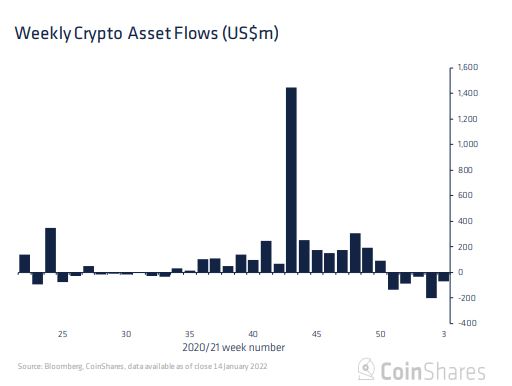

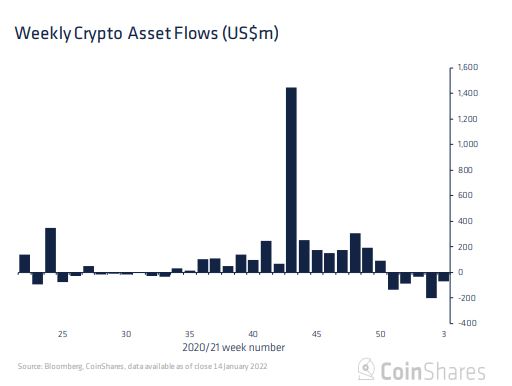

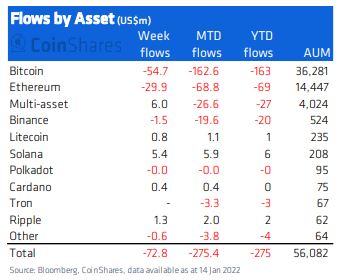

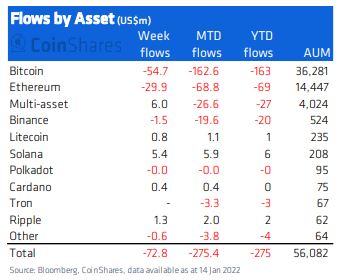

The cryptocurrency market has largely consolidated since the beginning of 2022, and trader sentiment is beginning to shift. According to a CoinShares weekly market report, digital asset investment products saw a net outflow of $73 million. This marked the fifth consecutive week, totaling $532 million, shared the report.

This was indeed the sharpest outflows the market has seen since 2018 in terms of the percentage of total assets under management. However, the market was not completely bearish yet. There has been positive news turning money into the market as daily inflows were noted on Wednesday and Friday.

Traders favor Solana

The consolidation has led the traders to act swiftly and try and secure a portion of their gains. While many took advantage of the price slipping to fill their bags, Bitcoin, the largest digital asset saw outflowed totaling $55 million, making it the fourth week of the five outflows. The total outflows stood at $317 million with Bitcoin’s AuM hitting a 3-month low of $35 billion mid-week.

Meanwhile, Solana, which ranks seventh on CoinMarketCap in terms of its market capitalization was noting a week of strong inflows of $5.4 million. As per the report, the asset has been an investor favorite as it has only seen two individual weeks of outflows since August 2021. Now, that’s a record Bitcoin has not touched given the volatility.

Solana has been posing as an Ethereum competitor and rightly so, as the market was seeing more value in the project currently. Ethereum’s net flows report says the same story as Bitcoin but affects more in the race between altcoins.

Ether closed in on its sixth week of outflows totaling $230 million. The asset was been noting a rise in negative sentiment with outflows representing 1.5% of AuM. The altcoin was seen forging its own path as it begins to lose its strong correlation with Bitcoin.

Meanwhile, Solana was also earning mainstream interest. Recently Bank of America analysts Alkesh Shah noted in his research note that Solana could take market share away from Ethereum. He described Solana “produces a blockchain optimized for consumer use cases by prioritizing scalability, low transaction fees and ease of use,” citing Lily Liu, Foundation member Solana.

Solana settled more than 50 billion transactions since March 2020 and has $10 billion in total value locked. The question of it being the “Ethereum killer” may remain, but currently, it was definitely among the top interest list of traders.

At the time of press, SOL was trading at $131.16 with a market capitalization of $42.61 billion.