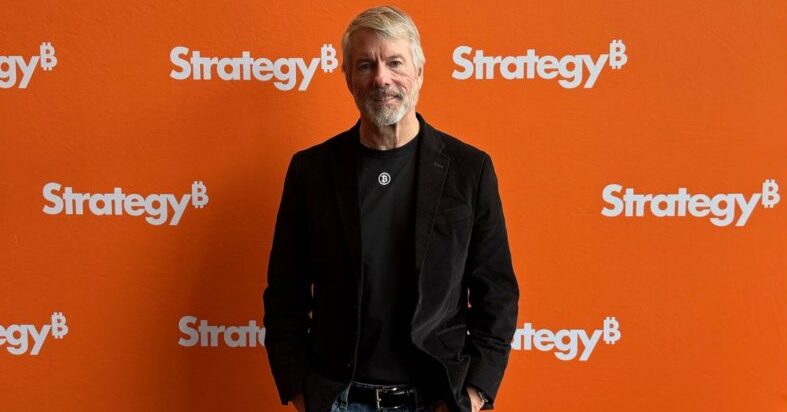

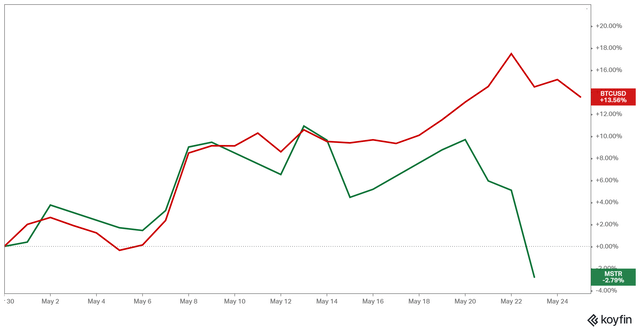

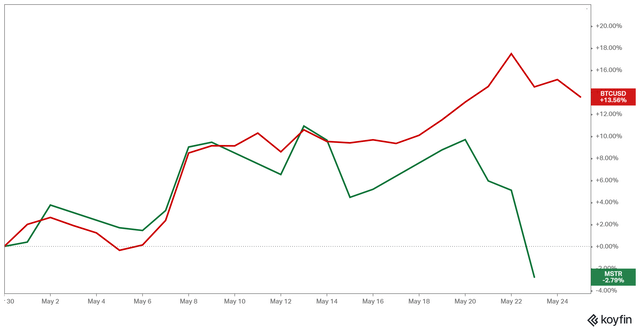

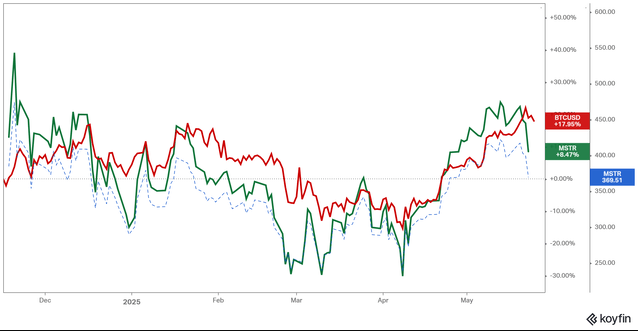

Strategy BTC rally underperformance continues right now as Michael Saylor conceals Bitcoin addresses worth $14 billion. The Strategy BTC rally disconnect from Bitcoin’s surge past $111,000 raises investor concerns about transparency and also regulatory risks affecting the cryptocurrency giant’s market position at the time of writing.

Why Strategy’s BTC Rally Lag Fuels Regulatory Uncertainty And Market Risks

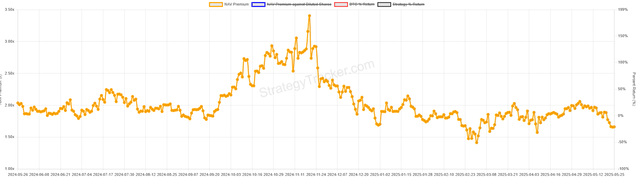

The Strategy BTC rally lag stems from mounting transparency concerns as Saylor refuses proof of reserves disclosure. While Bitcoin halving countdown approaches and cryptocurrency markets surge, regulatory uncertainty clouds Strategy’s $14 billion Bitcoin holdings right now, impacting the BTC rally strategy.

Also Read: Class Action Lawsuit Filed Against Michael Saylor’s Strategy Over Bitcoin

Saylor’s Transparency Stance Creates Market Discord

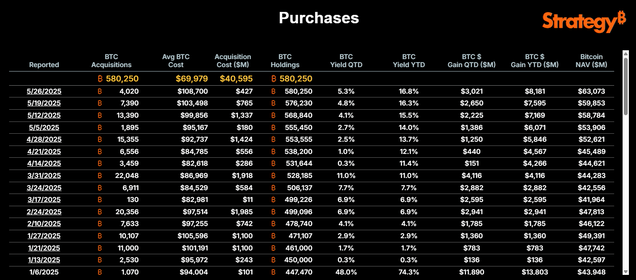

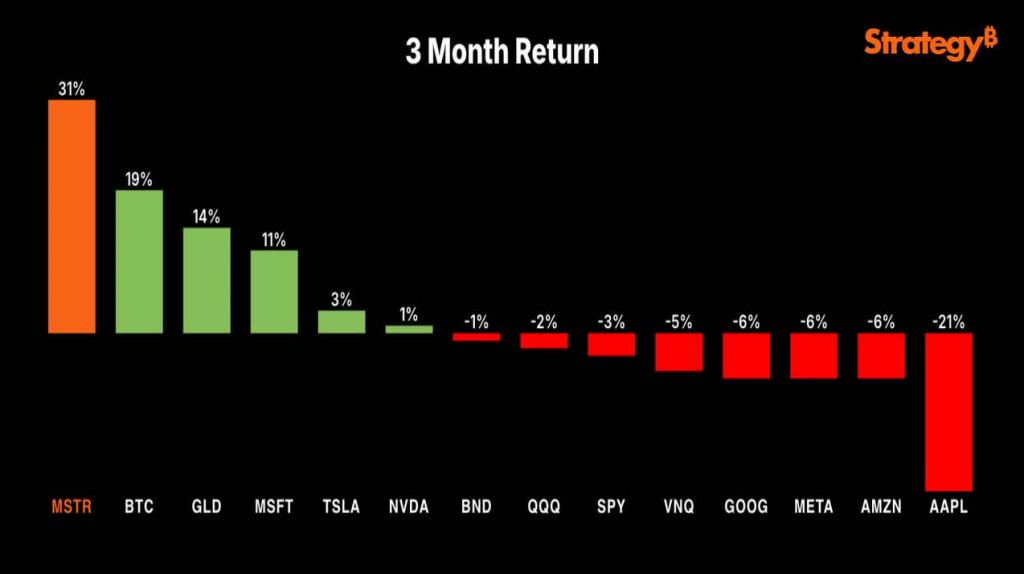

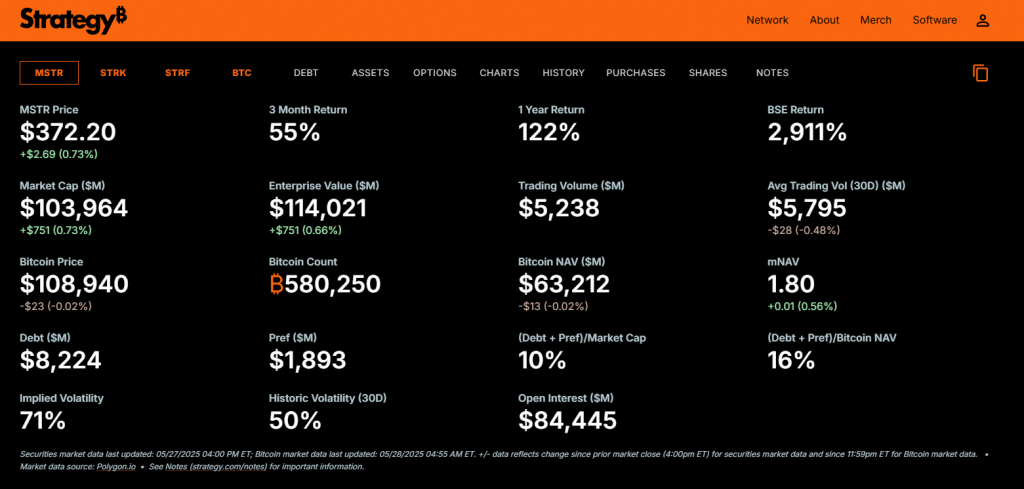

Strategy holds 580,250 bitcoins at $14 billion value, yet Saylor won’t publish wallet addresses. The Bitcoin halving countdown timing coincides with increased scrutiny over corporate cryptocurrency holdings and also regulatory uncertainty affecting investors. This scrutiny further complicates Strategy’s rally BTC plans.

Michael Saylor stated:

“The current conventional way to publish proof of reserves is an insecure proof of reserves.”

Saylor also said:

“It’s like publishing the address and the bank accounts of all your kids and [the] phone numbers of all your kids and then thinking somehow that makes your family better.”

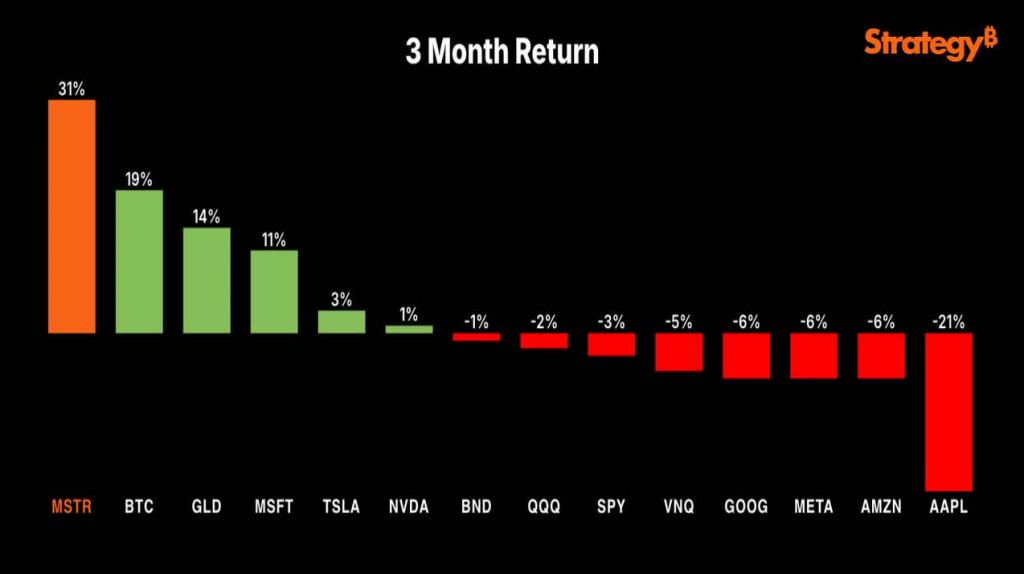

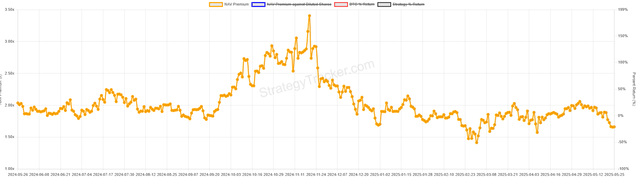

United States Dollar Strength Compounds Strategy Issues

The strengthening United States dollar pressures cryptocurrency investments while Strategy BTC rally momentum falters at the time of writing. Market volatility increases around Strategy stock, with regulatory uncertainty amplifying Bitcoin halving countdown expectations and investor concerns. These uncertainties challenge the strategy behind BTC rallies.

Mark Palmer from Benchmark stated:

“We note that the three previous bitcoin halvings, in 2012, 2016, and 2020, saw explosive appreciation in bitcoin’s price occur only after the halving had taken place.”

Also Read: Michael Saylor’s ‘Strategy’ Buys 13,390 Bitcoin Worth $1.34 Billion

Security Concerns Drive Reserve Secrecy

Saylor’s reserve concealment reflects security priorities over transparency demands right now. The Strategy BTC rally disconnect persists as cryptocurrency maximalists clash with corporate governance approaches amid regulatory uncertainty and ongoing market tensions, affecting the strategy of a Bitcoin price explosion.

Michael Saylor explained:

“The wallets, once they are published, are the attack vector for hackers, nation-state actors, every type of troll imaginable. It creates so much liability that you should think twice before you do it.”

The Bitcoin halving countdown may provide recovery catalysts, but Strategy Bitcoin boom potential remains constrained by transparency debates at the time of writing. Regulatory uncertainty and United States dollar strength continue pressuring cryptocurrency investments while market volatility persists around corporate Bitcoin strategies right now. Nonetheless, there is potential in a thoughtfully crafted BTC rally method.