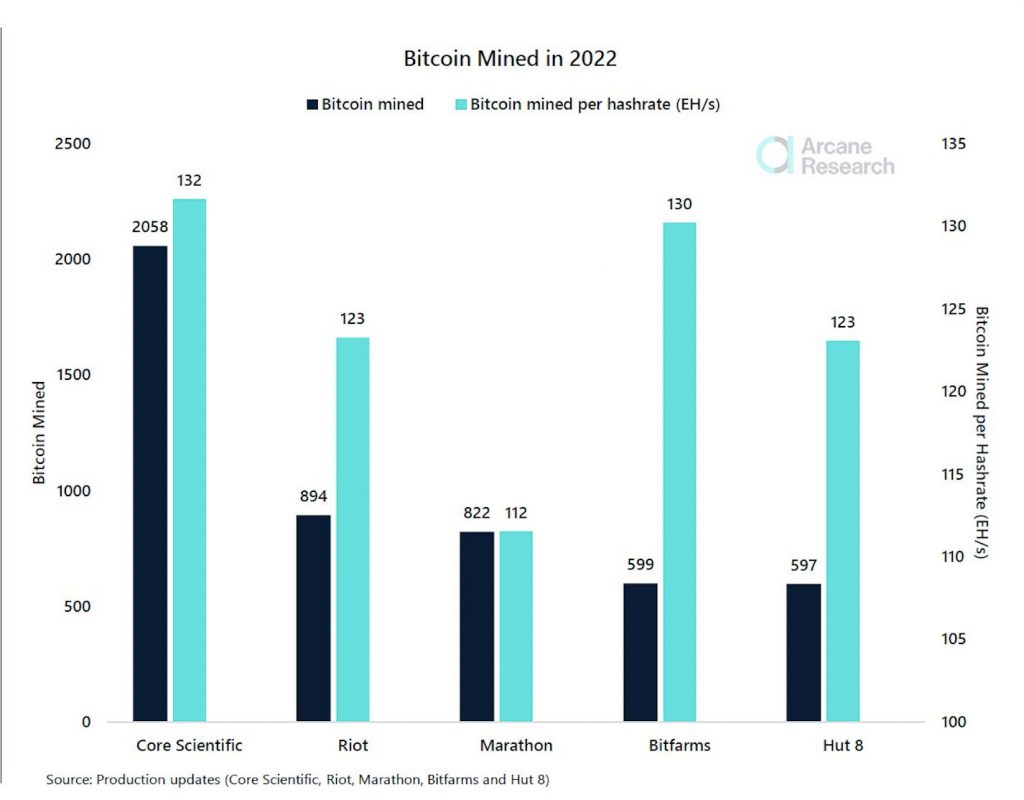

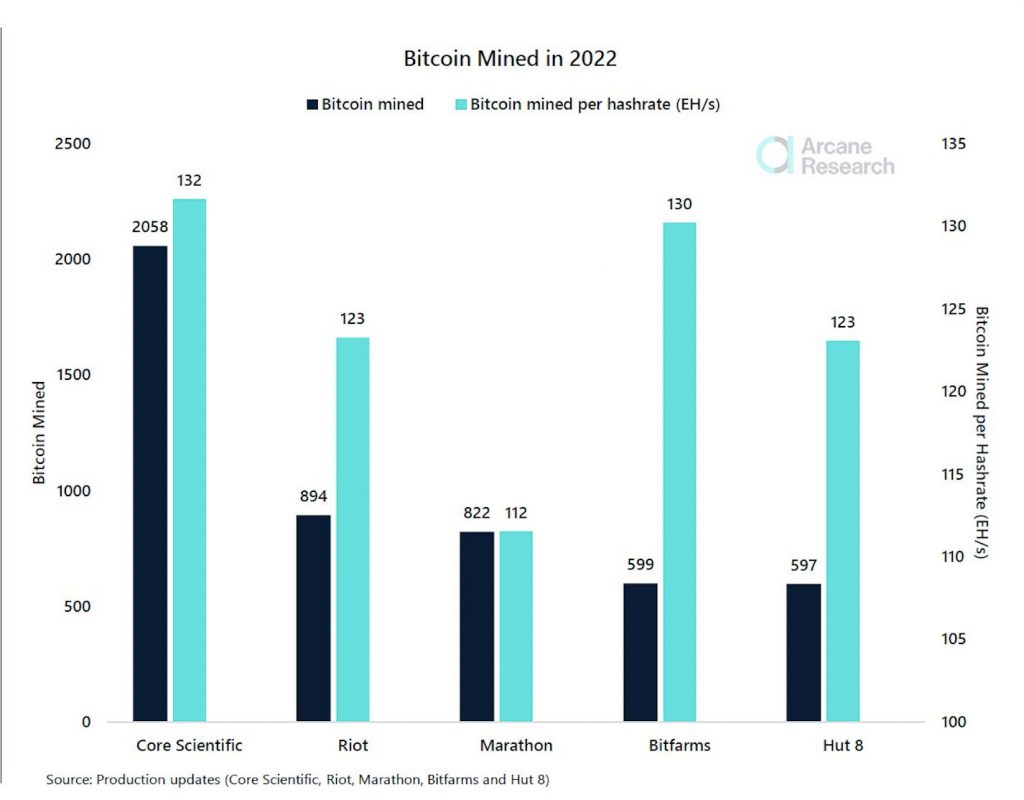

The largest Bitcoin miners have released their February production updates. This has allowed the calculation of their production volumes in 2022 so far.

As per the data from Arcane Research, there are significant differences between the largest publicly traded Bitcoin mining companies. Some of them seem to utilize their BTC mining abilities better than others.

Bitcoin (BTC) has lost more than 40% of its value since its all-time high (ATH) of $69,044.77 on November 10, 2021, since the beginning of 2022.

The network’s ability to enhance miners’ difficulty in obtaining BTC hasn’t been harmed by the price fluctuation. Bitcoin’s difficulty has reached a new all-time high for the second time in two months, as the competition among miners intensifies. Following the lows of last July, the hash rate has steadily risen by 45% in six months.

How did the Bitcoin mining companies fare?

Core Scientific was by far the biggest miner by production volume. They managed to mine 2058 BTC so far in 2022.

Rio and Marathon came in second and third place, respectively. Riot produced 894 Bitcoins, while Marathon managed 822 BTCs.

Bitcoin miners often showcase their hashrate, in order to attract new customers. It is helpful to calculate how many Bitcoin the companies mine, as per their claimed hashrate (EH/s)

Core Scientific was also the leader in terms of Bitcoin mined per EH/s, with 132 BTC. Bitfarm follows in a close second place with 130 BTC per EH/s. Marathon turned out to be the least efficient among the top five miners with 112 BTC mined per EH/s, in 2022.

Why do some miners utilize their hashrate more efficiently than others?

There are several reasons why some mining companies are more efficient than others, in terms of the hashrate. Downtime is one of the major reasons for the efficiency difference. Some mining farms have their machinery turned off for a longer time than others, leading to a lower number of BTC mined.

Moreover, Arcane Research has speculated that long-term efficiency discrepancies between BTC miners, can be due to the overestimation of production capacities by the mining companies.

In February, a cautionary development had unfolded when many miners were cashing in their BTC. This led to an increase in the miners’ position index (MPI), which reached its highest number since April of 2021. However, at the same time, Bitcoin’s mining difficulty also reached an all-time high at the same time, meaning that the system was more secure than ever before.

At the time of publication, Bitcoin (BTC) was trading at $39,208.85.