustrated below, the gap between the short and long-term participant curves has been bridging. Per data from ITB, the number of HODLers [1-year +] has risen by 6.20% over the past month. On the contrary, the number of cruiser addresses [1-12 months] has dipped by 0.26%, while the trading addresses [< 1 month] have dropped by 11.26%.

With the addition of conviction HODLers into the ecosystem and the unconventional exit of traders, Shiba Inu ownership is becoming clearer of late.

Is Shiba Inu in a positional advantage?

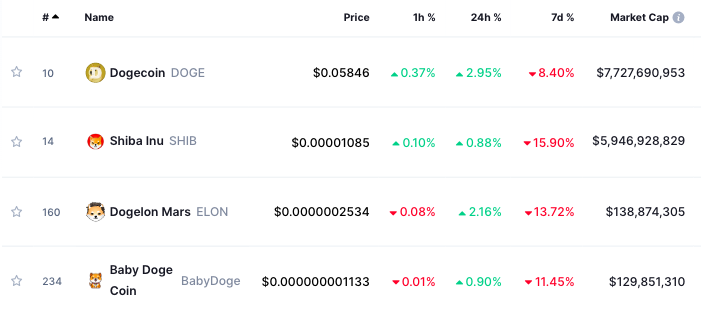

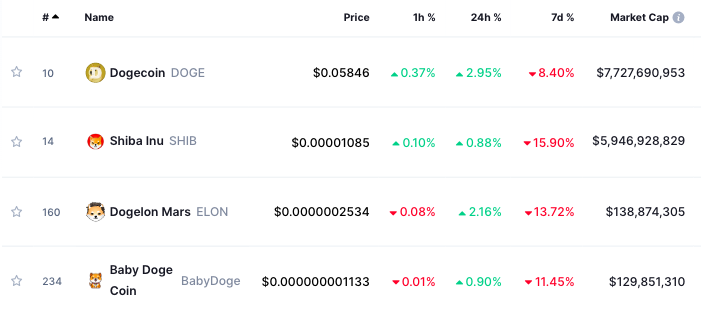

Over the past week, Shiba Inu has lost the most value when compared to its other counterparts from the same boat. While the likes of DOGE, ELON, and BabyDoge were down by 8%-14%, SHIB had lost roughly 16% of its value.

This means, that if the market notes a concrete relief rally going forward, Shiba Inu could rise the most. In fact, the buying pressure could seen steaming on Tuesday at press time. Over the past 1 hour alone, 18.72 billion additional SHIB tokens have been bought then sold. In fact, even on the 12-hour window, the pendulum was inclined towards bulls. This is with the buyer-seller trade difference standing at +70.76 billion SHIB.

However, users shouldn’t forget that Shiba Inu shares a positive correlation of 0.81 with Bitcoin and 0.84 with Ethereum. That means, at the end of the day, the broader directional bias will continue calling the shots.