MATIC owners were fetched with fancy returns in the mid-November to end of December period. In the said time frame, the asset doubled in value, climbing from $1.44 to $2.92.

Things did turn bearish after that. Amidst the broader sink, MATIC couldn’t keep its boat afloat. In fact, with the downtrend still intact, the coin has already shed up to 12% in the last seven days.

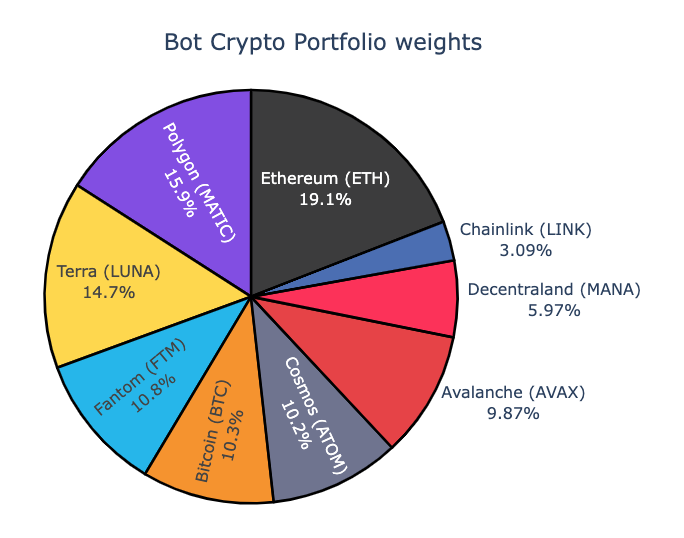

Despite the market’s sluggish state, an autonomous bot has been outperforming the crypto market by using data from weekly surveys of traders. The bot, in fact, indicated that several altcoins are gobbling up market share from the market’s stalwarts – Bitcoin and Ethereum.

The Real Vision Bot was co-developed by quant analyst and hedge fund CEO Mortiz Seibert as a way to obtain signals and gauge trader sentiment from users of the financial content platform Real Vision.

As per the platform, the bot has had an “astonishing” record of outperforming the aggregated bucket of top 20 cryptos by more than 20% – simply by surveying the preferences of traders.

Well, with a market capitalization of $15.39 billion, Polygon’s native MATIC token is currently the 13th largest crypto. Interestingly, after Ethereum, MATIC had the highest weightage [15.9%] in the bot’s portfolio.

In an interview with Real Vision, Seibert described the bot as a “hive mind” that’s able to beat other entities in the crypto ecosystem.

So, follow what the bot says?

Well, not really. MATIC’s downtrend has taken an even more definite shape since 16 January. As highlighted in our latest price prediction article, this alt is currently walking on a tight rope.

In fact, the sentiment-related metrics too portrayed bearish signs at the time of press. The 24-hour exchange net flows, for starters, reflected a positive value of 16.3 million. Positive values indicate inflow into exchanges and correspond to market participants selling their tokens.

The bull:bear ratio too portrayed a number less than 1, highlighting the dominance of bears in the MATIC market.

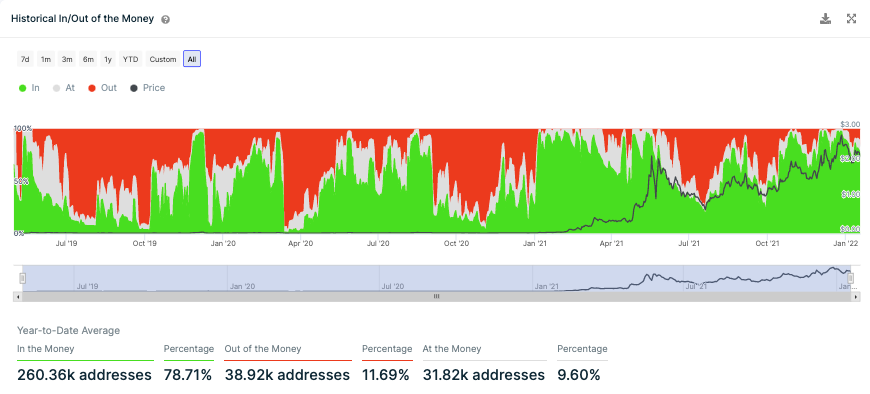

Additionally, at this stage, it should be noted that close to 80% of the HODLers are currently ‘in the money’ or in profit, which means the odds of them exiting the market is quite high. Such a behavior pattern has been witnessed numerous times in the recent past.

So, keeping the current state of the market in mind, short-term investors can steer away from the MATIC market. However, this dip might be a good time for long-term investors to find a good entry point and add MATIC tokens to their portfolios.