A couple of days back beleaguered crypto exchange FTX was hacked. A recent post by blockchain forensics firm Elliptic highlighted that various tokens on Ethereum, BNB Smart Chain, and Avalanche were removed. Out of the $663 million drained, around $477 million is suspected of being stolen, while the remaining is believed to be moved into secure storage by FTX itself.

Right after, developers and other community members suspected the hack might have also compromised Serum, a Solana-based protocol developed by FTX. Developers needed another version of Serum because the original could only be updated via a private key connected to FTX. The Serum DAO, on its part, did not have control over the key.

So, because of the FTX hack, that key may have been compromised, and thus, the team decided to go ahead with an emergency fork. Pseudonymous developer Mango Max who led the fork confirmed the same. The developer further highlighted that Serum was the central order book for LPs to backstop liquidations on Solana.

At the moment, liquidity aggregators are already working on integrations. For instance, Jupiter said a few hours back that it was live-testing an integration of the new version and “will announce it as soon as it’s ready.”

In fact, developer Mango Max also revealed that other community projects including the likes of Solape DEX, OpenSerum, and Switchboard were working to integrate with the fork. In fact, Mango Markets are also on the same side of the spectrum. Confirming the same, it recently tweeted,

“Mango v4 will use the Serum Community Fork”

Sentiment-Check, Price movements

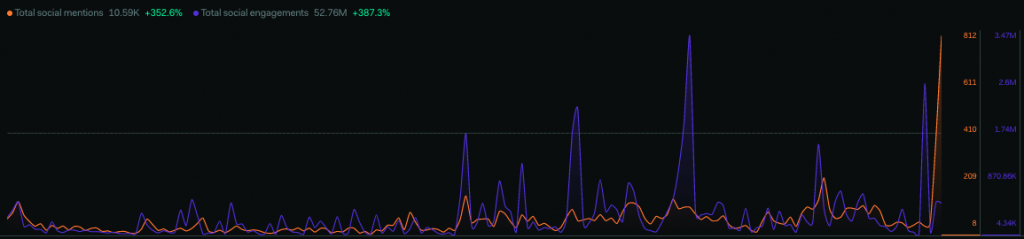

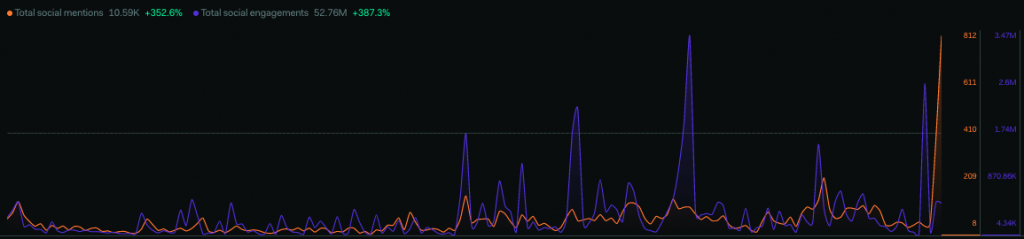

On social platforms like Twitter, there has been a lot of buzz associated with Serum. In fact, data from LunarCrush revealed that social mentions and social engagements have risen by 352% and 387% over the past week.

Post the FTX hack, Serum’s native token SRM’s prospects were dented and it lost a major chunk of its value. However, after the fork, the asset’s price started recovering. At press time, the token was seen rallying. When compared to November 13’s lows of $0.0118, SRM was trading at a level 175% higher.

Nevertheless, SRM ain’t out of the woods yet. The latest 175% rally hardly makes up for losses endured by investors over the long term. Priced around $0.33 at press time, the token’s price was still miles away from the double peaks of $12.98 and $13.73 created last year.