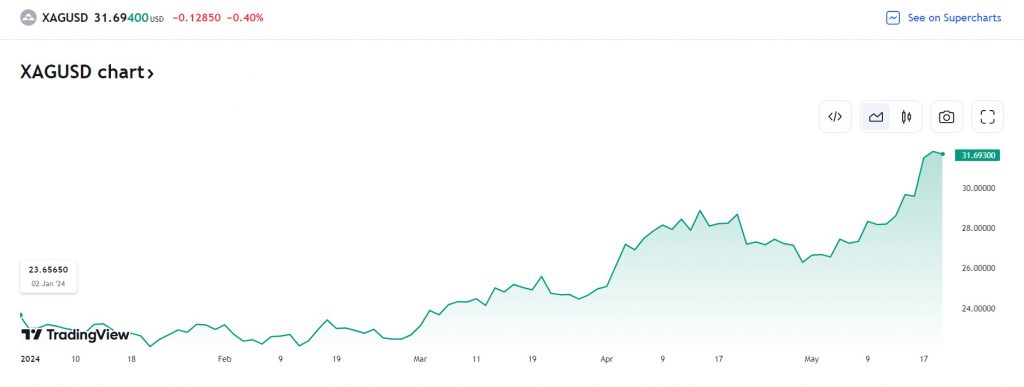

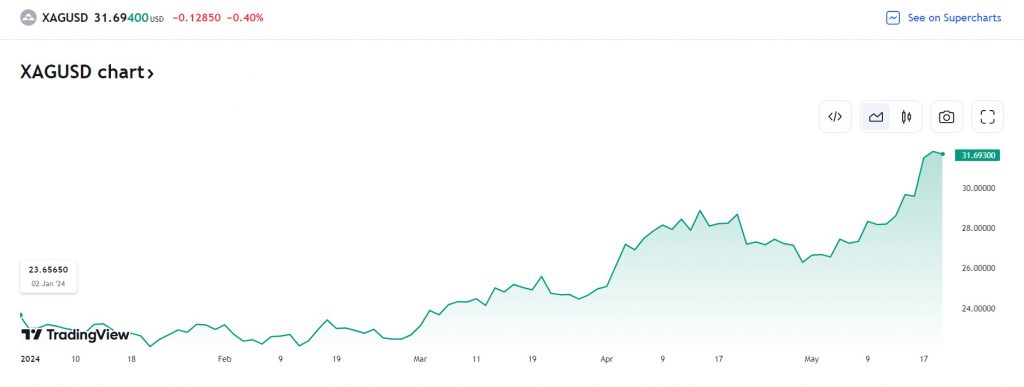

Silver is now the top-performing asset in the commodity markets in the metals sector as it outperformed gold by 100%. Gold prices rose 17.54% year-to-date while silver surged by 35% during the same period.

Also Read: After ‘Rigorous Analysis’, Expert Says Gold Prices Will Reach $27,000

Therefore, silver has outperformed gold prices by over 100% in the charts year-to-date in 2024. Apart from gold and silver, copper is also among the top-performing assets in the commodity markets. Copper prices have spiked 28% year-to-date delivering stellar returns to investors.

Also Read: Morgan Stanley Hikes S&P 500 Target By 20%

The price of copper climbed above the 10,857 mark surging by 259 points on Tuesday’s trade rising by 2.45%. Silver, copper, and gold prices are among the top-performing commodities this year that generated massive profits. Read here to know how high the commodity markets could surge by the end of 2024.

Silver Beats Gold By a Large Margin in the Commodity Markets

Veteran financial analyst Peter Schiff forecasted that silver prices could surge further this year compared to gold. The surge in silver prices indicates that inflation is on the rise, wrote Schiff. The analyst explained that silver is a better indicator of inflation than gold and the Feds must do more to cool the rising prices of daily essentials.

Also Read: What Made Gold Prices Hit An All-Time High Today?

If the Feds do not control inflation, a severe yet unprepared crisis could hit the markets soon, he predicted. The rising silver prices are a testimony that inflation is yet to be brought under control, wrote Schiff. On the other hand, gold prices also climbed above the $2,400 mark and are looking to breach the $2,500 threshold.

“Silver is up over 30% so far in 2024, trading at its highest price since Feb. 2013. Silver is both a precious and an industrial metal. It’s an even better indicator than gold that inflation is accelerating. The Fed is wrong and investors are delusional. Prepare for a crisis!” he tweeted.