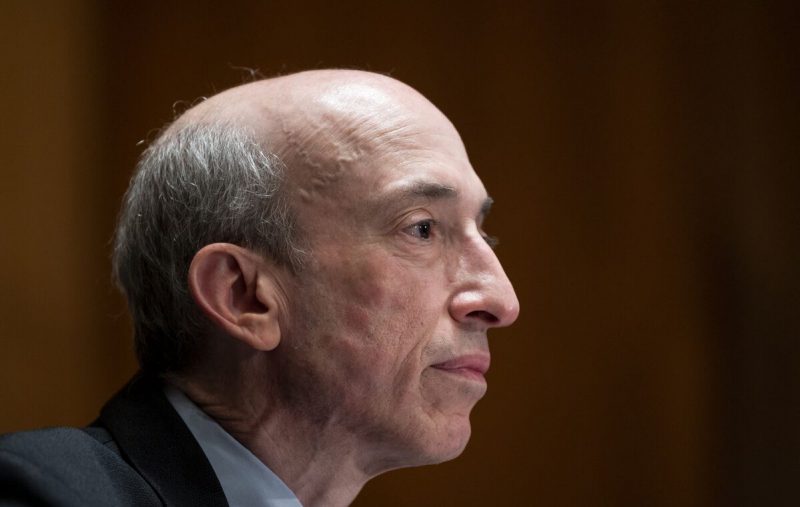

Solana could be set to see VanEck issue its first Spot SOL ETF if the US Securities and Exchange Commission (SEC) fires its Chair, Gary Gensler. Speaking on the crypto-based investment product, the asset management firm’s head of Digital Asset Research, Mattew Sigel, said the odds notably increase if the problematic agency head is not in the picture.

Gensler’s position in the SEC has been greatly scrutinized. Moreover, his ability to keep his position will depend on the 2024 Presidential Election this November. In a recent interview, Sigel noted that it is set to have a monumental impact on the cryptocurrency market.

Also Read: Solana Rallies 16%, Will Bulls Send SOL to $175?

VanEck Head Says SOL ETF Odds Rise Without Gensler

Just last week, both VanEck and 21Shares filed applications to issue Solana ETFs in the United States. The decision is still up in the air, but could be impacted by potential changes with the governing agency. Specifically, Solana would greatly benefit in its SOL ETF odds if the SEC fires Gary Gensler, according to VanEck.

“There’s a good chance that crypto voters are going to make the difference in this election,” Sigel told Bloomberg in an interview. “We’re already seeing a change in the regulatory environment at the elected official level. Multiple Democrats voting for pro-crypt legislation.”

Sigel notes that the ongoing regulatory environment will affect crypto-based ETF approval. “There’s some focus that there’s no regulated futures market for Solana,” Sigel said. “We think that is again Gensler Psyop. He has created that condition since taking power.”

Also Read: Solana: $1000 Monthly in SOL Since 2020 Worth $1.4 Million Today

However, the VanEck head did say that Solana would be confirmed as a commodity with an ETF. Similar to what occurred with Ethereum. Once the ETH ETf begins trading, then the asset would be verified in its status as a commodity, as opposed to a security.

“With the slight change in the regulatory environment in Washington, we think these will get approved,” Sigel said regarding Solana ETFs. However, he also noted that the outcome isn’t completely dependent on who wins the Presidency in November.

“I wouldn’t say no way,” he noted. “You know, we could still have a new SEC Chair, even if Biden wins. So it all depends on the SEC chair.” Ultimately, Sigel held firm to the belief that GEnsler’s presence would stand in the way of a Solana ETF that the market appears ready for.