2022 was particularly hard on Solana (SOL). After the FTX collapse, SOL took a beating as the exchange was heavily invested in the network. The token fell by nearly 95% towards the end of 2022, and many developers left the network to join other projects.

Nonetheless, Solana (SOL) made significant gains as we entered 2023. After the FED released positive CPI (Consumer Price Index) numbers for December, the cryptocurrency markets enjoyed much-needed relief.

SOL prices skyrocketed with almost 68% gains within the first two weeks. The token’s ~250% rally to $25 has surprised many in the industry. The project climbed back up the rankings to take the 11th position among the top tokens by market cap. However, the rally appears short-lived as SOL has dived the worse. At press time, SOL had fallen by 5.6% in the daily charts.

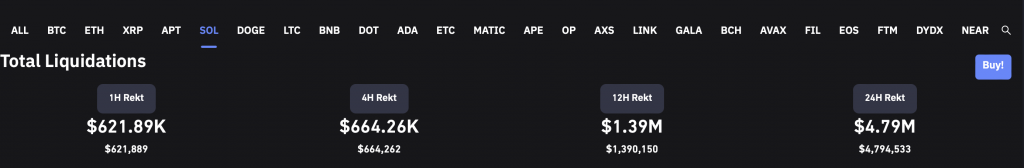

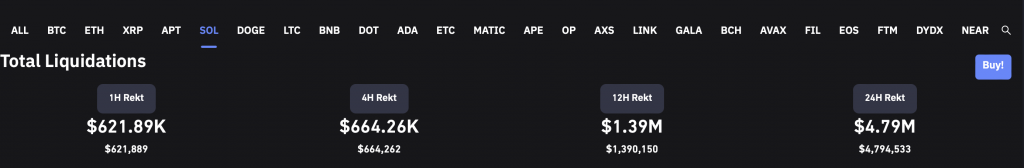

The cryptocurrency markets were hit with big liquidation numbers today. According to Coinglass, Solana (SOL) witnessed $4.79 million worth of liquidations in the last 24 hours. Ethereum (ETH) was the top liquidated project, with liquidations of $86 million in 24 hours. Meanwhile, $44 million worth of Bitcoin (BTC) was liquidated in the same time frame.

Moreover, traders who were keeping a watch on the SOL futures market’s negative funding rate may have seen the positive move coming before others. This is so that traders may let their stops run since negative funding rates imply that the majority of traders are on the short side. Most likely, a short squeeze in the futures market caused the recent SOL price increase from $10 to $25.

The bullish movement has the potential to develop into a medium to long-term positive trend if enough buyers are eager to join it.

One of the most effective metrics for examining activity throughout a platform is the total network fees measure. According to Solana’s token terminal statistics, the number of weekly active users has been falling steadily since 2022, signaling a decline in network activity.

What about NFTs on Solana?

In terms of NFT trading across blockchain platforms, Solana comes in second. With an 81.6% share of the overall NFT trading volume, Ethereum held the top spot. With an 11.6% slice of the pie, Solana is the second-largest player, according to data from Delphi Digital.

The SOL ecosystem suffered a setback when the two biggest projects, y00ts and DeGods, chose to leave. Top-performing projects leaving sets a poor example for product developers trying to introduce NFTs. Ethereum continues to be the preferred choice for major companies and community projects.