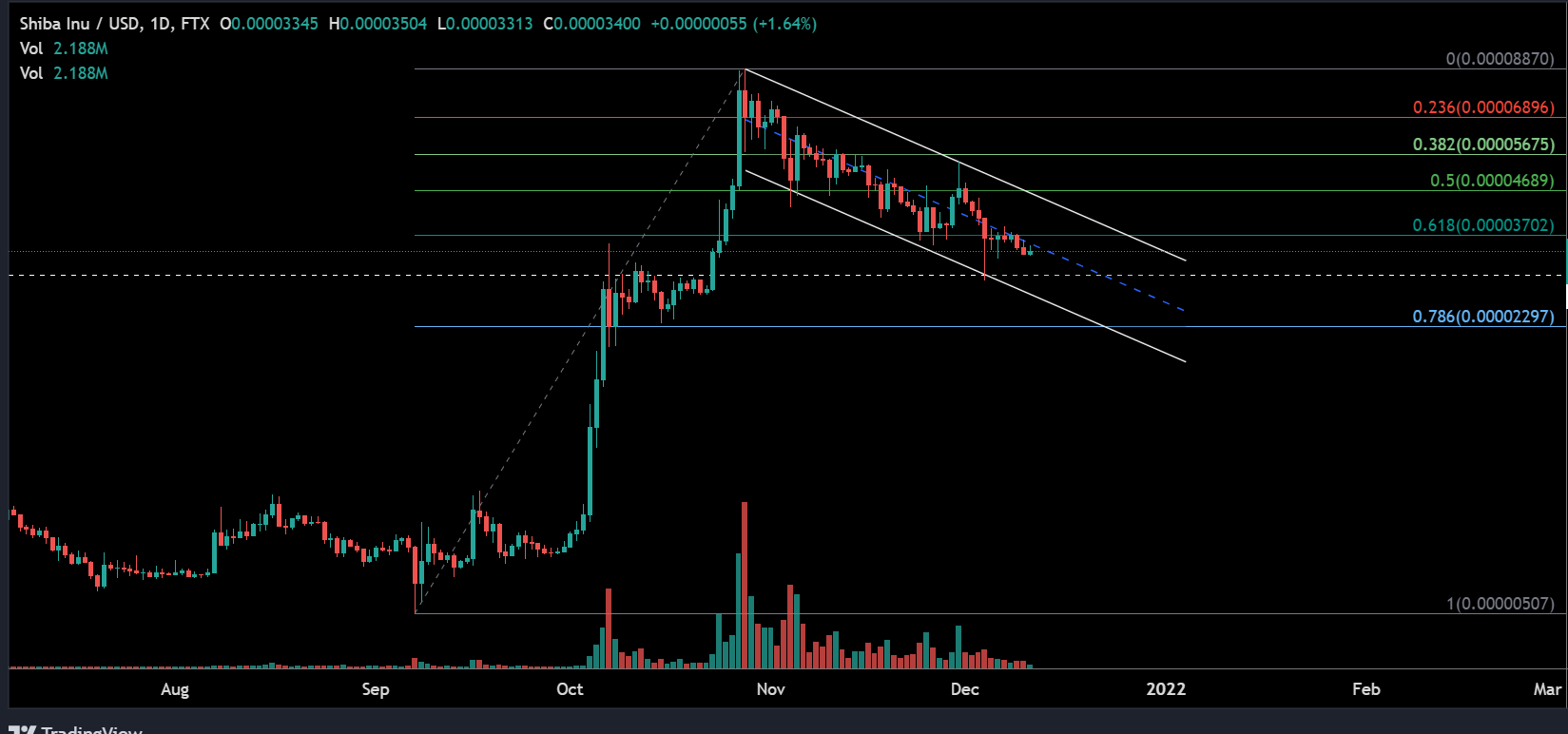

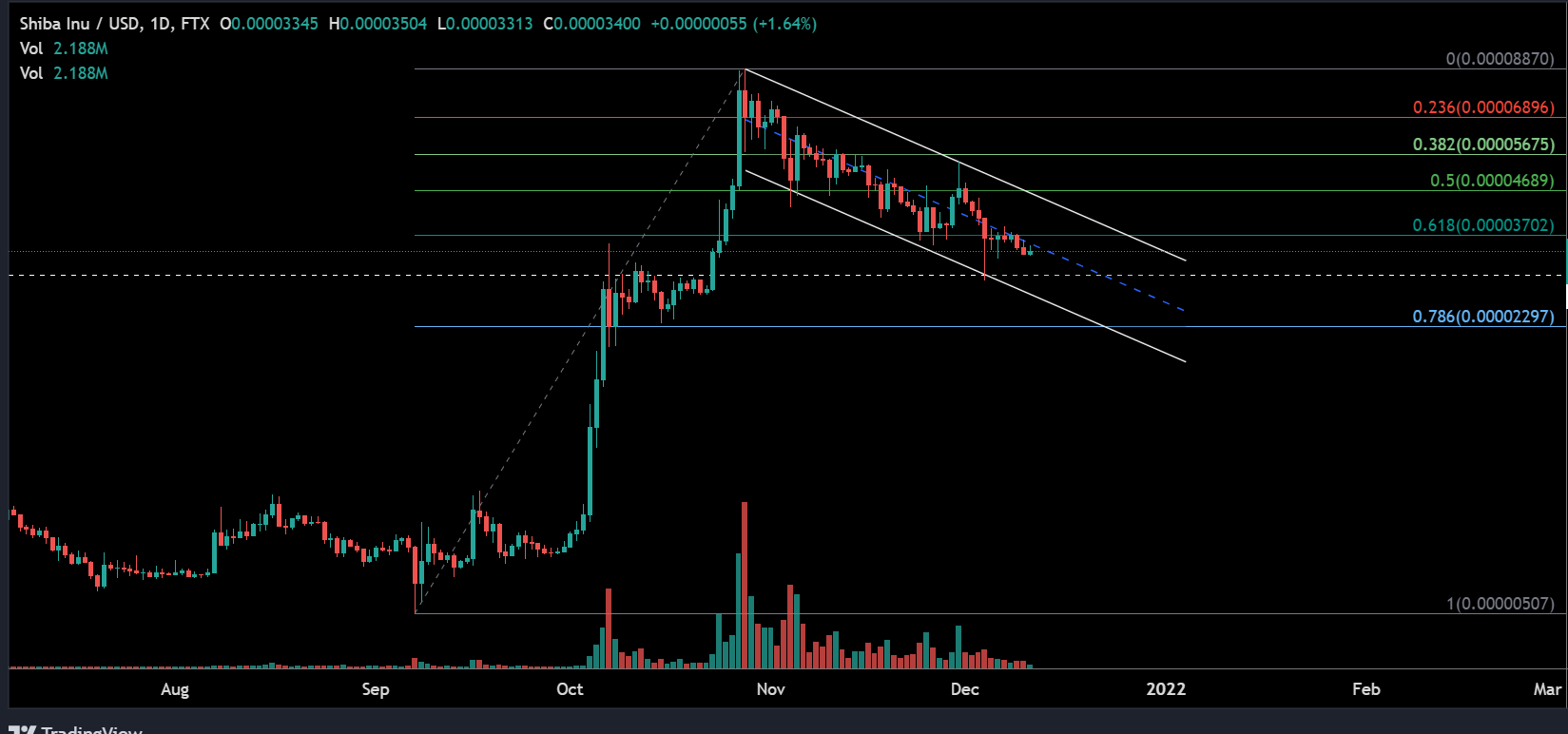

Since reaching a high of $0.00008870 on October 27th, Shiba Inu has faced a stern decline in this value. At press time, the price of Shiba is down by 62% since its ATH level. That is not the kind of performance investors were expecting from the meme token that rallied 1000% in October 2021. However, the largest narrative for Shiba Inu is still positive. Some of the developments that have taken place over the past couple of weeks indicate market attention and interest. However, it is important to understand and analyze if these narratives will incur long-term benefits for the asset.

Ethereum Whales continue to play around with Shiba Inu

According to recent data from WhaleStats.com, an Ethereum wallet Hulk that recently bought ~13.4 trillion SHIB transferred $13.2 trillion tokens to another wallet named Hulk 2. This is a peculiar development that has taken place between the ERC-20 wallets, but it did not cause a price movement. The supply in question is worth $473 million, which is a significant amount.

Earlier, the same ‘Hulk’ wallet had conducted three consecutive transfers to accumulate the aforementioned 13.4 trillion tokens. In context to the recent transfer from Hulk to Hulk 2, one thing is clear it is not involved in increasing sell pressure. The move is still bullish since the supply was not transferred to any exchange wallet.

Price Chart remains Dull

Whale activity with Shiba Inu tokens has been a regular affair over the past few weeks. On December 9th, Ethereum Whale “Jiraiya” bought 49,999,041,461 for $1.798 million. Now, speculations suggest that investors are taking the current decline of Shiba as a buying opportunity. Hence, the accumulation by various wallets such as the Hulk and Gimli has been extremely aggressive.

While these datasets so suggest a positive narrative, the daily price structure remains strongly bearish. At press time, Shiba Inu can be observed moving a descending channel. Now, the long-term implications are bullish for this pattern, but the concern arises from the 0.618 Fibonacci level.

Ideally, Shiba Inu should have bounced up from the support of $0.000003700, but it continued to drop, and now it is consolidating near $0.0000034. Technically, this is a long-term reversal towards a bear market, but the market remains open towards a bullish recovery. Only time will tell if momentum shifts in Shiba’s favor.