Solana revenue collapse has shocked investors as weekly earnings have crashed from $55 million to just about $4 million. This 93% freefall, which is quite a dramatic one, shows the extreme Solana price decline and crypto market volatility that’s affecting even well-established blockchain networks in 2025.

Also Read: CBDC Push in Canada: Will PM Mark Carney Make Digital Dollars Inevitable?

Solana’s Revenue Crash: Price Drop, Market Volatility & Risks

From Boom to Bust

The Solana revenue collapse became evident as earnings essentially plummeted from $55.3 million in mid-January to approximately $4 million just last week. This dramatic 93% drop coincides with the fading memecoin interest, which had previously driven the blockchain’s success and attracted so much attention.

CoinGecko founder Bobby Ong said:

The launch of TRUMP and MELANIA marked the top for memecoins as it sucked liquidity and attention out of all the other cryptocurrencies.

Dangerous Memecoin Dependency

The ongoing Solana revenue collapse has actually exposed some critical vulnerabilities in the network’s financial structure. Nearly 80% of Solana’s revenue was, believe it or not, generated through memecoin activity. Pump.fun, which is central to memecoin trading and all that, saw daily revenue drop by an incredible 95% from $15 million to under $1 million by early March.

This kind of overreliance on speculative assets definitely magnifies the Solana earnings drop when investor enthusiasm wanes, and it’s creating substantial risks for long-term network stability and such.

Also Read: Dogecoin (DOGE) Predicted To Rally 300% To $0.60: Here’s When

TVL and Price Freefall

The Solana earnings drop extends well beyond just revenue metrics. Total value locked (TVL) in Solana’s DeFi protocols fell from over $12 billion in January to around, well, $6.4 billion recently—that’s like a 50% reduction signaling diminishing investor confidence and trust.

The crypto market volatility has pushed Solana’s price down by about 58% from its January peak of $293 to approximately $122, which pretty much reflects reduced demand for the network’s applications and services.

Technical Outlook Weakens

The Solana price decline continues as the asset hovers sort of precariously above a crucial $125-$110 support range that will likely determine its next major move in the coming weeks.

Technical indicators, at the time of writing, provide little reassurance for recovery hopes. The RSI at 35.11 sits just above oversold territory, while the MACD remains firmly in bearish territory, basically confirming that sellers control market direction amid the ongoing crypto market volatility we’re seeing.

Also Read: Shiba Inu: AI Predicts SHIBs Price For March 15th 2025

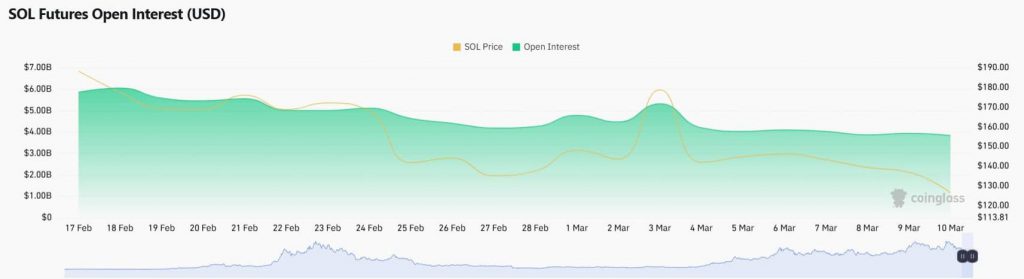

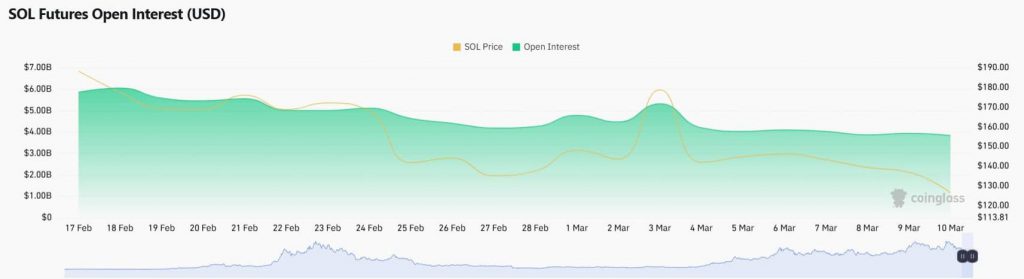

Futures Market Confidence Erodes

The Solana revenue collapse has substantially impacted trader sentiment and such. Open Interest in Solana Futures dropped by about 19% since early March, which coincided with price rejection near $180 and widespread profit-taking across the market.

External factors have also worsened these challenges quite a bit. Disappointing developments regarding the U.S. government’s crypto reserve plan triggered market-wide selling. Additionally, the impending FTX estate token unlock has raised some serious concerns about excess supply and all that.

Uncertain Recovery Path

Solana’s future remains kind of precarious amid the persistent Solana earnings drop. If it somehow maintains support above $125, a potential reversal could begin. And positive momentum in Bitcoin and Ethereum might lift Solana toward resistance at around $150-$160.

However, breaking below $110 would likely trigger increased liquidations and further problems. This scenario could worsen with, you know, macroeconomic uncertainties, regulatory concerns, or an extended altcoin sell-off in general.

Also Read: Hedera Coin: AI Predicts HBAR Price For Mid-March 2025

The Solana revenue collapse raises some fundamental questions about blockchain projects dependent on speculative markets and the like. As investors recalibrate expectations during this persistent crypto market volatility, Solana must adapt its strategy to ensure long-term viability.