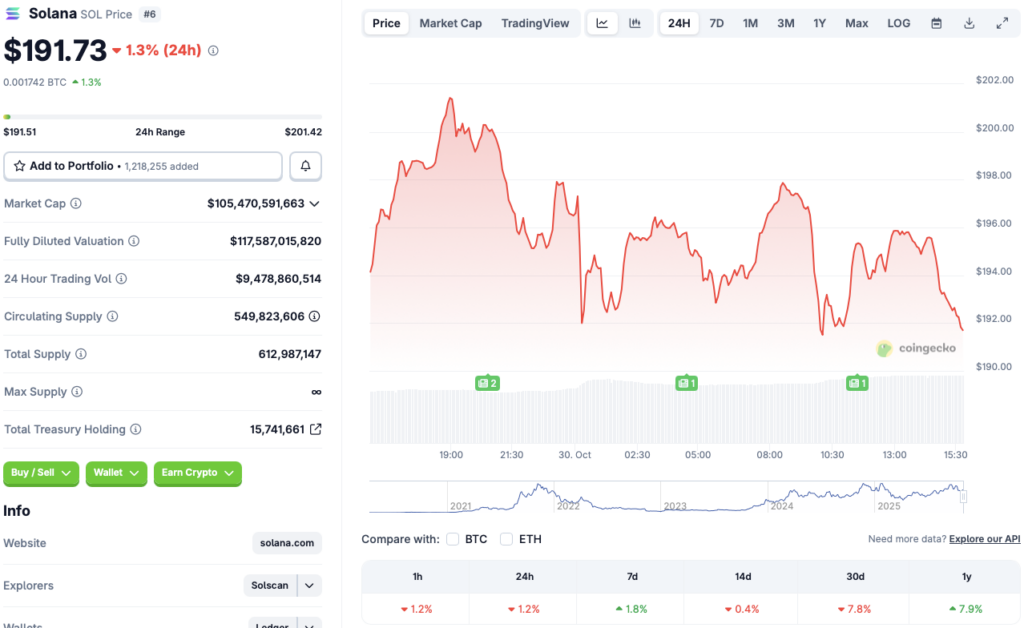

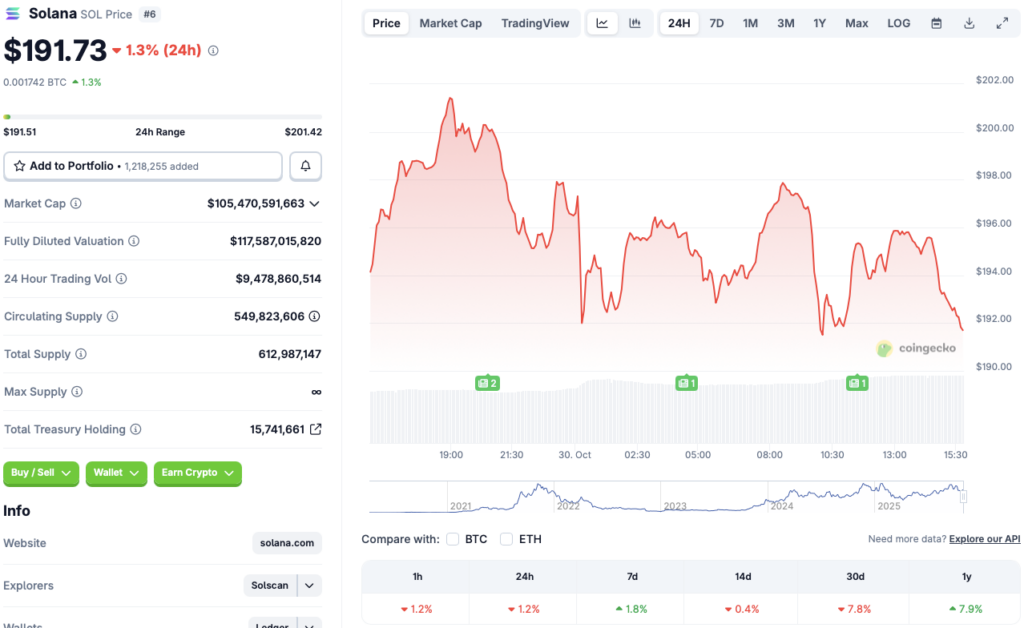

Solana (SOL) had two ETF launches this week. Bitwise’s BSOL ETF went live on Tuesday, while Grayscale’s GSOL ETF went live a day later on Wednesday. Bloomberg ETF analyst Eric Balchunas took to X and stated that BSOL was the biggest ETF so far in 2025, with $56 million in inflows. However, despite the big launch, SOL’s price continues to struggle. According to CoinGecko data, SOL is down 1.2% in the daily charts, 0.4% in the 14-day charts, and 7.8% over the previous month. SOL has registered some gains in the weekly and yearly charts, rallying 1.8% and 7.9%, respectively.

Why Is Solana Not Rallying After Two ETF Launches?

The lack of any positive price movement for Solana (SOL) is surprising. Not only did we get two ETFs this week, but the Federal Reserve also lowered interest rates by an additional 25 basis points. Both developments should have ideally led to a price rally.

It is possible that Federal Reserve Chair Jerome Powell’s economic warnings may have spooked investors away from Solana (SOL) and other crypto assets. Despite an interest rate cut, Powell stated that slow economic growth and rising inflation may present substantial challenges. Pair that with ongoing trade disputes, and you get a not-so-great market environment for risky assets.

Also Read: Western Union to launch stablecoin on Solana in 2026

Solana (SOL) may be following Ethereum’s (ETH) trajectory. The SEC approved several ETH ETFs last year, but the asset did not make any major price rallies until earlier this year. SOL may have fallen victim to the general market bearishness and may break out once things cool off. Solana (SOL) is among the most resilient crypto assets in the market. Many anticipate the asset to hit new highs once market conditions improve. SOL is currently down by 34.5% from its all-time high of $293.31, which it attained in January of this year.