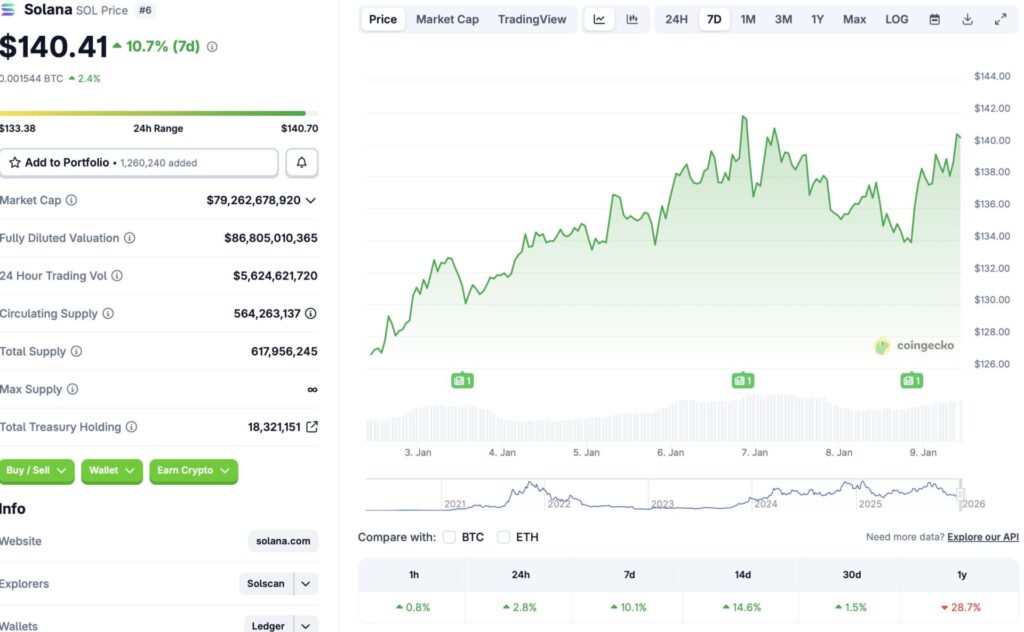

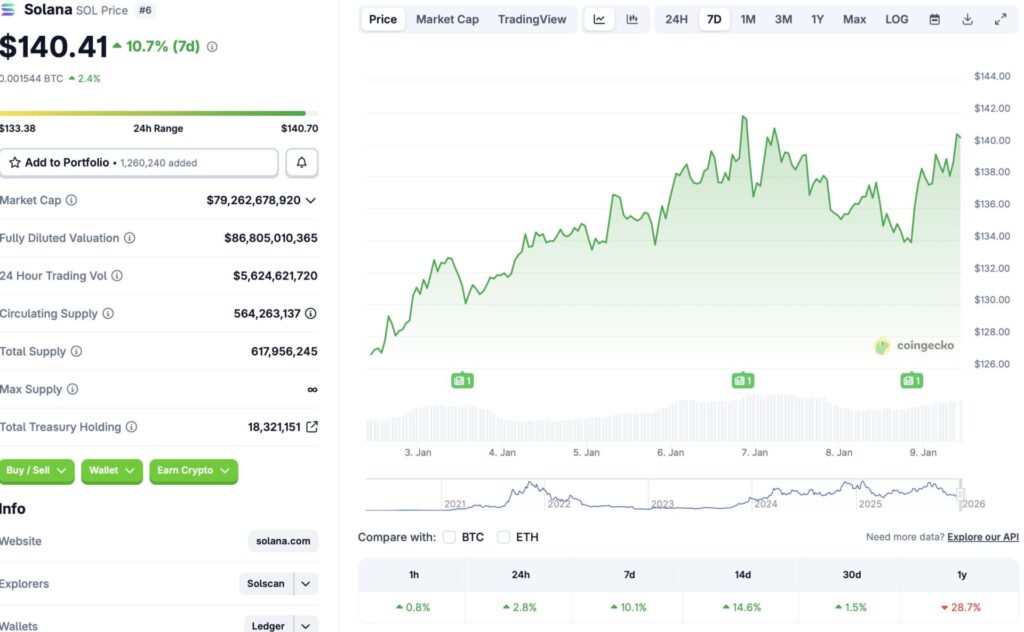

Solana (SOL) seems to be turning bullish, rallying in the green zone across almost all time frames. According to CoinGecko’s data, SOL’s price has surged 2.8% in the last 24 hours, 10.1% in the last week, 14..6% in the 14-day charts, and 1.5% over the previous month. SOL’s rally comes amid a larger market correction, with Bitcoin (BTC) falling to the $90,000 price level after hitting $94,000. Let’s discuss why Solana (SOL) is experiencing a price rally, and if the rally will sustain.

What’s Behind Solana’s Price Rally?

Solana’s (SOL) price rally could be due to a surge in stablecoins. According to Artemis Terminal data, stablecoin supply has risen by more than $900 million on the SOL network. The development may have triggered a price jump for SOL.

Solana (SOL) has also seen strong on-chain growth, with a surge in liquidity. Moreover, the asset saw the launch of several ETFs last year. ETF momentum has slowly picked up over the last few days.

While Solana’s (SOL) price rally is commendable, it is unclear if the rally can sustain itself. The larger crypto market is showing signs of consolidating around current levels. Bitcoin (BTC) seems to be settling around the $90,000 mark. Other assets are also showing signs of slowing down. Given the lackluster market environment, there is a chance that Solana (SOL) will either face a price correction or enter a consolidation phase.

Also Read: From Memecoins to RWAs: These Are Crypto’s Hottest Trends Right Now

However, the crypto market could see some positive price action later this month. The US is expected to pass pro-crypto legislation in a few weeks. The move could lead to a surge in investor sentiment. Such a scenario could lead to a market-wide rally. Solana (SOL) could go beyond the $150 mark under such circumstances.