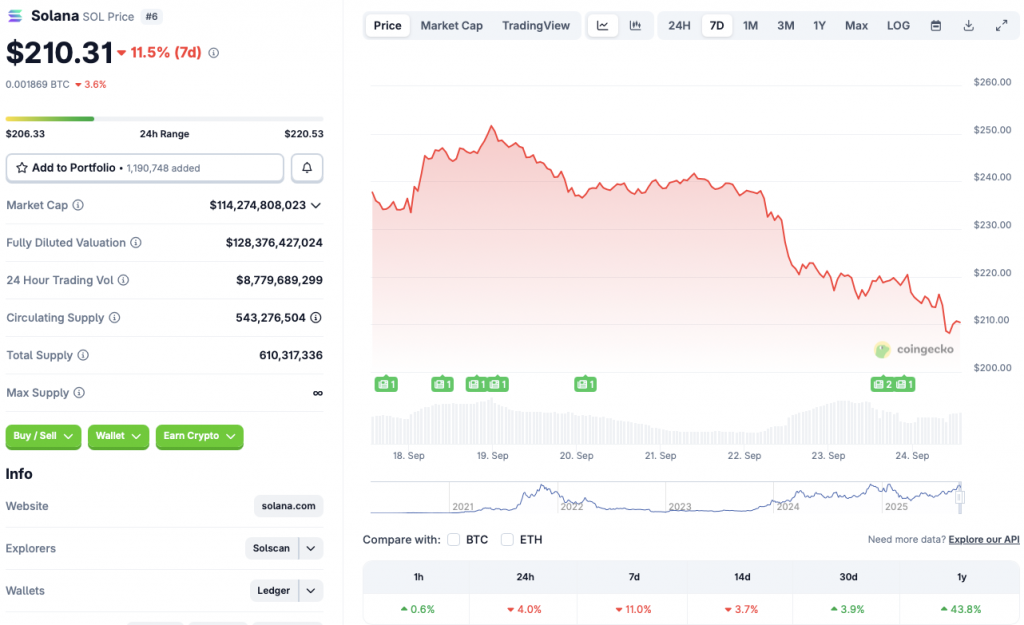

Solana (SOL) has faced a steep price correction over the last couple of days, following the market-wide dip. According to CoinGecko, SOL’s price has fallen 4% in the last 24 hours, 11% in the last week, and 3.7% in the 14-day charts. SOL has maintained some gains in the monthly and yearly charts, rallying 3.9% and 43.8%, respectively. Solana (SOL) faces some risks of falling below the $200 mark. Let’s discuss if the asset can recover soon.

Will Solana Fall Below $200?

Solana (SOL) last traded below the $200 mark in early September. Falling to this price point would wipe out all gains made over this month. SOL climbed to a high of $251 on Sept. 18, but has seen a gradual decline since then.

Solana (SOL) has some support at the $210 price level. The asset’s price could consolidate around the current level if liquidations slow down. Further volatility could be troublesome for SOL’s price.

Also Read: Solana Loses September Gains: Will October 2025 Be Different?

Bitcoin (BTC) seems to be holding at the $112,000 price point. BTC is the market leader, and Solana (SOL) will most likely follow BTC’s trajectory. BTC stabilizing could mean that SOL will also follow a similar pattern.

According to CoinCodex, Solana (SOL) will not fall below the $200 mark just yet. The platform predicts SOL will dip to around $208 before making a recovery. CoinCodex analysts anticipate the asset to hit $235.77 on Dec. 3.

There is also a chance that Solana (SOL) will go much higher than $235.77. There is a very high chance that the Federal Reserve will roll out another 25 basis point interest rate cut in October. Another interest rate decline could lead to a surge in risky investments. Such a development could lead to Solana (SOL) seeing increased inflows, leading to a big price rally.