The prices of most top coins in the crypto market have hardly deviated over the past day. At press time, the returns for the likes of Bitcoin, XRP, Dogecoin, etc. stood capped under 1% on the daily window. Shiba Inu, however, registered a 5% gain, and stood at an elevated $0.00001387. Resultantly, it was the highest gainer in the top 100 list on Friday.

Whale’s flock into the Shiba Inu market

Whale data analysis platform WhaleStats brought to light that top Ethereum whales have been buying SHIB tokens en masse of late. During the wee hours of Thursday, SHIB made it to the top-10 purchased tokens list by the said category of whales.

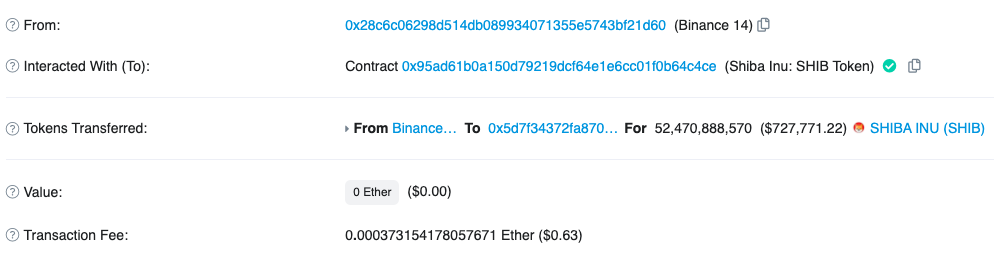

Things did not stop there. The ball of momentum continues to roll. Consider this: Per data from Etherscan, a particular whale purchased more than 52 billion Shiba Inu tokens [worth $727.7k] from a Binance wallet a few hours back. Notably, a mere 0.373 ETH was incurred as fee by the said whale.

Thus, the said on-chain data sets clearly point towards the fact that whales are more inclined towards the purchase side than the sell side at the moment.

Alongside, it is interesting to note that the top 1000 ETH whales now collectively hold SHIB worth approximately $162.127 million. For comparison, their total balances of other prominent tokens like LINK, UNI, MANA, and MATIC revolve in a much lower bracket—$66.7 million to $45.6 million.

Word of caution

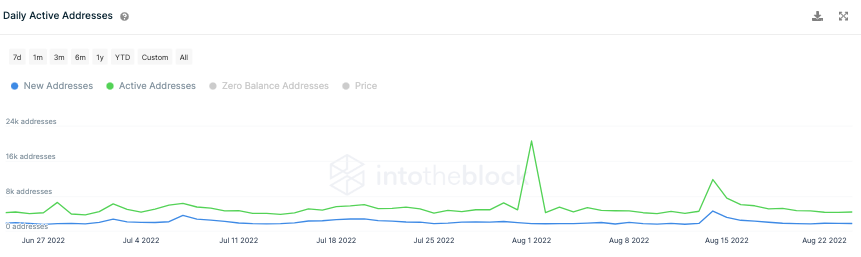

Whales engaging in Shiba Inu transactions and the token’s price reacting to the same is definitely a positive sign. However, it would not be fair to ignore the flattening number of new and active addresses on the network. Per ITB, both the aforementioned metrics have registered a 24% dip over the past 7-days. They reflected fizzled-out readings of 1.7k and 4.3k at press time.

Simply put, an address is considered to be active when it becomes a direct participant in a successful transaction. And new addresses, as such, gauge the number of fresh entrants into the ecosystem. Conventionally, the higher both the numbers, the better, for they hint towards refining participation by traders/investors. Effectively, the ongoing downtrend ain’t encouraging and might play spoilsport going forward.