Undoubtedly, the current cryptocurrency market was one of the most active and volatile periods. However, the crypto market was not the only one swaying side-to-side; the stock market is witnessing a tough time too. The plunging price gave rise to a bearish market sentiment which was reflected clearly as a massive increase in the short position for traders in Q2.

Traders generally use this strategy to benefit from decreasing asset prices; however, this time around, it is occurring against the backdrop of collapsing markets. This trend was highlighted in the ‘Pulse’ report that analyzed all executed trades on Capital.com between 1 April 2022 and 30 June 2022. According to the report, nearly 38% of traders on the platform carried out short-position transactions in Q2 2022, which was 34% higher than the previous quarter.

The country-wise distribution of these short trades indicated that the UK, Africa, and Asia had the highest proportion of short trades. Meanwhile, Australia reported the lowest proportion of about 34%. Although Australia’s short-trade proportions lagged, the country still witnessed an increase compared to Q1.

The report noted,

“Short positions became increasingly popular on Capital.com in Q2 and were more profitable for traders. The highest proportion of short trades was seen in the UK, Africa, and Asia (41%). The lowest proportion of short trades was seen in Australia (34%), though this was increased from Q1. Forex was the most heavily shorted market.”

Q1 and Q2 were more profitable for short-sellers [32.1%] than long-position [28.7%]. Considering the state of the cryptocurrency market, the price of Bitcoin plunged almost 60% in the period mentioned above. Given the massive asset price hike, this downside did bear profiteering fruits for the short traders.

As the BTC market got inflated with minor dips followed by institutions and individuals buying those dips, there was not much organic support formed, to begin with. Therefore, when BTC stumbled at its peak, it induced prolonged weakness in the market.

Capital.com’s Chief Market Strategist David Jones shared a similar opinion. Jones stated,

“The ability to sell-short could well have an impact on traders’ overall profit and loss. This could be particularly true if we enter a period of prolonged weakness in markets, where investors stop being rewarded for just blindly buying the dip. Using sensible risk control measures such as stop losses in tandem with short-selling could be a prudent addition to a trader’s overall strategy.”

Of Stocks and Crypto

So what was more fruitful for traders? Trading in the traditional market or crypto market? Talking about short traders specifically, they were interested in crude oil and natural gas. As per the report,

“The mass influx of traders into crude oil seen in Q1 was followed by an almost equally rapid exodus in Q2. Natural gas, which also saw a large Q1 influx, remained popular.”

However, the most popular traded asset in Q2 was the Nasdaq 100 index. It witnessed many traders shifting strategies to short trades as the market crashed. However, it still wasn’t the most shorted market, and it was Forex.

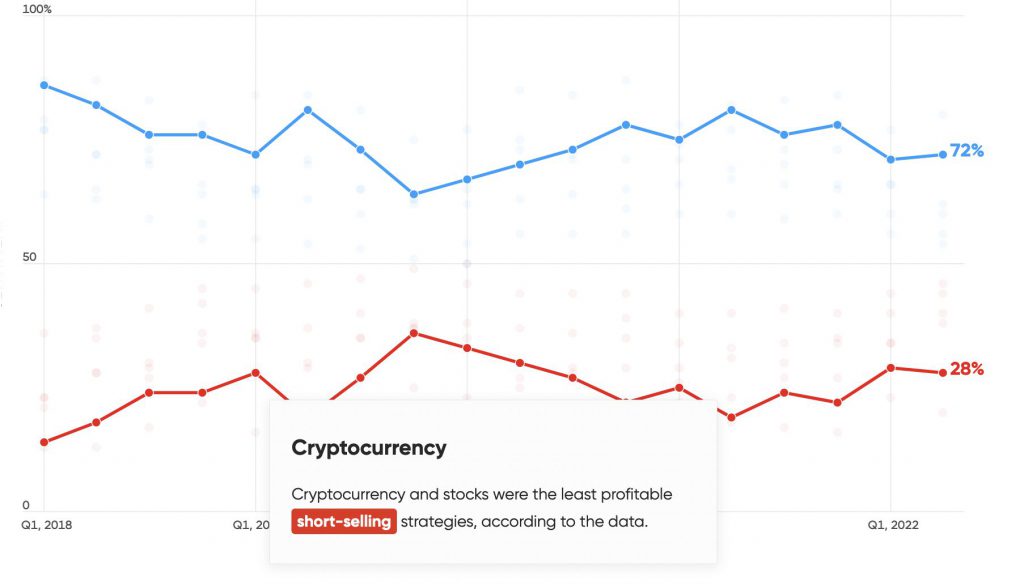

So, where did cryptocurrency stand in this trend? According to the report, cryptocurrencies and stocks were the least profitable short-selling strategies.

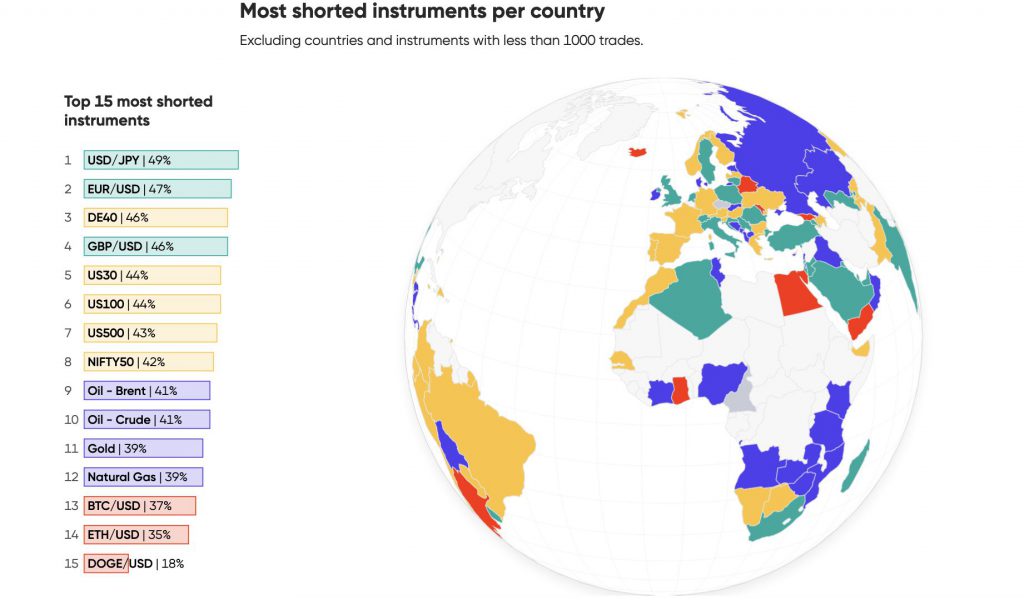

As mentioned above, the foreign currency saw the most shorted trades, followed by Crude oil and Natural gas. The cryptocurrency that took the 13th, 14th, and 15th spot on the ‘Top 15 most shorted instruments’ were BTC/USD [37%], ETH/USD [35%], and DOGE/USD [18%].

The above chart illustrates that most countries, except the UK and Africa, had a currency pair as their most-shorted instrument. This was the USD/JPY, as the US began an aggressive rate-hike policy while Japan held its ultra-loose stance. The short-trade for the crypto assets was also against the US dollar. It also noted a vital addition of DOGE in the traders’ list of assets worldwide, after BTC and ETH in the top 15 most shorted instruments list.

A crucial point to remember here was if the crypto assets were among the least profitable for short traders, the long-position was also not rearing much profit.

It means the traders in the crypto market were moving cautiously and no longer betting on the price of the digital asset rising. This was at least true for the short term.