When compared to Dogecoin, Shiba Inu has been affected to a much greater extent by the broader market bearishness. Over the past day, while the largest meme token shed 4% of its value, the second-largest token from the same category lost almost 9%. In fact, on the weekly window too, the situation was quite similar. DOGE dipped 8%, while its counterpart—SHIB—plummeted by 18%.

Shiba Inu traders, beware!

From a technical perspective, it doesn’t look like Shiba Inu’s losses are going to halt anytime soon. On its weekly chart, SHIB has been making lower highs for quite some time now. When the trendline connecting the said levels was joined with the horizontal series of lows, a descending triangle was formed.

At press time, Shiba Inu was tussling with the lower horizontal line of the said bearish setup and was on the verge of breaking below it.

As chalked out above, the vertical height between the two trendlines stand close to 56%, implying that the token could dip by a similar magnitude if it ends up breaking below the structure.

Sell orders on the rise

Bulls have evidently lost control in the market of late. Per the buyer-seller trade difference data on ITB, more than 9 billion additional SHIB tokens were sold than bought over the past 12-hours. In fact, the number stood at an elevated 950 billion in the 6-hour period.

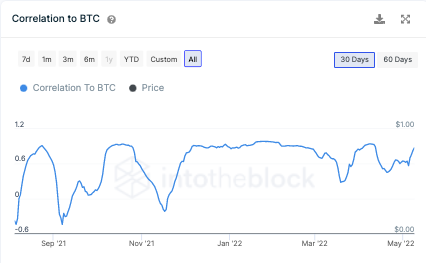

Alongside the sell-pressure, it should be noted that Shiba Inu’s correlation with Bitcoin has noted an uptick recently. At press time, this metric’s reading reflected a value of 90%, indicating that SHIB’s fate is closely tied with that of Bitcoin’s.

So, unless the broader market notes some sort of relief rally, SHIB would find it challenging to defy the macro-trend. As a result, the odds of a bearish breakdown are quite high for SHIB at the moment.