Since the beginning of the year, Solana’s (SOL) price has surged by over 500%. SOL has even outperformed Bitcoin (BTC), which has risen by about 152% in the same time frame. Despite its stellar performance in 2023, SOL has faced a 7% correction in the last 24 hours.

Also Read: Solana (SOL) Forecasted to Rise 47% and Hit $82, Here is When

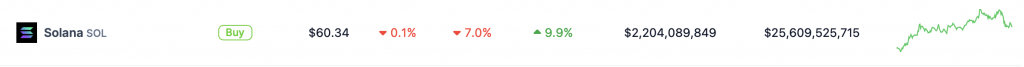

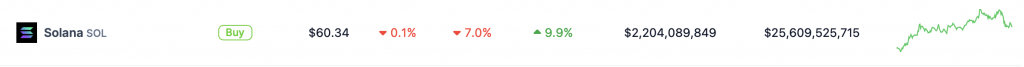

The cryptocurrency market witnessed a surge when BTC broke the $41,000 barrier. Almost all significant altcoins began to rally behind BTC. SOL hit a high of $65.18 on Dec. 3, 2023, but has fallen to $60.34 after failing to break past the $65.3 resistance level.

Moreover, the dip in Solana’s (SOL) price comes after it saw $4.3 million in inflows last week. According to CoinShares’ latest fund flow report, Ethereum (ETH) saw the highest inflows among altcoins with $30.8 million. SOL followed far behind ETH. Nonetheless, last week’s inflows mark several consecutive weeks of funds for SOL.

Solana’s (SOL) latest dip could be due to investors changing their positions and putting their money on Bitcoin (BTC). BTC is approaching its halving cycle in a few months, and the asset’s price could surge very soon. Moreover, there is a high probability of the SEC (Securities and Exchange Commission) approving a spot BTC ETF (Exchange Traded Fund), which could further propel BTC’s price.

Will Solana’s price rally soon?

According to PricePredictions, SOL’s price might consolidate over the next week. However, the platform anticipates the token to pick up steam by Dec. 12, 2023.

CoinCodex also expects Solana (SOL) to rally later in the month. The platform forecasts SOL to breach the $70 level early next year.

Also Read: Solana: ChatGPT Predicts SOL to Rise 700% and Hit $500

Solana (SOL) is among the best-performing cryptocurrency assets in 2023. The token’s surge is especially commendable, given its massive dip after the collapse of FTX. Moreover, the now-defunct exchange has received a green light from a US court to liquidate its holdings, of which SOL makes up a majority.