According to the data from Shibburn, 352,210,738 Shiba Inu (SHIB) tokens were burned in February 2023. Moreover, the burns took place over 128 transactions. This represents a significant drop in burns compared to January. In the first month of 2023, SHIB’s burn portal removed almost 1.2 billion tokens from circulation. February burns represent a fall of 70.65%.

Since its launch in April 2022, Shiba Inu’s burn portal has removed around 90 billion tokens from circulation. Currently, 589.6 trillion SHIB tokens are in circulation, compared to the initial supply of 1 quadrillion.

The recent plummet in burn rate could be attributed to a fall in network activity. Fewer people might be using the network, and investor interest may have dropped.

Regardless, the burns have done little to push the price of the popular canine-themed cryptocurrency. Many are hopeful that the launch of Shibarium will lead to even more burns, which may lead to a price increase. However, how burns will take place on the new layer-2 network, remains to be seen.

Shiba Inu’s on-chain metrics show bearishness

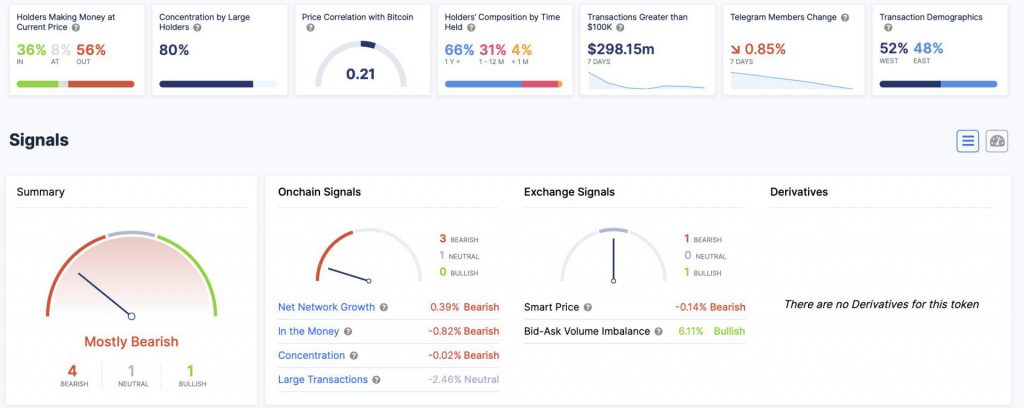

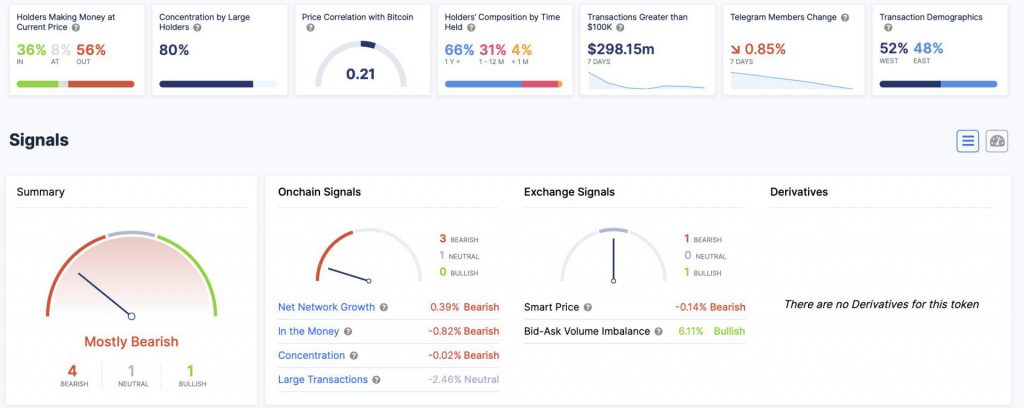

Apart from the burns, SHIB’s on-chain metrics also lack any bullish behavior. According to IntoTheBlock, only 36% of SHIB holders are in profit. A majority of SHIB holders (56%) are at a loss, while 8% have broken even.

However, one of the major causes of concern among SHIB holders is the concentration of large holders, or whales. According to IntoTheBlock, 80% of SHIB’s supply is controlled by large wallets. Other bearish signals include the drop in network growth. Shiba Inu (SHIB) has witnessed a fall of 0.39% on that front.

Nonetheless, long-term holders have reached 65%, while short-term holders have dropped to 4%. This is a sign that investors are confident about SHIB’s performance in the long run. Moreover, the total unique addresses are at the highest levels.

At press time, Shiba Inu (SHIB) traded at $0.00001196, down 3.0% in the last 24 hours. Moreover, the token has fallen 8.8% in the weekly charts.