The Shiba Inu (SHIB) market has been patiently waiting for the meme coin to witness some growth. The asset is currently 84% below its all-time high of $0.00008845. While the 1 cent mark may be far-fetched for the asset given its current scenario, reclaiming its previous high could be feasible for the meme coin.

Also Read: Apple iPhone 16: Analyst Reveals if This Is the Best Phone To Buy

Shiba Inu’s Current Performance And Future Predictions

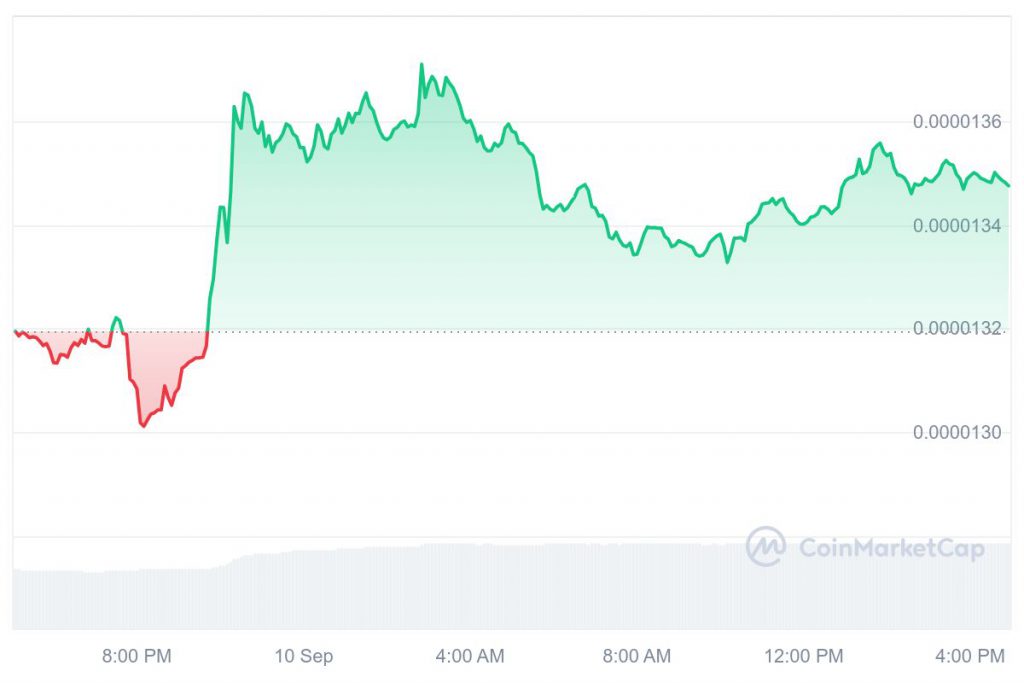

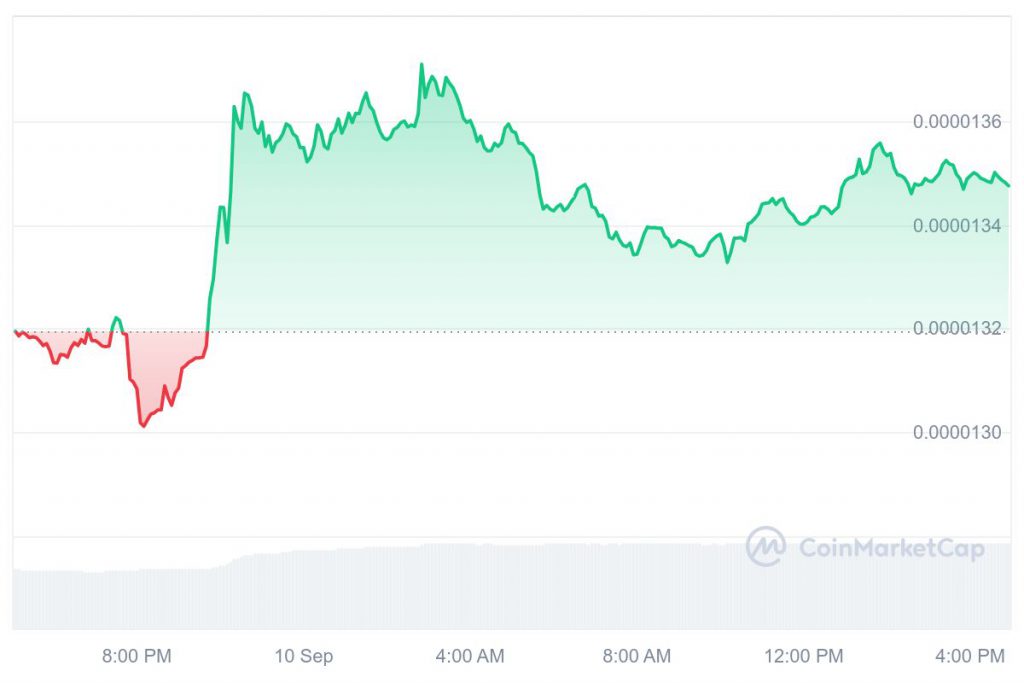

At press time, SHIB was trading at $0.00001345, following a 1.94% rise over the past 24 hours. The asset started the week on a good note, going from a low of $0.00001302 to a high of $0.00001371.

Also Read: Musk’s Dogefather Skit Recall Sparks Dogecoin’s 6% Rise: $0.22 Next?

Shiba Inu To Record 10x Rise

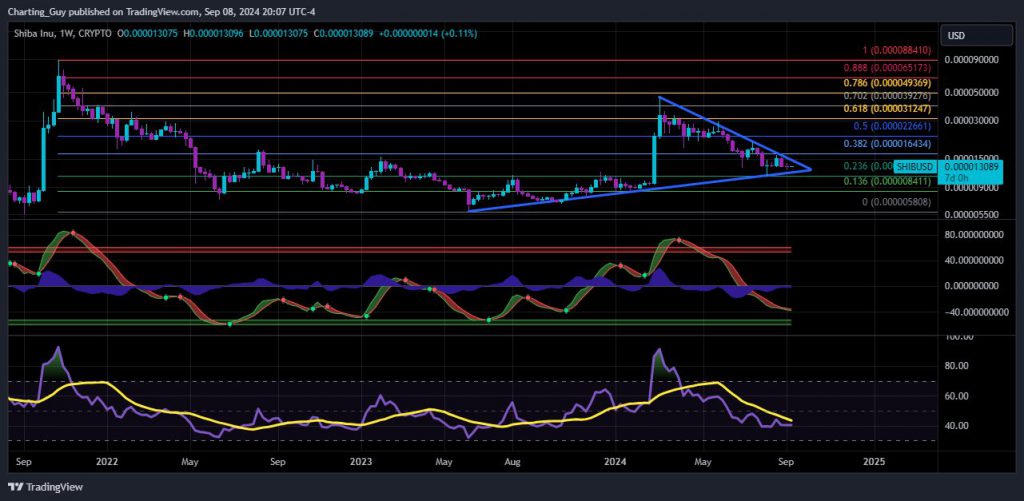

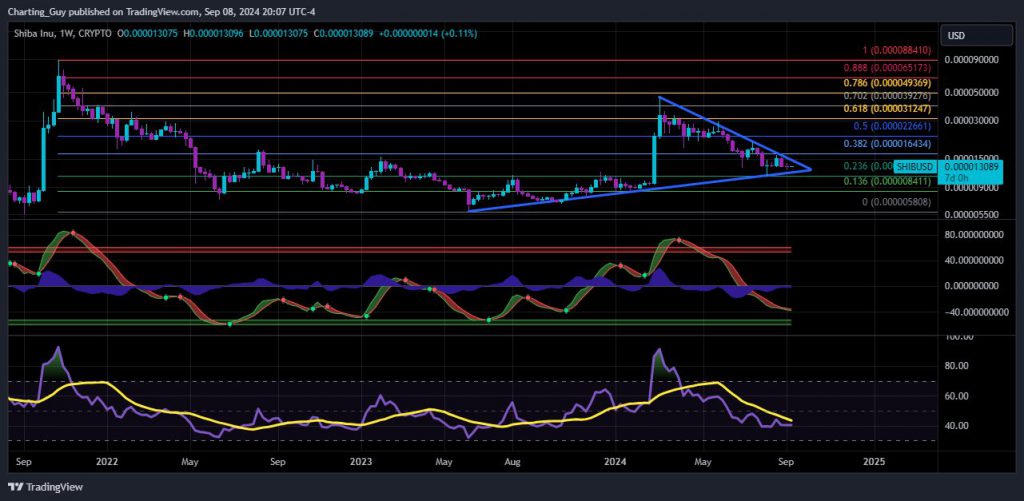

An analyst who goes by Charting Guy has pointed out that Shiba Inu could see a notable price increase beyond its 2021 highs. The expert discusses the golden pocket, a crucial Fibonacci retracement level between 0.618 and 0.65.

This frequently acts as a resistance zone, where SHIB most recently encountered rejection. This happened a few months ago when Shiba Inu returned to the $0.000031 to $0.000045 price range. After this rejection, the analyst pointed out that SHIB has solid support at the 0.236 Fibonacci level.

Elliott Wave Theory And Shiba Inu’s Future

The analysis also showed that Shiba Inu’s current movement is consistent with Elliott Wave Theory’s basic wave 1 and 2 patterns.

Now that the first two waves have passed, the market may be preparing for wave 3, which is usually the strongest. The study indicates that Shiba Inu could surpass its all-time high if wave 3 materializes.

Investor Sentiment And Market Impact

This analysis is much needed for SHIB investors hoping for an uptick.

Also Read: Cardano (ADA), Ripple XRP Price Prediction: Mid-September 2024

According to IntoTheBlock, about 52% of SHIB holders were at a loss, and only 42% of the asset’s investors were making money at its current price.