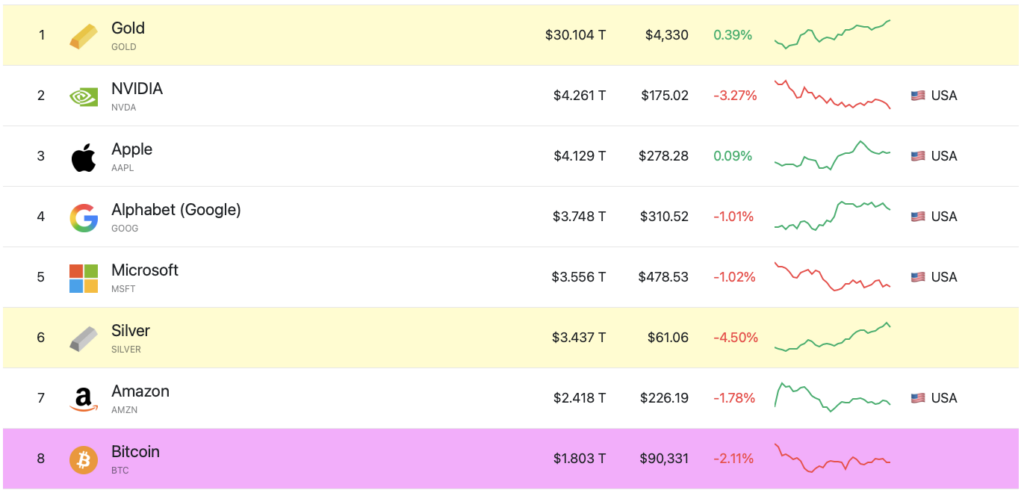

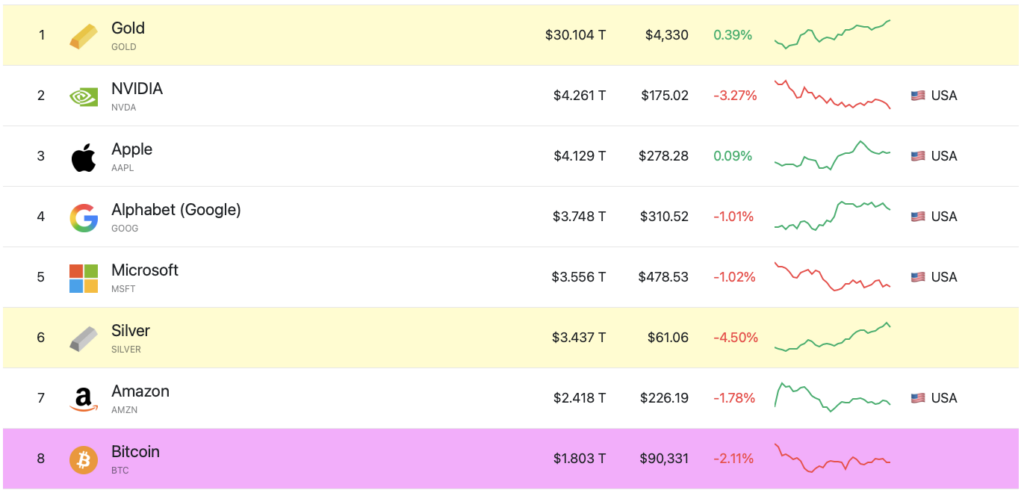

According to CompaniesMarketCap, silver has overtaken Amazon’s (AMZN) and Bitcoin’s (BTC) market cap after hitting a new all-time high of $64.64 per ounce on Friday. The metal has hit a global valuation of $3.437 trillion, while Amazon is valued at $2.418 trillion, and BTC is valued at $1.803 trillion. Silver had quite a bullish year in 2025 as investors moved away from risky assets over the last few months. Let’s discuss if the commodity will continue its upward surge over the coming months.

Will Silver Outshine Bitcoin?

Silver and gold have seen incredible growth in 2025, hitting multiple new peaks. Silver’s latest upswing is likely due to investors hedging their investments amid slow economic growth. Market participants are moving away from risky assets such as Bitcoin (BTC) and other cryptocurrencies. The development is reflected in the crypto market entering a consolidation phase. Silver overtaking Bitcoin’s market cap is a sign of the movement away from risky assets.

The Federal Reserve rolled out an additional 25 basis point interest rate cut earlier this week. However, the rate cut did not push Bitcoin’s (BTC) price. The lack of movement in the crypto market could be due to macroeconomic uncertainties. The same reason could be why investors are moving their funds into gold and silver.

Also Read: US Markets: Assets to Exit Now & Top Assets To Explore In 2026

However, the trend may change in 2026, as many anticipate Bitcoin (BTC) to climb to a new all-time high next year. Grayscale and Bernstein claim BTC has pivoted from its 4-year cycle and now follows a 5-year cycle. Bernstein predicts BTC to hit the $150,000 mark in 2026 and the $200,000 mark in 2027. Bitcoin (BTC) hitting a new all-time high could see funds exiting silver and gold markets. However, there is no telling with the crypto market. Fresh volatility could present unforeseen challenges.