According to CoinTelegraph, Solana ETFs saw a weekly inflow of more than $400 million. ETFs have played a major role in the current market cycle. Bitcoin (BTC) and Ethereum’s (ETH) big price rallies had a lot to do with growing ETF inflows. However, the market trend has changed over the last month. Despite registering large inflows for its ETF vehicles, SOL’s price continues to follow a downward trajectory. Let’s discuss why.

Why is Solana Slumping Despite Big ETF Inflows?

Not just Solana (SOL), but most major crypto assets are trading in the red zone. CoinGlass data shows that $1.85 billion was liquidated from the crypto market in the last 24 hours. The global crypto market cap has dipped 4.1% in the same time frame to $3.48 trillion. SOL’s price is likely a victim of the market-wide correction. Bitcoin (BTC) has fallen to the $102,000 price level and may even fall below the $100,000 mark.

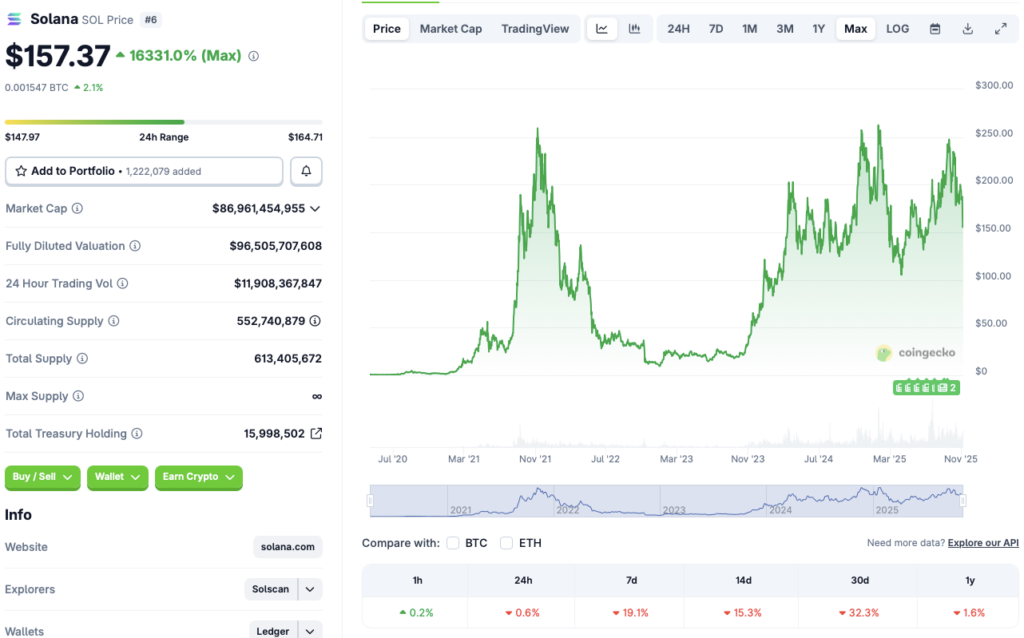

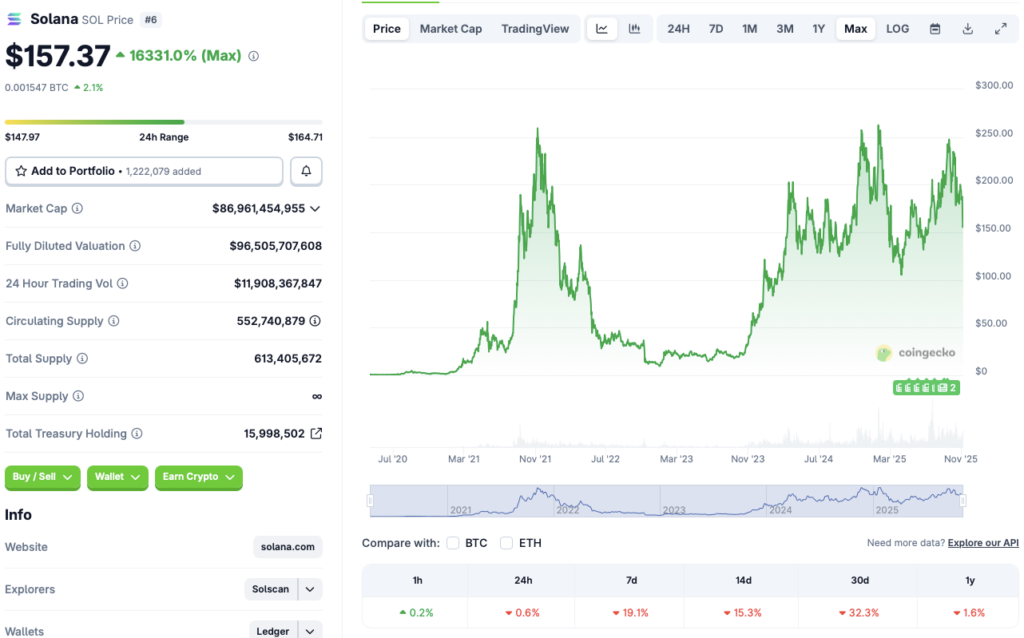

According to CoinGecko’s SOL data, Solana’s price fell by 6.6% earlier this morning in the daily charts. However, the asset seems to be making a slight recovery and is currently down by 0.6% in the last 24 hours. SOL is also down by 19.1% in the weekly charts, 15.3% in the 14-day charts, 32.3% over the previous month, and 1.6% since November 2024.

Solana (SOL) was among the best-performing cryptocurrencies of 2024. However, the recent market crash has led to the asset losing all its gains made over the last year.

Also Read: Solana Price Dips 11% in 24 Hours: Will SOL Fall Below $100?

Despite the current lackluster performance, there is a chance that Solana (SOL) will attempt a recovery over the coming weeks. Rising ETF inflows are a positive sign. It could mean that institutional interest remains high. Moreover, the Federal Reserve reduced interest rates by another 25 basis points. We could experience a delayed rally. If Bitcoin (BTC) makes a comeback, other assets will likely follow suit.