STEPN [GMT] has been trending on social media for quite some time now. People from the crypto space have been having an eye on this token since the second week of March. Back then, it was merely valued at $0.1. Fast forward to 20 April, STEPN went on to peak at $3.85900, resulting in a 3800% pump.

Can history repeat itself?

The rally over the past few days has been a result of STEPN’s bull flag breakout. As illustrated in the chart below, the token rallied by 324.24% from 27 March to 1 April. Post that, it traded within a descending channel until 10 April, right after which it broke above the upper trendline of the said bearish structure.

Per the thumb rule, traders set bull flag targets by measuring the previous uptrend’s height and project the same from the breakout point. According to the same, the token has the potential to rally up to $9.69077.

Is ‘324.24%’ blown out of proportion for STEPN?

Well, massive pumps ain’t an alienated concept in the crypto space. As far as STEPN is concerned, it has already pulled off a meteoric rally over the past one-and-a-half months. However, attaining $9.69 does seem to be a far-fetched target for now. Here’s why:

- At press time, only three tokens from the top 100 were trading in the green, and STEPN was one among them. This essentially means that the state of the broader market remains to be bearish. Coins from the space that have defied the macro-trends in the past haven’t been able to tread too far without the company of the pack. Thus, in the current market conditions, it’d be quite challenging for STEPN bulls to continue asserting their dominance.

2. STEPN’s RSI has been hovering in the overbought zone since the end of March. To be more specific, the reading of the said metric has hardly dipped below 70 in the said timeframe. RSI peaks are usually followed by a brief period of retracement. So, keeping the overheated state of the market in mind, the odds of STEPN witnessing a pullback over the short term seem to be fairly high.

3. STEPN’s visit to its previous ATH of $3.859 would result in the creation of a double top—a bearish technical reversal pattern that is formed after an asset reaches a high price two consecutive times, with a moderate decline between the two highs. As can be seen from the price chart snapshot above, the token isn’t trading very far from the said level. So, even with a slight incline, the double-top pattern would materialize, and the odds of STEPN correcting would intensify.

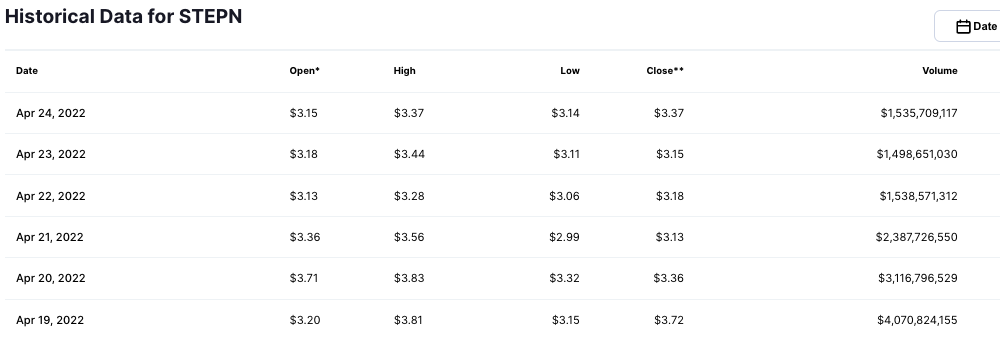

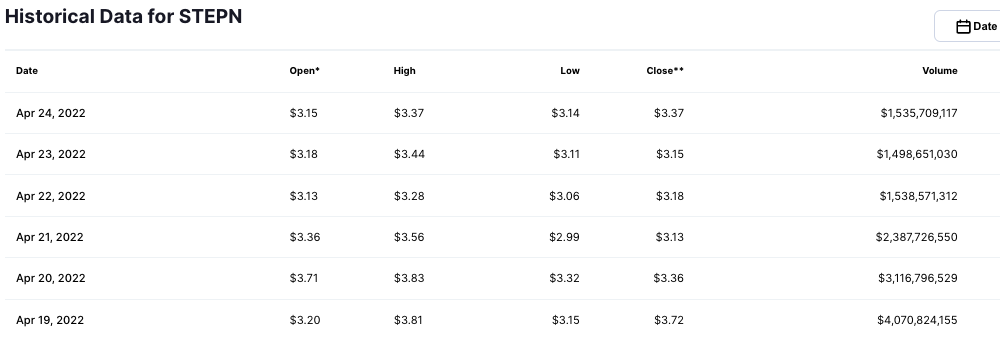

4. At this point, the token volumes have been declining consistently. Per data from CMC, STEPN’s volumes totaled $4 billion a week back [on 19 April]. However, over the last couple of days, the number has been hovering around $1.4-$1.5 billion, indicating the withering interest of market participants toward this token.

5. People from the community had attributed STEPN’s recent pump to its strong fundamentals. In fact, per a Financial Express report, STEPN’s recent earning report is believed to be one of the major reasons behind the massive price uptrend. As per an official statement of the company, STEPN made a profit of $26.81 million from its NFT marketplace trading and royalty fees in Q1 2022. Now that the hype associated with the same has already fizzled out, STEPN has lost yet another catalyst to help it incline on its charts.

Bottom line

Over the short term, both technicals and the macro-market conditions do not paint a favorable picture for STEPN. If the conditions continue to remain the same, market participants can at the most expect the token to rally by 15% to attain its pre-set ATH.

Having said that, the odds of a 324% rally cannot be completely ruled out. In the weeks to come, if the dynamics change, then STEPN would be in a position to attain new highs. Nonetheless, $9.69 remains to be a highly optimistic target for the #52nd ranked token.