South Korea’s crypto surge hit record levels as trading reached $34.2 billion during a brief military rule period. The crypto market volatility intensified when President Yoon Suk-Yeol declared martial law for six hours. The event revealed something important. Political stability directly affects cryptocurrency regulations. And in Asia, this matters even more – especially since this is one of the region’s biggest digital asset markets.

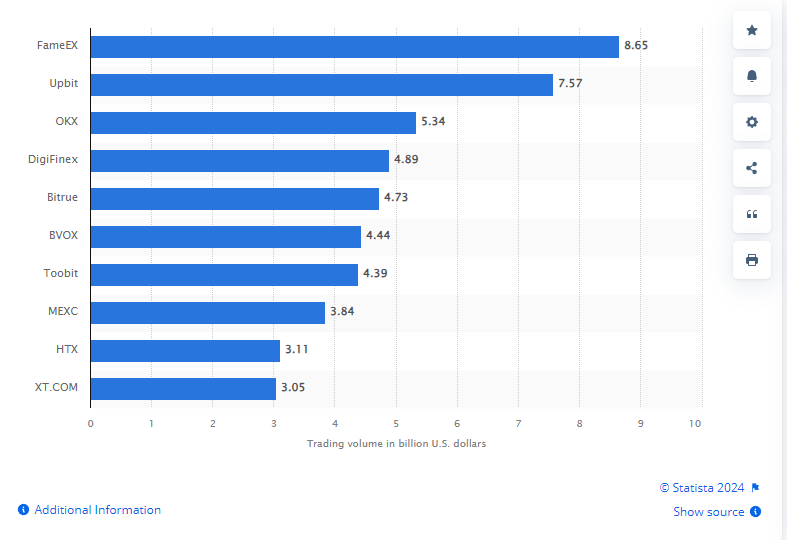

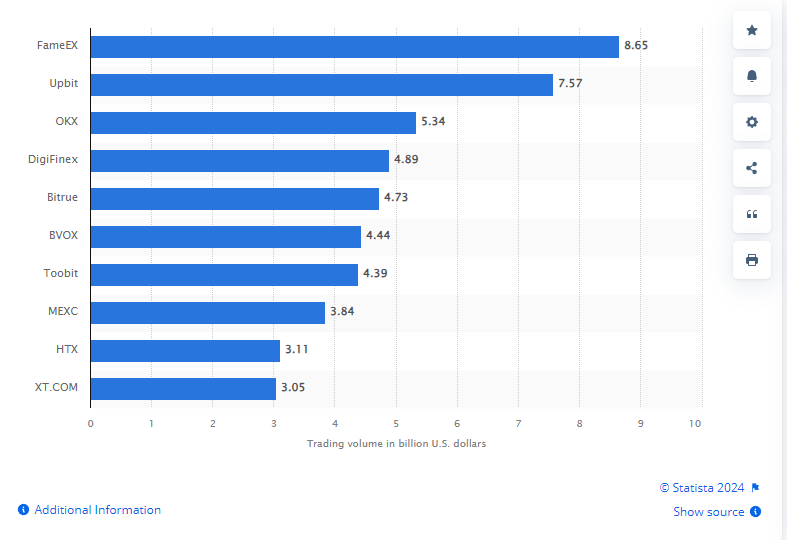

The South Korean crypto market powerhouse Upbit handled $27.25 billion in trades. This doubled the previous day’s $18 billion volume and set a new record for 2024. The surge highlighted the market’s growing influence in global crypto trading.

Also Read: Polkadot (DOT) Predicted To Hit $22: Here’s When

Crypto Market Impact and Trading Risks

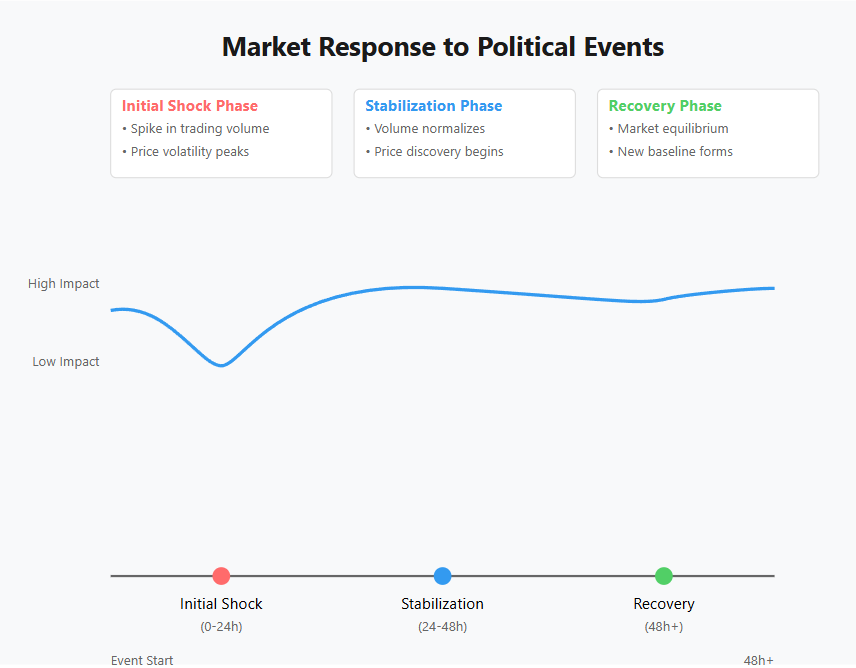

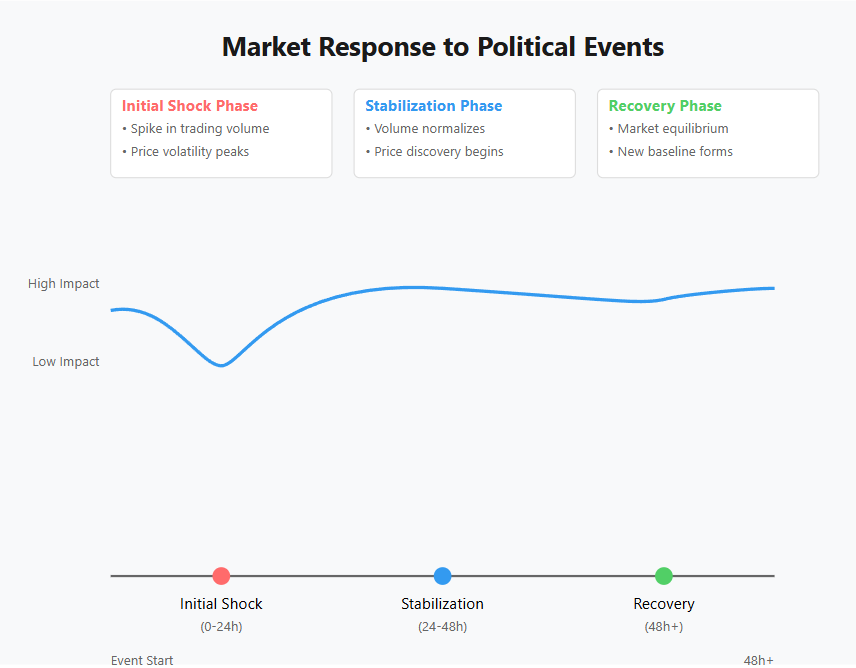

The martial law triggered immediate crypto trading risks. Bitcoin’s price on Upbit fell to 88 million won ($62,182), causing widespread panic selling. Many exchanges faced technical problems due to heavy trading. These issues showed how political events can create both system failures and price swings, underlining the risks of crypto trading during unstable times.

Regulatory Landscape and Market Response

The military rule period revealed key issues about cryptocurrency regulations:

- Rule Gaps: The event highlighted the need for better regulations during political turmoil

- Emergency Plans: Exchanges showed varying levels of preparation for market crises

- Technical Limits: Trading platforms struggled with the sudden volume surge

Also Read: Shiba Inu: New Forecast Claims SHIB Hitting $0.00007, Here’s When?

Political Aftermath and Market Stabilization

The crypto market volatility eased after parliament voted against the martial law. However, the opposition party’s move to file charges against President Yoon and ministers created new concerns. These actions continue to affect the South Korean crypto market, as shown by shifting predictions about political changes.

Future Implications for the Market

This South Korean crypto surge revealed important lessons:

- Political events directly impact trading patterns

- Markets need stronger cryptocurrency regulations

- Systems must handle extreme market volatility

- The South Korean crypto market influences global trading

Traders must consider these factors when planning their strategies, especially in markets where political events can trigger major price and volume changes.

Also Read: VeChain Hits 2-Year High, Outperforms Bitcoin, Solana: $0.1 Next?

Despite these challenges, the South Korean crypto market remains resilient. As cryptocurrency regulations evolve and trading systems improve, this event will shape future policies in this key Asian market.