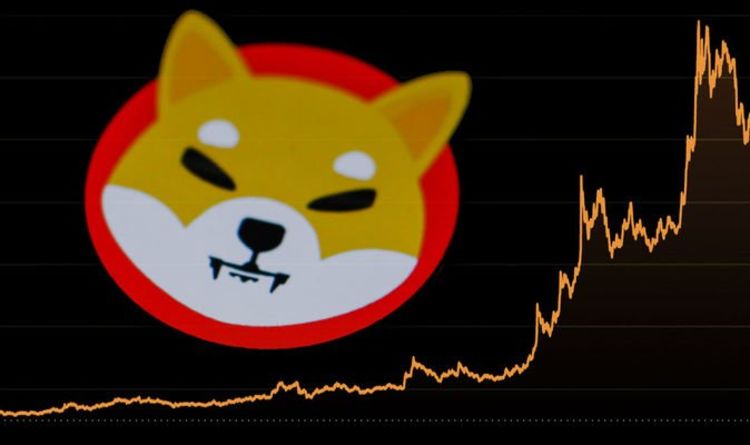

The Shiba Inu crash momentum appears to be slowing down right now as technical indicators scrape oversold levels that typically show up during capitulation phases. The meme coin has been hammered into territory where the RSI signals exhaustion, and the selling pressure might finally be easing up. At the time of writing, SHIB is trading near multi-month lows around $0.00000080, but the descent has actually started to stabilize. This SHIB price analysis shows the token’s downward spiral could be approaching a critical juncture where either a Shiba Inu recovery begins or further declines take hold. The Shiba Inu crash has pushed the asset into deeply oversold conditions, and some technical indicators are now suggesting that sellers might be running out of steam.

Also Read: Shiba Inu Dec’ Price Prediction: Will SHIB Rocket on Year-End Hype?

SHIB Price Analysis Points To Oversold Signals And A Possible Recovery Path

RSI Reset Signals Exhaustion

The Shiba Inu RSI recently dropped into deep oversold territory, which is a technical signal that often marks turning points in price action. Sellers appear to be losing momentum rather than accelerating their push downward, along with volume patterns that suggest controlled selling. The fact that volume remained comparatively steady throughout the Shiba Inu crash suggests this was a controlled unwind rather than panic-selling. All major moving averages—including the 50, 100 and 200—are actually stacked above the price, which indicates a persistent macro downtrend is still in place. However, buyers are responding to the Shiba Inu RSI signal and the temporary exhaustion of downward pressure, creating a technical bounce rather than a sentiment-driven rally.

Shiba Inu team member Lucie had this to say about the recent market conditions:

No one predicted this outcome. I’m proud of those who stayed strong and kept pushing forward.

Three Paths Forward

A short-term rally toward the 50-day moving average represents the first scenario for the Shiba Inu crash reversal. If the oversold bounce extends over the next few sessions, SHIB could actually climb toward the $0.0000095-$0.000010 range where the 50-day and 20-day MAs meet. Rejection at that level would confirm traders see the bounce as merely temporary relief, and they would expect another test of the lows. This SHIB price analysis suggests that even a brief rally could face significant resistance.

Sideways stabilization offers a healthier path for a Shiba Inu recovery. If volatility drops and SHIB holds above $0.0000080, consolidation would signal that sellers have exhausted their positions and quiet accumulation has begun. Analysts typically see this flat base as the most constructive setup for a medium-term reversal, though it requires patience and time to develop properly. The Shiba Inu RSI needs to stabilize above 30 for this scenario to gain traction.

The breakdown scenario remains possible if the bounce fails immediately. A close below the recent low would invalidate the RSI reset and pull the token into deeper liquidity zones around $0.0000070. Actual buy volume accompanied the oversold rebound, making this outcome currently the least likely, but traders cannot rule it out entirely in volatile market conditions. If SHIB breaches this support level, the SHIB market outlook would turn significantly more bearish.

Also Read: Shiba Inu Price Prediction for December 2025 Takes an Intriguing Turn

Market Outlook Remains Fragile

The SHIB market outlook hinges on whether technical support can actually translate into sustained buying interest right now. The token faces resistance from multiple moving averages overhead, which creates significant hurdles for any recovery attempt. This SHIB price analysis suggests this is a technical rebound driven by oversold conditions rather than renewed optimism. Trading volume will need to increase meaningfully for SHIB to reclaim higher price levels and break out of its current bearish structure.

The current price action suggests exhaustion rather than reversal, meaning traders are watching closely for confirmation signals before committing to either direction. The SHIB market outlook depends on whether buyers can defend the $0.0000080 level in the coming sessions, along with how Bitcoin performs since SHIB often follows broader market trends.