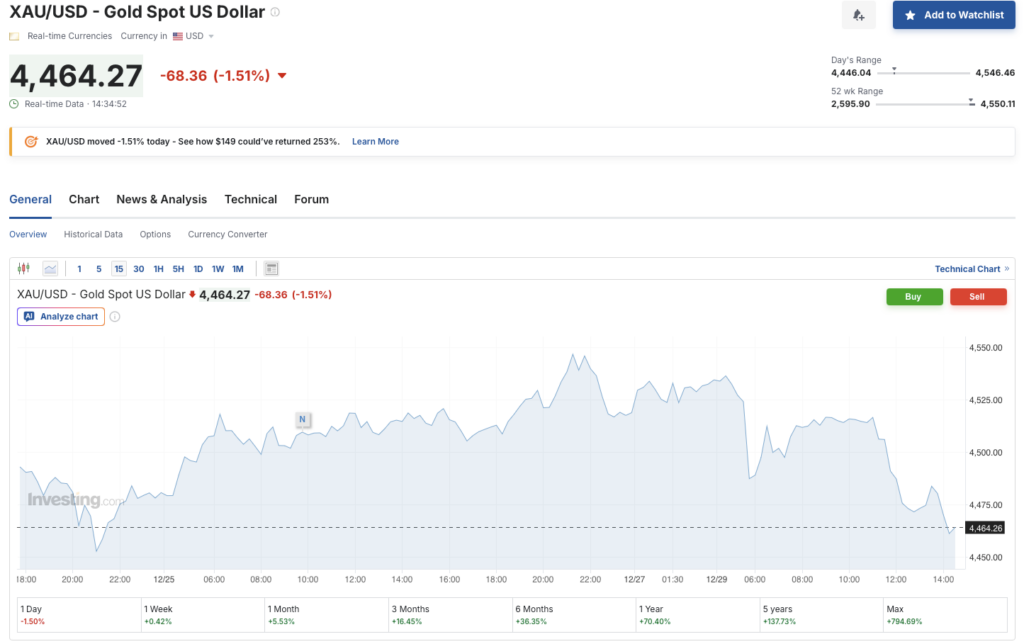

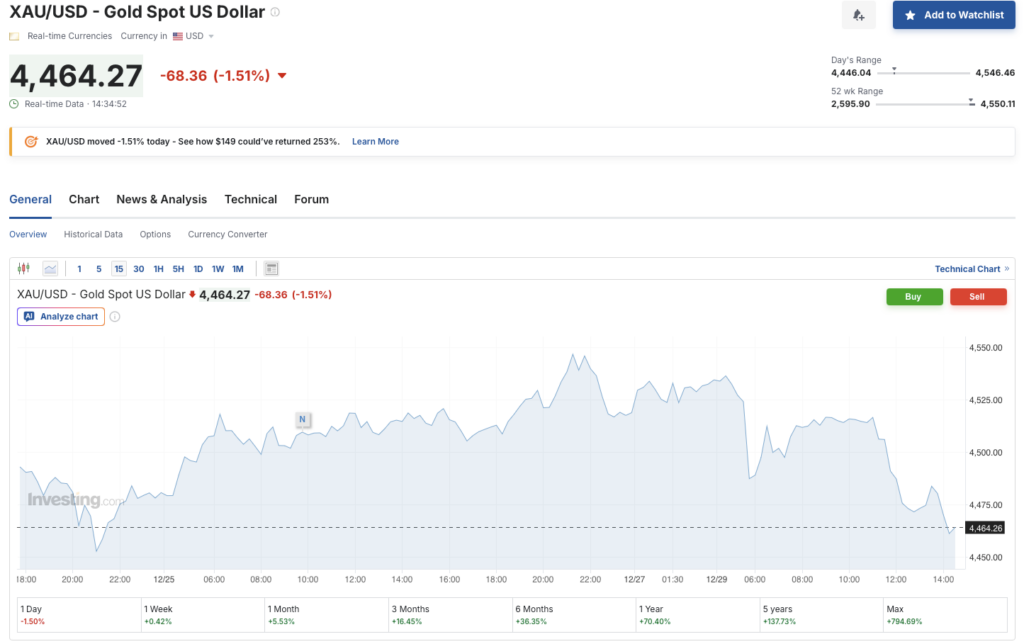

Spot gold prices saw a 1.5% dip today, falling to $4464.27, while Bitcoin (BTC) registered a near 2% gain in the same time frame. Despite the dip, the yellow metal has hit multiple peaks over the last few months. According to Investing.com, gold’s price has risen 5.5% over the last month and more than 70% over the previous year. Let’s discuss if the latest turnaround is a signal for a crypto market rebound.

Gold Dips While Bitcoin Rises: Is The Market Turning Around?

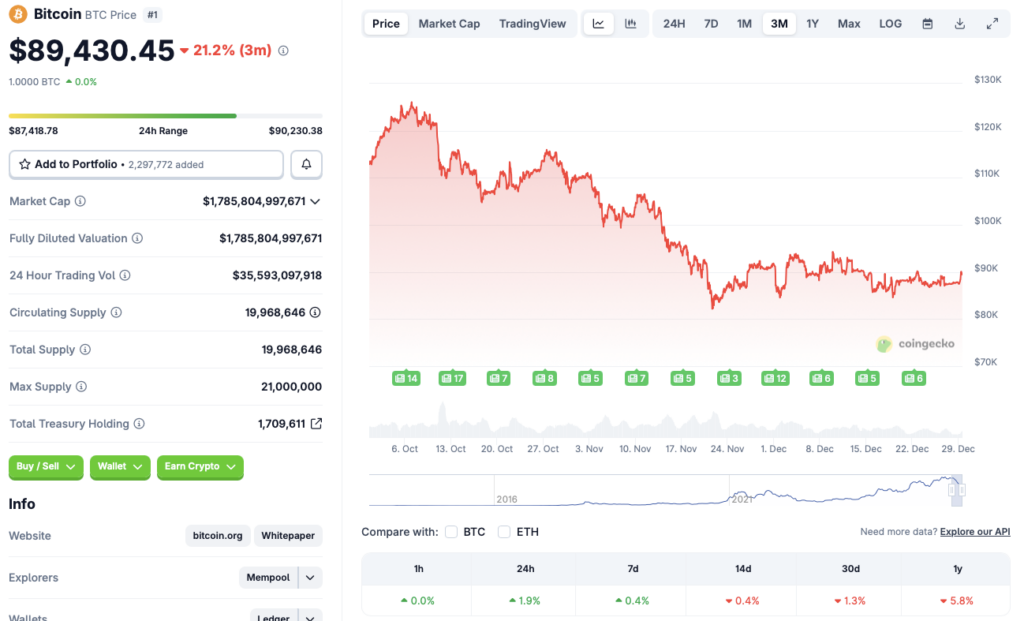

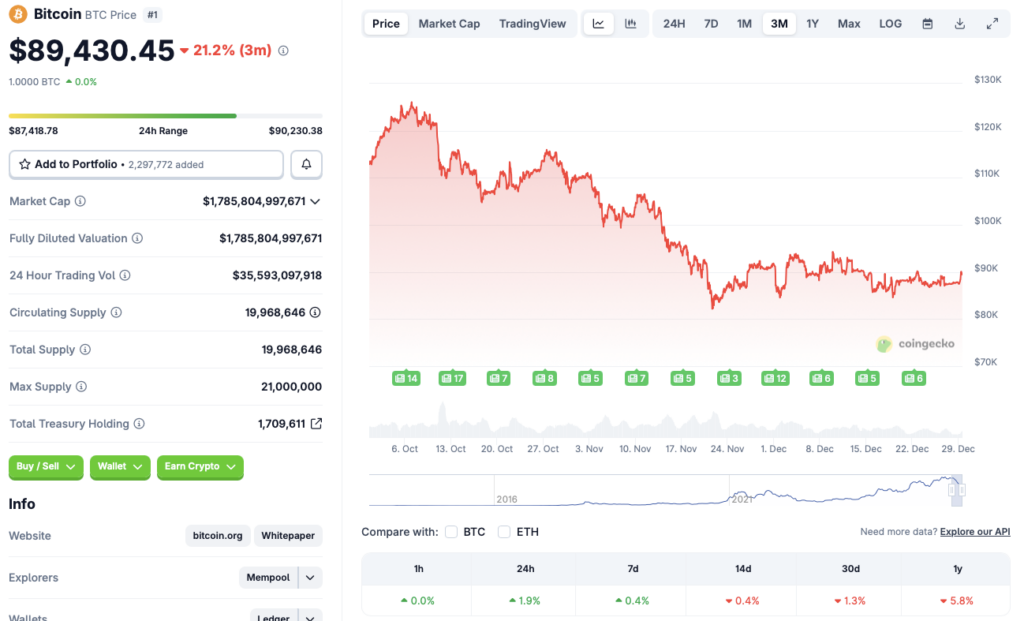

According to CoinGecko data, Bitcoin (BTC) has rallied 1.9% in the last 24 hours and 0.4% over the previous week. However, the original crypto is still down by 0.4% in the 14-day charts, 1.3% over the last month, and 5.8% since December 2024. Bitcoin (BTC) is currently facing resistance at the $90,000 price level. Breaching beyond $90,000 could take BTC back to $100,000, a price level last traded at in mid-November 2025.

Bitcoin (BTC) faced a steep price correction over the last few months after investors began to take a risk-averse approach. The development steps from macroeconomic uncertainties, leading to diminishing chances of another interest rate cut in early 2026. Investors have likely moved their funds from risky assets, such as Bitcoin (BTC) and other cryptocurrencies, to safe havens such as gold and silver. The trend may continue over the coming months, until macroeconomic conditions improve.

Also Read: Is Silver a Smart Buy Before 2026? Analyst Screams YES

The recent dip in gold and rise in Bitcoin (BTC) could be a signal that the trend may be in for a change. However, it is also possible that investors are testing the waters before 2026 kicks off. BTC could see a price dip, or a price consolidation over the coming days. However, if gold continues to dip, we may see a surge in crypto investments.