Solana’s price has dropped 20%, testing its $110 support level. This sharp decline worries investors about market volatility and possible further drops.

Also Read: Global Gold Net Purchases Breach 480 Tonnes: Why Is AUX Surging?

Market Volatility: Can the $110 Price Support Level Hold Amid Solana’s 20% Drop?

Understanding the Factors Behind The Coin’s Decline

The entire crypto market is correcting. Bitcoin fell below $58,000, putting pressure on altcoins like Solana. Solana’s price has fallen for eight straight periods, totaling a 20% drop.

Technical Analysis: Charting The Coin’s Path

Solana’s charts show mixed signals. A resistance trend line has formed. The RSI suggests a possible upward move. However, a bearish “death cross” between key moving averages has occurred. This could mean more downward pressure.

On-Chain Metrics: A Deeper Look at SOL’s Network Activity

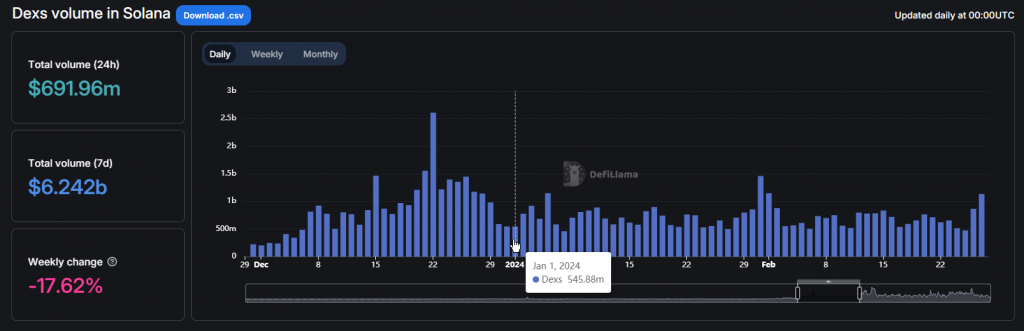

Solana’s network use has fallen sharply. Trading volumes on its decentralized exchanges dropped 19% last week to $539 million. This is an 87% decrease from the $3.8 billion daily volume in early March 2024.

Also Read: Cardano’s Chang Fork: Success or Setback for ADA Investors?

Future Outlook: Potential Scenarios for SOL

Solana might reach the $125 level next. If it falls further, $115 and $110 are key support levels to watch. If prices rise, $136 and $145 are potential resistance points. The $110 level is crucial for Solana’s short-term price movement.

Market Implications: What This Means for Investors

Solana investors face risks and opportunities. The price drop and lower network activity could lead to more selling. But signs of a possible upturn exist if support levels hold. Investors should watch both price charts and network activity closely.

Also Read: Ripple: Should You Buy Or Sell Your XRP? Finder Panel Predicts

Solana’s ability to stay above $110 is key for its near-term price. This level is being tested after a 20% drop. Investors and fans alike should watch for technical indicators and on-chain data closely.