Solana has kept up appearances as part of the top 10 coins in the cryptocurrency market. Its price was trading at a 9% premium compared to yesterday, making it the highest percentage gainer among its larger competitors. While a risk on-broader market certainly helped create a bullish argument for Solana, the smart contract operator was buoyed by a listing on the crypto exchange, Gemini.

Gemini Lists Solana

Gemini, led by the Winklevoss twins Cameron and Tyler Winklevoss, announced Solana’s addition to the platform on 1 March. In a blog post, the Gemini team added that trading pairs for USD, GBP, EUR, CAD, AUD, HKD, and SGD would be rolled out on the mobile application as well.

Valued at a little over $7 Billion, Gemini is a well-known crypto exchange that operates in over 60 countries. Its largest footprint lies in the United States, offering services in 49 of the 50 US states. As per CoinGecko, the exchange’s 24-hour trading volume came in at a little over $240 Million. The team added, “We believe SOL will provide value to our users as we continue to support the growth of the decentralized finance and crypto communities.”

Naturally, the community took revered the decision on social media websites. Data from LunarCrush showed that Solana’s daily social volume ticked up by 4% during the day. On the flip side, LunarCrush also pointed to a highly bearish sentiment score of 128%. The reading is averaged out after taking bullish or bearish mentions of an asset on social media platforms. One reason for this could be a weak TVL figure which has consistently bled in 2022.

Trouble In Paradise?

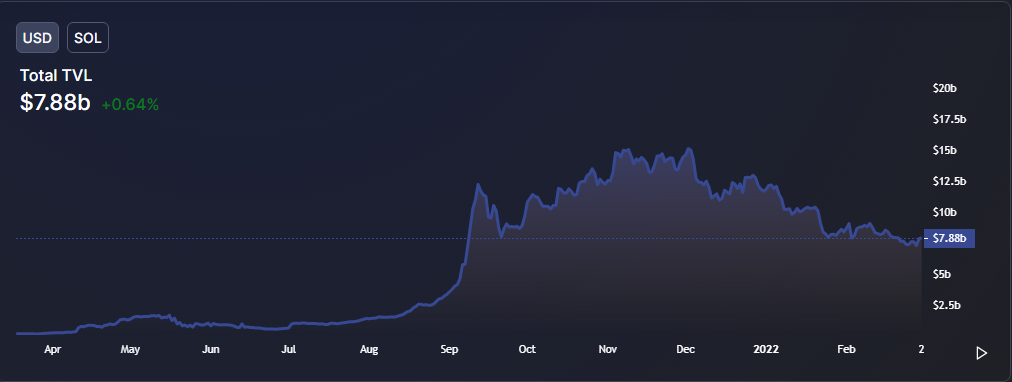

While the Gemini listing is an important development for Solana, it does not overshadow a weakening TVL. TVL, or total value locked, is a measure of the total assets locked within a protocol. At times, TVL is used to judge the health of a project as it signifies how popular the lending, staking, and liquidity pool options are for users.

The chart above showed that Solana’s TVL has declined throughout 2022. The figure touched a near 6-month low on 28 February, dropping to $7.2 Billion. During the same period, rivals Avalanche and Ethereum noted an uptick in their TVL figures, amounting to $17 Billion and $144 Billion, respectively, at press time.

Solana 4-hour Chart

A green candle on 28 February was the largest daily hike since August 2021. The candle emerged in a key support area for Solana present between $89-$80.7. A quick technical analysis showed that the alt’s next major resistance lay between $130-$140. This meant that SOL had the potential for another 25%-32% jump this week. However, TVL figures may need to improve before SOL revisits its all-time high of $260.