SushiSwap has found a new lease of life after witnessing a symmetrical triangle breakout just days. The past week has accounted for nearly a 90% percentage jump and technical indicators suggest more to come. Having said that, SUSHI did need to overcome a possible pullback before eyeing the next leg forward. Hence, focus should be on a few support levels which would offer aggressive buy entries for investors. At the time of writing, SUSHI traded at $8.58, up by 12% over the last 24 hours.

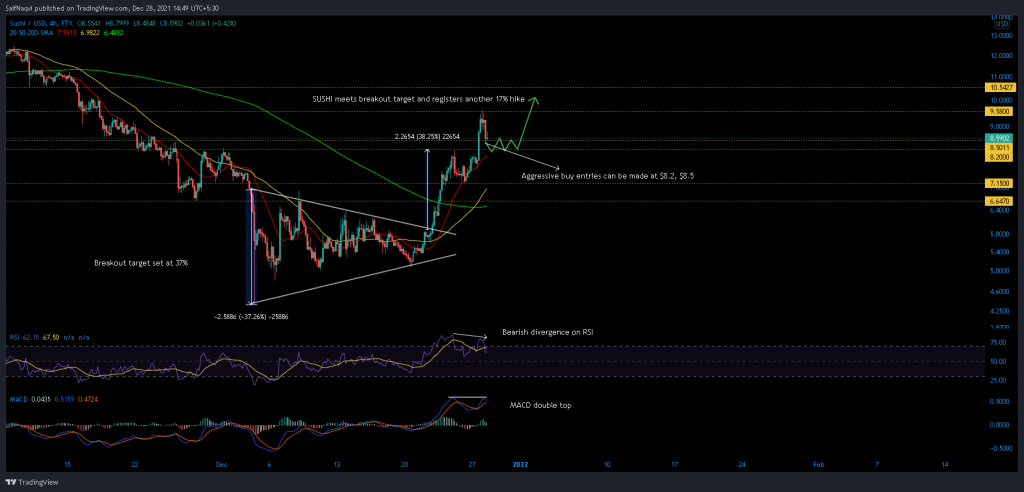

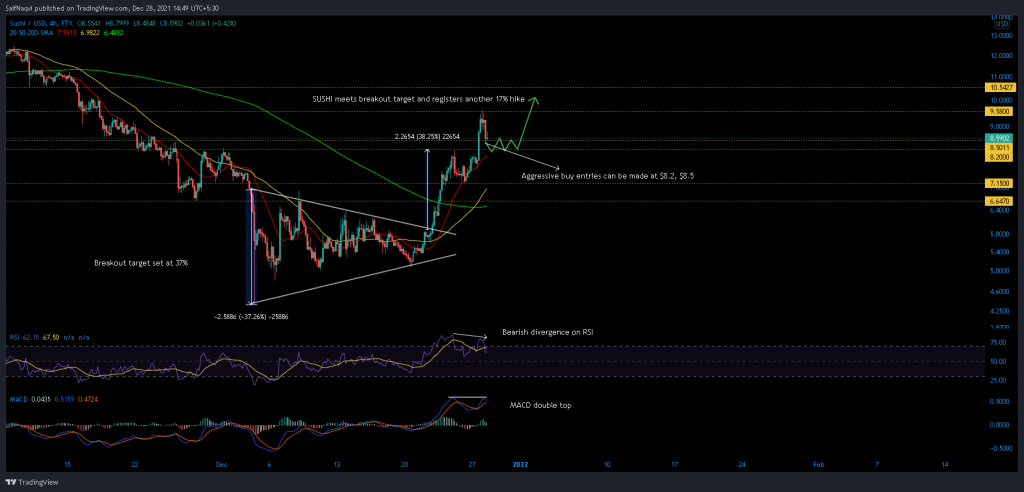

SushiSwap 4-hour Time Frame

SushiSwap was begging to look bullish once again after a tumultuous period between November to early December. A series of lower highs and higher lows gave rise to a symmetrical triangle which depicted a 40% breakout target. Now calculating SUSHI’s ascent from the breakout point to $9.58 resistance shows a price hike of 63%. This meant that bulls have continued to add more volumes even as SUSHI scaled past its earlier target, which is a really good sign. Another positive came in the form of a bullish crossover between the 50-SMA (yellow) and 200-SMA (green).

However, a few sell-signs developing on the RSI and MACD called for a minor pullback. Since SUSHI’s overall trajectory was favorable, expect the price to bounce from immediate support levels at $8.5 and $8.2. The region between $9.58-$10.5 could induce some selling pressure, which is why a broader market rally could be key during SUSHI’s next ascent. On the flip side, a close below the 20-SMA (red) would allow more sell pressure to settle in. Focus then switch to $6.64 support, backed by the 200-SMA (green).

Indicators

Although SUSHI’s indicators traded in bullish positions, signs of exhaustion were beginning to creep in. The 4-hour RSI flashed a bearish divergence and was currently stabilizing from overbought readings. It remains to be seen whether bulls can sustain the RSI above 55 heading forward. Moreover, the MACD was on the cusp of a bearish crossover after forming a double top pattern. Considering SUSHI’s recent spike, such signs would offer investors a chance to cash in their gains and renter and cheaper price levels.

Conclusion

SUSHI was expected to take a minor hit before resuming its upcycle. Aggressive buy orders can be made at $8.5 or $8.2. Meanwhile, safer bets can be placed depending on how the price interacts at its 20-SMA (red). Should SUHSI slip below this near-term moving average, new longs can be initiated at the 200-SMA (green) close to $6.64 support.