One of the largest international banks on the planet, Standard Chartered has recently predicted that Bitcoin could see as much as $100 billion in Spot ETF inflows. Specifically, the bank stated those funds could be seen in 2024, following approval of the investment product.

Industry experts have increased their expectations of the product’s approval in the coming days, with many expecting approval to arrive by Wednesday of this week. Moreover, Standard Chartered has forecasted a massive price increase for the digital asset following approval of the more than a dozen spot Bitcoin ETF applications that the US Securities and Exchange Commission (SEC) is currently contemplating.

Also Read: Bitcoin: Standard Chartered Says ETF to Bring 165% Gain in 2024

Standard Chartered Bank Predicts $50-100 Billion in Inflows for Bitcoin After Spot ETF Approval

For the last several months, anticipation over a Spot Bitcoin ETF approval in the United States has reached a fever pitch. The digital asset industry is anxiously awaiting a decision on the host of applications. Subsequently, many are predicting what such an approval could mean for the industry as a whole.

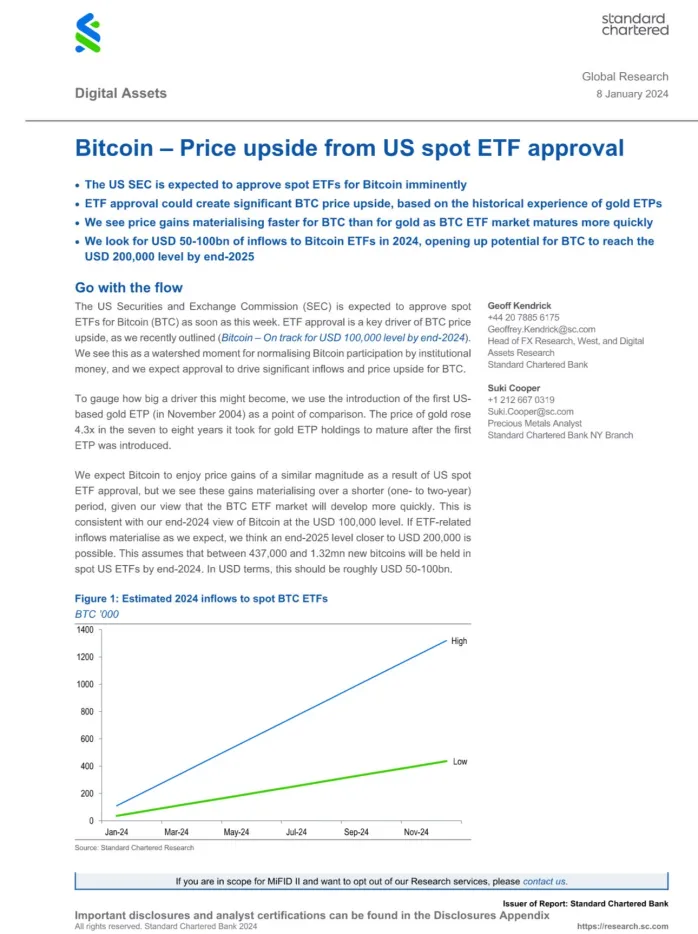

Among them is Standard Chartered Bank, which says that Bitcoin could see as much as $100 billion in Spot Bitcoin ETF inflows. Specifically, the bank notes that the inflows will be between $50 and $100 billion. Additionally, they expect a massive impact on the price over the next year.

Also Read: All Spot Bitcoin ETF Applicants Submit S-1 Final Amendments

The bank also noted that Bitcoin could reach a price of $200,000 by the end of 2025. Although it would certainly require the Spot Bitcoin ETF approval, it would be a monumental increase. Subsequently, that mark would skyrocket past Bitcoin’s previous all-time high of $68,789.

The expectation from those within the industry is that approval is set to arrive at some point this week. Standard Chartered noted that such an approval is imminent in their predictions. Conversely, the deadline for a decision has long been observed as January 10th.