Regulators from Cheongju, South Korea, are looking to confiscate crypto assets from local tax evaders. Yonhap’s report revealed that seven South Korean crypto exchanges have been asked to look into the holdings of tax offenders. Specifically, authorities have ordered companies including Upbit and Bithumb to uphold the crypto assets of 8,520 users who owe at least 1 million won [748 USD] in local taxes.

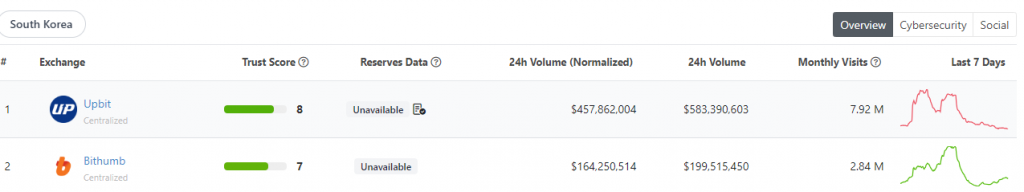

Upbit and Bithumb are the top exchanges in South Korea. Over the past week, the trades on Upbit have declined, while on Bithumb, the volume has been recovering. In the last 24 hours, the platforms managed to settle $583.3 million and $199.5 million in volume respectively. XRP and Bitcoin were the top traded assets.

Also Read: SEI Volume Surpasses $1 Billion in 24 Hours: Koreans ‘Hoard’ Token

Cryptocurrency used to conceal property: Cheongju Admin

Regulators believe that citizens are using crypto assets to conceal property in South Korea. Thus, the latest move will make sure that citizens who have not paid taxes are held liable for their negligence.

Seizing cryptocurrency on account of tax arrears has been quite a common practice in South Korea. The South Korean government seized over 260 billion Korean won [180 million USD] worth of crypto assets over the past two years [i.e. in 2021 and 2022] owing to tax arrears. Regulations allowing the seizure of digital assets for tax evasion were enforced in 2021.

In fact, that year, the Seoul government had also found 1,566 individuals and heads of companies that had overdue taxes. Authorities seized more than 25 billion won [$22 million USD] in virtual assets from 676 of them.

Also Read: South Korea: Top Banks Explore CBDC, Stablecoin Alternative

The latest development comes at a time when the South-East nation’s financial regulator, the Financial Services Commission [FSC], issued new draft rules pertaining to the accounting of cryptos and other digital assets. As reported by Watcher Guru, companies that issue or own crypto assets will have to provide in-depth disclosures in their financial statements from 2024. This means internal information regarding their business models and internal accounting practices with respect to crypto sales and profits will have to be provided.

Also Read: South Korea Issues New Crypto Accounting Rules