If you’re tracking Shiba Inu’s price on the hourly chart, you may end up feeling relieved by the bullish resurgence on Tuesday morning. Well, looks can be deceiving. Shiba Inu was essentially trading in ‘ no man’s land’ on the daily chart and the long-term outlook was still overtly bearish.

Shiba Inu marks a 31% spike

At press time, Shiba Inu’s price was reacting similarly to its other counterparts. The altcoin negated its Monday losses and switched to green thanks to trading inflows on Tuesday morning. Since the past few hours, SHIB rallied by 31% and eyed $0.00001800-resistance at press time.

One would expect that a 31% increase would have been well supported by technical levels on the chart. Well, strangely enough, that wasn’t the case. Shiba Inu was essentially trading in no man’s land after losing out on major support of $0.00001200 following Monday’s correction. This was a major red flag as rallies not reinforced by significant support tend to be short-lived.

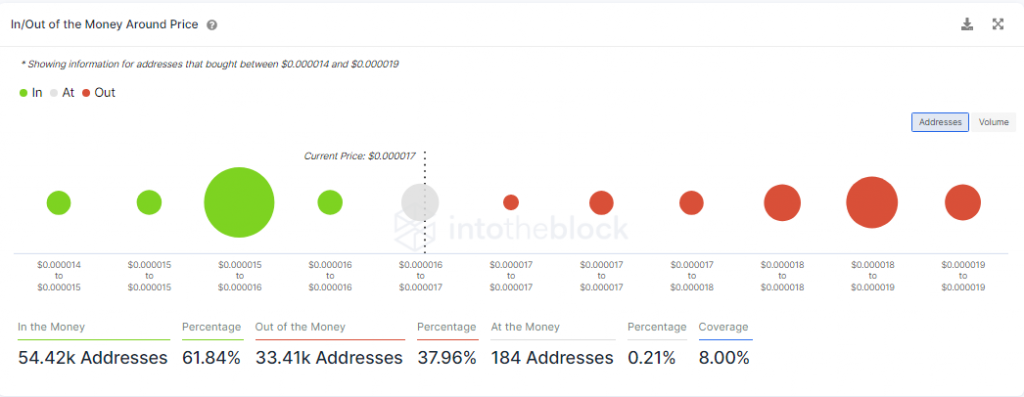

The second red flag pops up after looking at IntoTheBlock’s In/Out of the Money model. As per the model, 54K addresses that purchased Shiba Inu between $0.000014 and $0.000016 were currently in profit. This was a significant figure. With downside risks still at large, the assumption was that a majority of these addresses would lock in their gains and exit the market before sellers inflict more pain.

Talking about pain, there weren’t many support options to rely on besides $0.00001350. If the broader market tumbles and SHIB fails to hold above this level, the price could slip by an additional 12% to its next support around $0.00001200. This represented an overall loss of 33% from SHIB’s press time level.

Conclusion

Do not let Shiba Inu’s relief rally confuse you. The current price increase would most likely be short-lived and with no reliable support levels, a fall back to $0.00001200 was a more logical outcome over the longer run.