Shiba Inu’s price lost some luster on Wednesday and the hourly chart pointed to a few imminent dangers ahead for the world’s 15th largest cryptocurrency. To maintain its bullish bias, SHIB had to sustain its value above a crucial level at least over the next 24 hours or risk losing a potential comeback to its 2022 high.

A monumental Robinhood listing handed Shiba Inu its second-best price performance of 2022 thus far as the digital asset climbed by 21% and looked to revisit its 2022 high of $0.000035339. However, SHIB’s price action on Wednesday was a slightly different story.

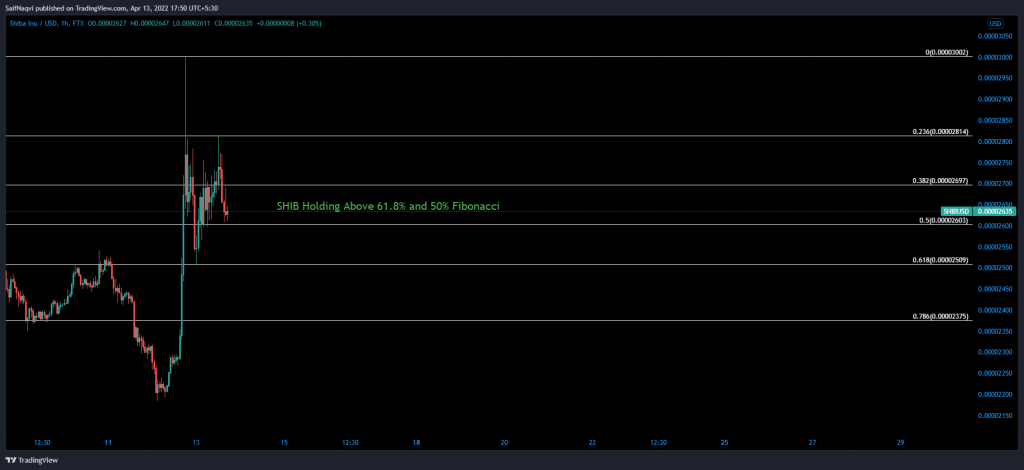

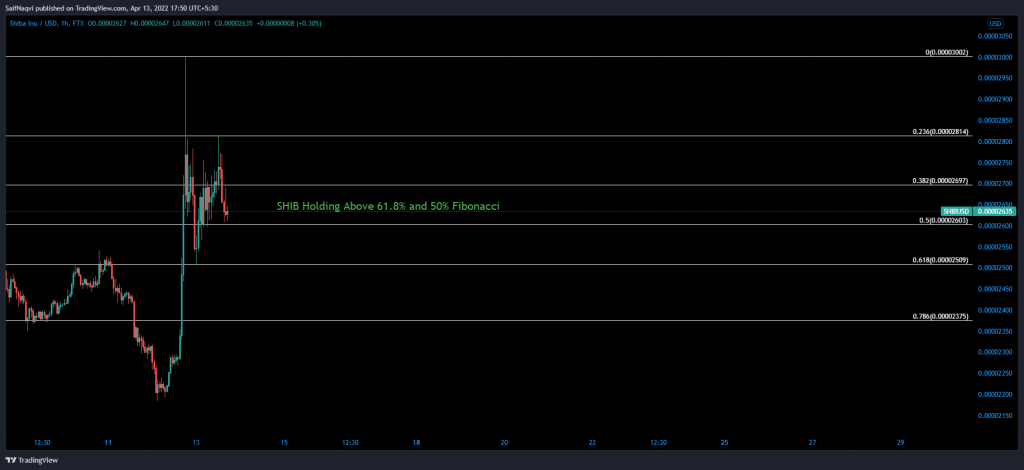

The price was close to negating an ascending triangle on the hourly chart after failing to close above $0.00002814. In technical terms, invalidation of a bullish pattern can agitate investors to offload some of their holdings.

Can SHIB Maintain Its Bullish-Bias?

Fortunately, the situation was not on hand just yet. Shiba Inu’s price was still trading above the 61.8% Fibonacci level at $0.00002509 – an area that carries bullish significance. The Fibonacci tool, plotted along with a rally, highlights important price levels on the chart.

For bulls to maintain their advantage, SHIB must hold above the 61.8% Fibonacci at least over the next 24-48 hours as volatility cools down. The encouraging price level can allow buyers to mount another attack at $0.00002814 and trigger a breakout to 2022’s high of $0.000035339. The potential move would account for a full 35% increase from SHIB’s current price level.

Price Strategy

Considering SHIB was not yet out of a favorable position on the chart, long trades were still a way to go. Investors can set up buy orders at $0.00002850 and take-profits at $0.00003530. Stop-loss can be kept at $0.00002500. The hypothetical trade setup carries a 1.94 risk/reward ratio.