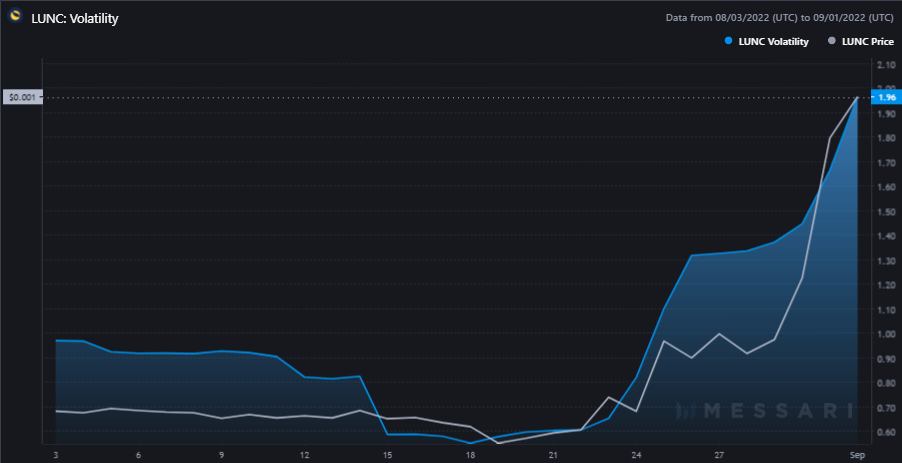

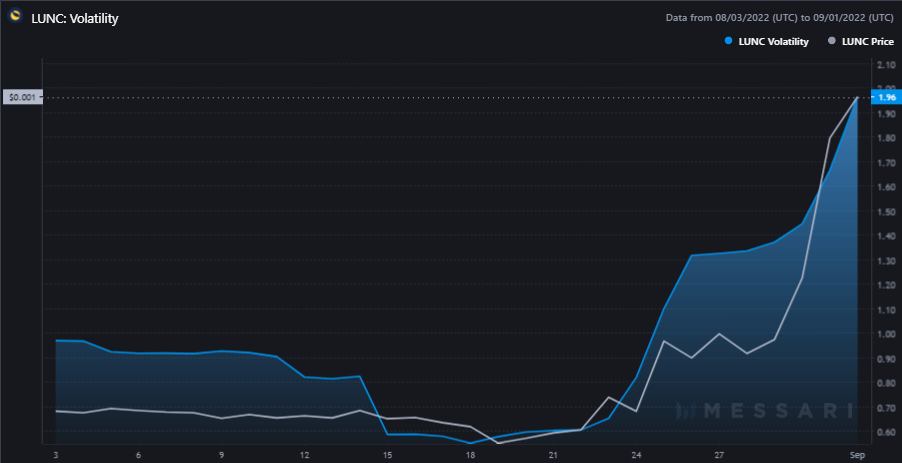

Terra Classic has, yet again, become the talk of the crypto town. The volatility in its market started rising towards the end of August. In fact, at press time, it stood at its 1-month peak. As a result, LUNC’s price has sharply swung by more than 51% over the past day and 132% over the past week.

At this point, it seems like LUNC has its bull run in a bear market. But why?

Stars align in Terra Classic’s favor

Per data from LunarCrush, the social sentiment associated with Terra Classic has been refined. Both engagements and mentions have substantially risen—the former had noted a 121% incline over the past week, while the latter reflected a 140% rise.

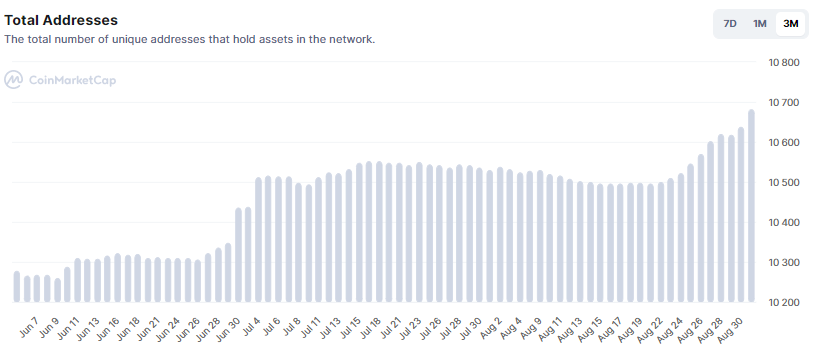

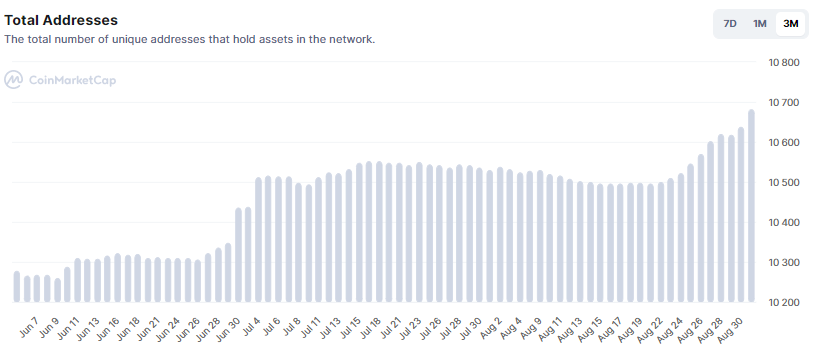

Also, new participants have been continually entering the ecosystem. CMC’s stats revealed that the number of LUNC HODLers has been hovering around their peak of 10,683. The same signals that the price is not controlled by a limited few anymore, and Terra Classic’s rise is likely not fabricated.

Furthermore, tech upgrades have simultaneously been happening in the ecosystem. As highlighted in a recent article, the v22 upgrade for LUNC validators was voted upon earlier last week. People from the community expected the vote to get through, and it did. Top exchanges like Binance announced their support by suspending deposits and withdrawals until the upgrade was completed.

As part of the said network update, the staking function became active on Terra Classic. At the moment, 7% of LUNC’s supply is already staked. Per stakingrewards, stakers receive a reward of 37.9% for staking their tokens, and perhaps that could be one of the reasons why LUNC has been garnering a lot of traction of late.

Parallelly, regular burns have also been taking place within the ecosystem, and this factor, along with others in conjunction, has positively impacted Terra Classic’s price.