2022 has been quite a mundane year so far in terms of crypto asset price movements. The bearish environment, however, hasn’t lowered the spirits of the developer community. They’ve collectively been using this time to build and refine projects from the space. Nevertheless, it’s not all roses and sunshine.

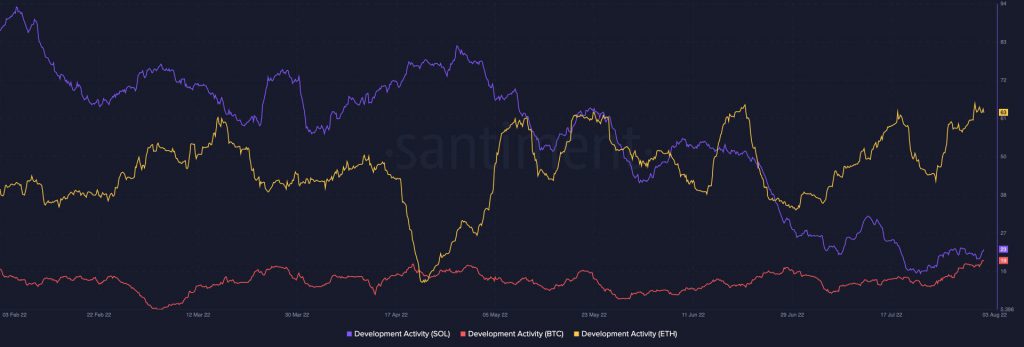

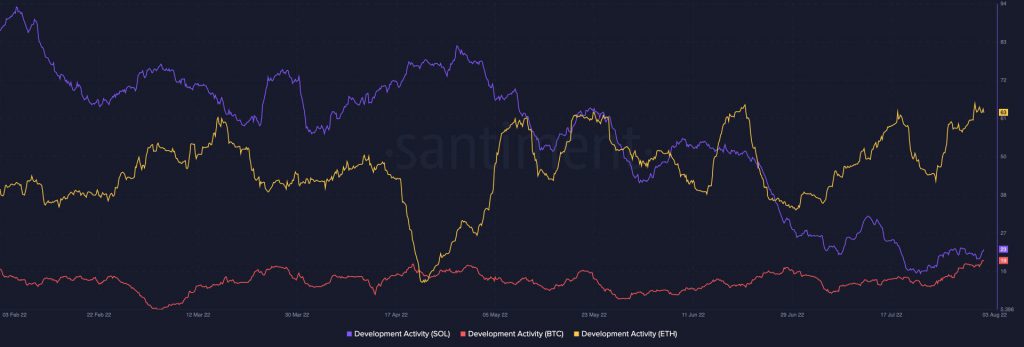

Regarding Ethereum, developers have been diverting their efforts into making The Merge a reality. And as depicted below, it currently has the highest development activity relative to Solana and Bitcoin.

Also Read: Ethereum Merge to take place mid-September; Details

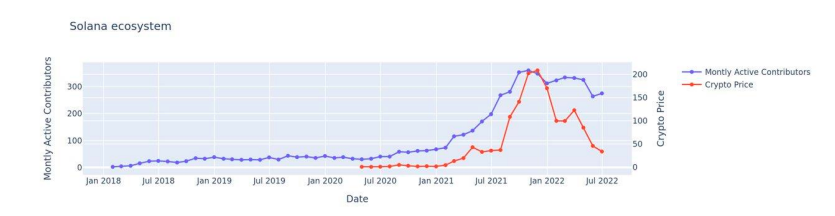

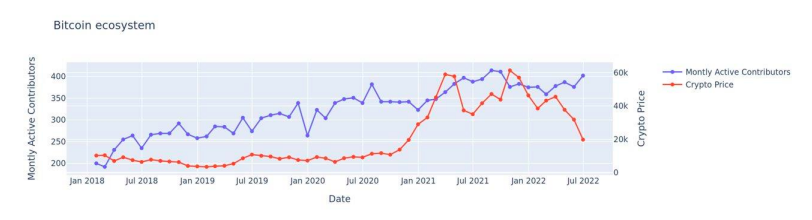

As far as Solana is concerned, its activity on this front had been on a downtrend until mid-July. Now, however, it has changed its course and has been inclining of late. Bitcoin’s development activity had stagnated for most of this year. However, like Solana, it has been able to pose an improvement lately.

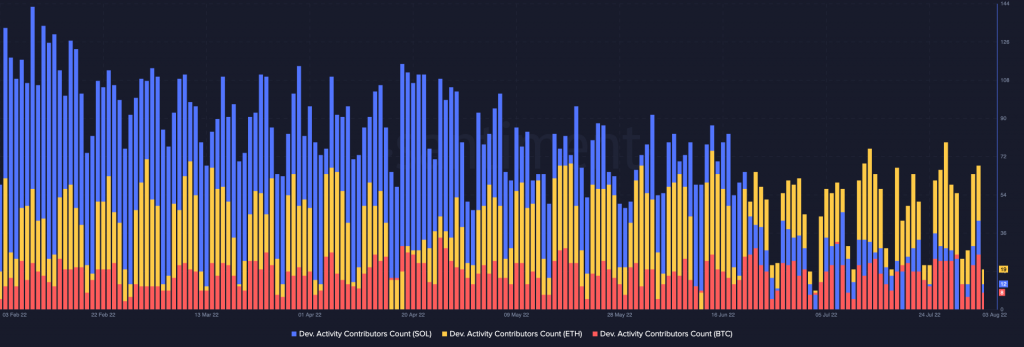

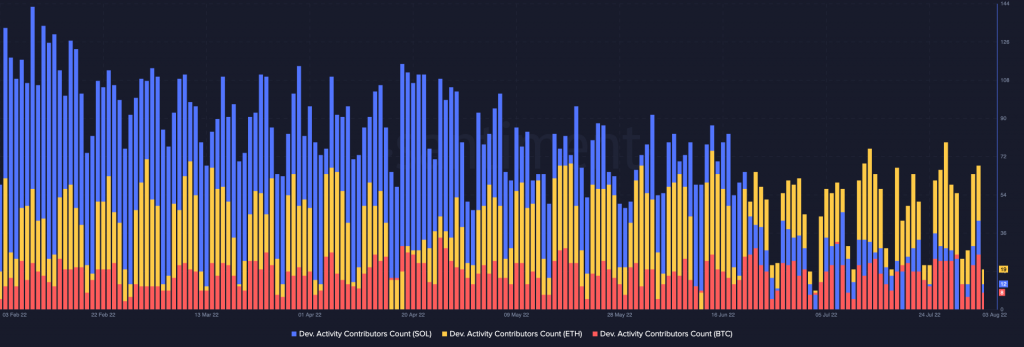

In terms of active developer count, Santiment’s data revealed that Ethereum currently leads the pack, while Solana and Bitcoin occupy the second and third spots, respectively.

Solana owns the long-term game

Bitcoin and Ethereum have been in space and acted like stalwarts since they were launched. Solana, however, rose to popularity only last year, and the same was, notably, fuelled by the meteoric 1000%+ rise of its native token.

However, as far as macro performance is concerned, Solana has been able to grow faster than both Ethereum and Bitcoin. The network has registered the most significant annual increase in monthly-active contributors. A recent report from technology investment firm Telstra Ventures revealed,

“Solana is growing rapidly and is on the heels of Ethereum. Solana’s contributors have grown at a 173.0% compound annual growth rate over the past 4 years since January 1, 2018.”

On the other hand, Ethereum and Bitcoin’s CAGR of contributors stood at 24.9% and 17.1%, respectively, in the same 4-year timeframe.

Footnote

Well, the development activity and the developer’s counts are pretty essential tools that aid in gauging the growth potential of a blockchain. The higher the activity and the number of contributors, the better, since devs are likely working on projects to deliver better overall results.

Resultantly, institutional investors keep this factor in mind before deciding to divert funds into crypto-centric ecosystems. Since none of the three projects’ development activity has remained stagnant over the long term, investment opportunities for institutions remain open. Telstra Ventures’ report noted,

“Institutional investors are aligned with robust blockchain development in each of the 3 primary ecosystems, and investment opportunities remain.”