Terra was undoubtedly at the center of the 2022 crypto market crash. Before the tragedy, the project was one of the most successful, reaching an all-time high of $119.18 in April. However, the meteoric rise made way for a historical fall. The death spiral that followed caused mass panic among investors and users. Life savings were wiped out, and many people’s lives were utterly ruined.

The Terra team has since hard forked the network, creating a new Terra Luna token (LUNA, and renaming the older one as Terra Luna Classic (LUNC).

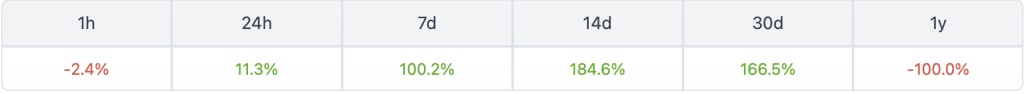

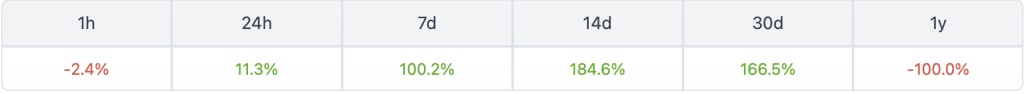

LUNC has been gaining much traction in the last couple of weeks. According to CoinGecko, the token has increased by 11.3% in the previous 24 hours. Moreover, LUNC is up by 100.2% in the last seven days and 184.6% in the previous two weeks.

Terra Classic’s latest rally is likely due to the v22 upgrade. The upgrade has brought back staking options to the project, which were much anticipated. Stakers receive rewards up to 37.8%, according to staking rewards. The high yield may be the reason for the increased interest in LUNC.

However, there are some additional developments taking place in the network.

Terra Luna Classic proposes tax parameter change

There is a new proposal on Terra research for a tax parameter change. Edward Kim put forward the proposal. According to the proposal, taxes will be levied and burned for on-chain activities, including transferring money between wallets and interacting with smart contracts. Taxes on off-chain activity cannot be implemented with this parameter change (like trading on CEXs).

Kim has also outlined some of the pros and cons of the tax parameter change. He says the tax would proof of community-driven governance realized on-chain. Furthermore, it would put deflationary pressure on both LUNC and UST. Kim also highlights the potential short-term catalyst in attracting new retail investors. And lastly, CEXs will not consider a burn-off chain until enacted on-chain.

However, Kim admits that taxes harm long-term economic activity and utility on-chain. Moreover, existing dApps that do not account for taxes will be unsupported. Additionally, there is no guarantee that CEXs will burn off the chain. Also, the tax may push remaining liquidity off-chain to CEXs that do not tax

The proposal is open for discussion and will be submitted once the talks conclude.