Ripple’s XRP has gained 425% in a year and breached $3.50, allowing investors to make stellar profits in a short period. Traders who stayed invested in the altcoin have seen their portfolios swell and turn green in bigger numbers. The surge came after a stagnancy period of close to two years, where it failed to move up in the charts. The development indicates that the market rewards investors with patience and gives nothing to paper hands.

Also Read: Coinbase Launches US XRP & SOL Futures Aug 18; XRP Analysts Eye $10-$20

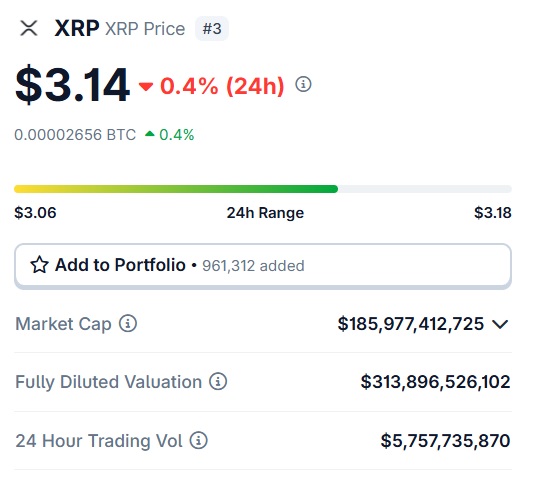

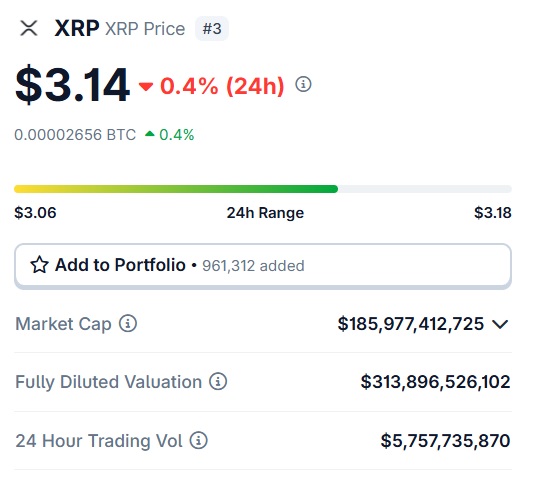

It regularly weeds out the ones with no patience and gives the fruits to traders who hold on for the long term. That’s the way the markets have operated, where patience is a virtue and short-term rewards are minimal. Considering Ripple’s XRP trading below the $3.50 mark, As CoinGecko reveals, should you take an entry position now or wait for further dips? In this article, we will explain the best strategy you can take to reap the benefits of the bull run.

Accumulate Ripple’s XRP under $3.50?

After surging more than 400% in a year, Ripple’s XRP is facing corrections below the $3.50 range. Traders have taken strike options on the altcoin at $3.50, $3.80, and $4, and the options expire in September. Until then, the price could remain rangebound as many traders have already jumped ship, booking profits when it reached $3.65. The rest of the traders could eventually bow out as the options near their expiry date.

Also Read: PayPal Adopts XRP: 530% Rally Prediction as SEC Vote Looms

Chances of a dip remain high during this period, making Ripple’s XRP test the $3.50 price range. If retail investors fear further slumps, its price could fall well beyond the $2.90 to $2.80 mark next. Accumulating the altcoin at this level could be beneficial as its price could have bottomed out. An entry position anywhere above $3 before September is deemed risky due to the options’ expiry. Liquidations could pull its price down, but buying below the $2.90 mark could be a wise decision.