Michael Saylor’s Strategy is the largest corporate holder of Bitcoin, as the reserves had topped more than $75 billion in July 2025. That was at the time when BTC was climbing above the $119,000 price level. Saylor remained extremely bullish on the digital asset, which led to increased confidence in the broader cryptocurrency market. While that was in July, December is painting a gloomy picture.

Strategy currently holds 650,000 BTC, and the $75 billion worth of reserves have now fallen to $56 billion. The company recorded a decline of $19 billion in just five months as Bitcoin dipped to the $86,000 range. On average, Strategy’s holdings stand at $73,000 per BTC while its profits are up only 18%. Another round of bearish market could erase this, leading to its holdings trading in the red.

To keep things afloat and diversify their Bitcoin reserves, Strategy announced on Monday that the company will establish $1.44 billion in USD reserves. “Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution, and we believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit,” said Saylor.

Also Read: Alphabet vs. Nvidia (NVDA): Why GOOGL Surged 11% This Month

Bitcoin Dip Leads To Strategy (MSTR) Stock Decline

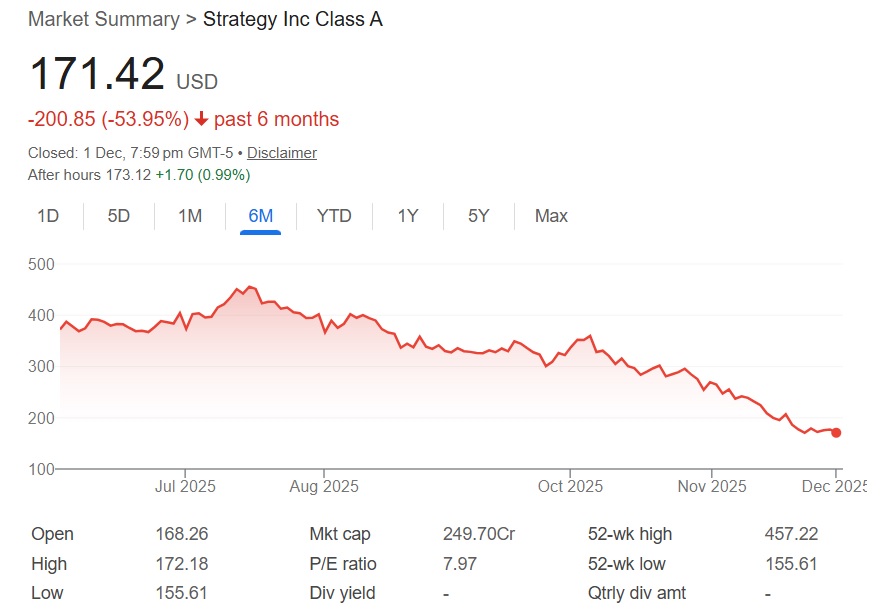

Strategy (NASDAQ: MSTR) is experiencing a bloodbath as Bitcoin fell to the $86,000 level. MSTR is down nearly 54% in six months and has erased all the gains it generated this year. Traders’ wallets that took an entry position in the stock in 2025 have all turned red. MSTR entered 2025 at $300 per share and is now trading at $171 in December.

In a month alone, Strategy stock has moved in tandem with Bitcoin, sinking 36% in the indices. BTC is down 22% in a month, and both assets are flashing bearish sentiments. If BTC begins to decline in 2026, falling below $70,000, the charts could be merciless for MSTR. Though it is standing at a close point of break-even, a tip-down from here could add immense pressure on Saylor.